‘Now I am become Death, the destroyer of worlds.’

—J Robert Oppenheimer, on witnessing the first atomic detonation in history

They call it the Doomsday Clock.

It’s the most haunting reminder of our nuclear age.

In the aftermath of Hiroshima and Nagasaki, the scientists who participated in the Manhattan Project were, in equal turns, thrilled and terrified by what they had unleashed upon the world.

For the first time in human history, mankind had the ability to destroy itself many times over with the press of a button. This was no longer within the realm of mythology. This was reality.

As they obsessed about the potential for extinction, these scientists knew they had to do something bold. Something to remind the general public of the looming danger.

So they created the Doomsday Day, which they have maintained since 1947.

Tick-tock

The imagery of it is simple but effective.

Every time humanity takes a stepcloser towards total annihilation, the hand on the clock creeps nearer to midnight. And every time humanity eases away from self-destruction, the hand inches back.

Here are some of the most significant highlights of the Doomsday Clock.

- In 1949, the clock is set to 3 minutes to midnight. The Soviet Union becomes the second nation to test an atomic weapon, sparking an arms race with America.

- In 1953, the clock ticks forward to 2 minutes to midnight. America tests a next-generation thermonuclear weapon, and the Soviet Union retaliates with the same. The arms race heats up.

- In 1969, the clock suddenly reverses in a rare show of optimism, sitting at 10 minutes to midnight. Most nations recognise the danger of nuclear weapons and collectively sign the Nuclear Non-Proliferation Treaty.

- In 1991, there’s a cause for great celebration, and the clock sits at 17 minutes to midnight. The Berlin Wall falls, and the Soviet Union dissolves. The Cold War is over.

- In 2018, the clock leaps forward to 2 minutes to midnight. World leaders have failed to address the issue of nuclear war and climate change, raising the ugly spectre of global annihilation once more.

How close are we to economic midnight?

As a Wealth Morning reader, you’re not necessarily worried about the potential for nuclear war or climate change. But you’re almost certainly concerned about something much more immediate: the potential for a recession.

There’s every reason to be worried.

Since March 9th 2009, we’ve enjoyed over 10 years of strong economic growth. Many pundits are calling it the longest bull run since the Second World War. Some are even more optimistic, declaring it the longest Bull Run in human history.

Yes, it’s an economic miracle.

But there are signs now that the good times may be ending.

The Reserve Bank of New Zealand has dropped its OCR to 1%, while the Reserve Bank of Australia has just dropped theirs to 0.75%. Business and consumer confidence is sagging. And across the world, governments are desperately trying to shore that up with more credit.

One of the most pressing questions I get from friends and family is this: ‘When do you think the next recession is going to happen?’

To which I shrug and sometimes say, ‘We may already be in a recession. We just don’t know it yet.’

Sometimes the reaction I get is a nervous chuckle.

Sometimes the reaction I get is stunned silence.

Mm-hm. My answer is eyebrow-raising and perplexing. I know. But allow me to unpack my response so that you can better understand what I mean.

What exactly is a recession?

In the United States, analysts say a recession represents ‘a significant decline in economic activity spread across the market, lasting more than a few months…’

In the United Kingdom, analysts are a little bit more precise. They say a recession happens when there’s an economic slowdown lasting two consecutive quarters.

But, hey, what exactly does that mean?

Well, let’s simplify it. Take a look now at your yearly calendar. It has 365 days. It has 12 months. Now, imagine if your calendar was a cake. Imagine if you sliced it into four equal portions.

And, yes indeed, there you have it.

Every year, our calendar is divided into four quarters. And the experts gather and dissect macroeconomic data in that fashion. Public consumption, government expenditure, international trade — they look at everything in a high-level way.

The most obvious sign of a recession is when the GDP (Gross Domestic Product) shrinks. The GDP measures the financial value of all the good and services being produced and consumed nationally and internationally.

When that figure contracts over a set period of time, a recession could be imminent.

But here’s the thing: you can only really know that based on past data. The present and future is educated guesswork.

However, that said, we can still learn a thing or two from what’s happened in the past.

What’s the psychological impact of a recession?

The average recession lasts 17.5 months. Which is 1.5 years.

It’s marked by events that most people find frightening.

Stocks fall. Companies stumble. Unemployment rises. Homes are lost.

Let’s face it: nobody likes to live through one.

And yet…after this‘hard reset’…there is a phoenix-like rebirth.

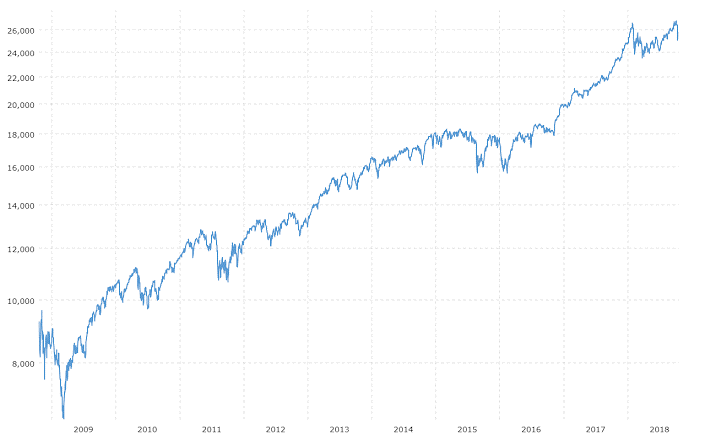

Here’s what the Dow Jones Index looked like before, during, and after the