‘It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.’

I don’t know if Mark Twain actually said this. It’s not in any of his books. But it provides a good warning.

All too often, we blaze a trail based on what we know.

Without help and advice, you can sometimes find yourself travelling the wrong direction.

The wrong home. Wrong job. Wrong financial path.

When it came to buying our second home, I was busy building my business. We were about to start a family, and my wife was planning to quit her hated accounting job.

And we knew something. We didn’t want a large garden to tend. But we would like to see the harbour.

Well, with hindsight, we made two great decisions — quitting a job in accounting and starting a family.

But we made one not-so-great decision — buying a home on a small wedge of land with no grass, albeit looking into the shipping channel.

What we knew for sure about not wanting a garden missed some finer points. Your neighbours are a lot closer. Privacy is curtains. And the stress relief of gardening and beautifying a piece of land is gone.

Now, in this sort of situation, advice can be key. And a great adviser will ask you about your goals. What you want from life.

FOBO — Fear of Better Options — is the affliction of the modern, digitised world. In moments, you can online-search all the options available to you.

But that doesn’t give you the independent viewpoint you need from a wise head who’s not tied up in your situation.

Which is why the advice of an authorised financial adviser or independent mentor can provide a signpost in the jungle. Not your family, who may want you living close by or joining the business.

Start with the financial pros and cons

When approaching any decision, map out the pros and cons. Most paths in life come with upside and downside. Pros and cons help you understand what a particular path may need.

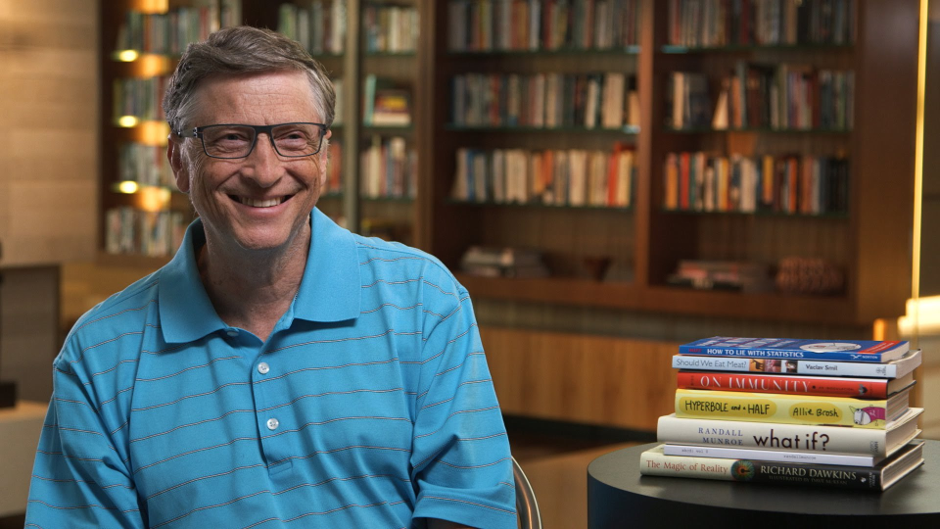

According to an interview with Melinda Gates in the Netflix documentary Inside Bill’s Brain, her husband uses this approach. Across all aspects of his life.

Inside Bill’s Brain: Decoding Bill Gates. Source: Conversations About Her

Inside Bill’s Brain: Decoding Bill Gates. Source: Conversations About Her

In the late 1980s, Melinda and Bill were dating. One day, she walked into his boardroom. He had a list drawn up on his whiteboard: ‘The pros and the cons of getting married’.

‘I took the idea of marriage very seriously,’ Bill says.

Though neither spontaneous nor romantic, it seems to have worked out for him. So has the approach.

The documentary goes on to show how much advice Bill takes on-board. When he travels, his PA packs a haversack of half-a-dozen books for even a week’s trip. He’s looking to learn all he can in any area where he could be making decisions.

Then he reaches out to the world. When he was looking to work on sanitation problems in poor countries, he wrote to leading researchers at the top universities.

Most didn’t bother to respond.

Even when you’re Bill Gates, it can be hard to enlist help and support.

But if you want to succeed, you are best to seek all the advice you can.

Work out the key success factors

When Bill was building Microsoft. he knew the key was to be the dominant operating system for the computers that would soon sit on every desk.

You can map out pros and cons, read and take all the advice you like. But, at the end of the day, you still need to reach a conviction.

Perhaps you’re thinking about your best financial plan. You may like to map out the pros and cons of different paths. Read up on investing. And speak to an independent financial adviser.

A good adviser could assist you to build a plan.

When it comes to a successful financial plan, there are 3 areas that make up key success factors:

1) Produce

Producing wealth comes down to maximising your income and minimising your costs to create surplus.

You can invest surplus to generate more income. And a circle of wealth builds over time.

Some good advice I received was to concentrate on a job or business you enjoy, are good at, and be the best at it. This gives you a high probability of developing a sustainable and growing income over the long term.

Especially if you can match your interests with a profitable niche in the market.

But I also come across people who do jobs they don’t like for many years. Because the pay is good.

This may work if you’re able to generate so much financial surplus you can create an escape fund in the short-run. Because, over the long-term, doing a job that turns Sunday night into a dread-fest can damage your mental health and relationships.

2) Protect

Once you build up meaningful wealth, you’ll then want to consider the risks that could destroy it. Particularly since your capital is a producer. If invested properly, it can also produce meaningful income.

You can reduce risks in business and from other people claiming against you — by not owning your assets.

Using a family trust, trustees may hold and manage your assets for you. With you and your family the beneficiary of those assets.

Trusts have a long legal history, going back to the Crusades of the 12th century. While men were away fighting, they left their homes in the care of another to look after, manage feudal dues and so forth. Sometimes crusaders encountered a refusal to hand back this property on return. Over time, the law of equity developed to recognise the beneficial ownership these men had.

The crusader was the ‘beneficiary’, and the acquaintance was the ‘trustee’ — paving the way to what the law today recognises as a ‘trust’.

Beyond ownership risk, there is also the risk of catastrophic events. It makes sense to insure your key assets and against any event that could wipe out 10% or more of your net worth.

Also, in many situations, others will have custody of your assets. Banks and brokerage houses are prime examples. It pays to consider if these businesses fail — is there any protection or guarantee scheme?

In New Zealand, deposits are not currently guaranteed by the government, nor is there any compensation system. This is due to change with a deposit-protection regime on the cards for next year. However, initial limits seem light compared to other jurisdictions.

3) Prosper

You need a plan to take your surplus and turn that into lasting prosperity.

Many Kiwis struggle with this because of debt multiples or rent on expensive housing. Interest and rent carve out surplus that could otherwise get invested.

Some will argue that the interest cost is worth it. Particularly in prime locations — since potential capital gain can generate wealth well beyond the cost.

This is a factor. But to make that wealth produce, you would need to sell the property or be able to rent it out at a good yield.

When you factor in all time and cost, yields on prime residential property are often anaemic.

Commercial property may fare better, although the entry price can be high. (Unless you enter via a REIT or fund which may have less personal leverage opportunity).

My general sense is that most people are best to minimise any non-productive debt. And take reasonable risk in relation to their age and circumstance in productive business assets — e.g. stocks and shares.

Given how high the NZX currently sits by business valuations, I’m happy looking into businesses in developed markets around the world.

It can be a good idea to diversify a bit. Away from a small primary-product focused country. And not put all your eggs in a volcanic harbour or pretty town built over a fault line.

What does prospering with your financial surplus look like?

It’s about owning assets that produce income and capital growth. Assets that you can leverage economically if necessary.

And it’s about finding the right opportunity.

Here’s a few investing examples from my friends that stand out:

- Put $1 million down 10 years ago to own a commercial property. Currently worth over $10 million, with a running yield of about 4% and borrowings of 50%.

- Invested $250,000 in key growth shares that have generated returns more than 1,000% over the past 5 years. Currently worth over $2.5 million.

- Secured a diversified share portfolio of $1.3 million that generates a running yield of 6.5% — approx. $85,000 a year. Built up through average annualised capital growth over the past 5 years of more than 10%.

Of course, to begin with, these scenarios depend on different levels of capital and different risk appetites to match that. I’m also obliged to caveat these stories with a warning: past gains cannot predict the future, and yields via dividends or rent are not guaranteed.

But prospering with a surplus can start at any level. And it can compound your wealth over time.

Well, you have to also consider these objectives with some balance. Investment is a tool, not life. If you want a garden, a trip to Italy, or time with family — these choices can turn out far more valuable than ending up rich and alone.

You need to know when what you know could be wrong. And find the best path for you and yours.

Regards,

Simon Angelo

Editor, WealthMorning.com

PS: You’ve spent a lifetime working hard. Building your career. Nurturing your dreams. Making the most of precious opportunities. Now you’re in a good position. Happy. Secure. Fulfilled. But your job’s actually not done yet. Now you need to defend your legacy. Click here to find out how Wealth Trusts can help you protect what matters most to you.

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.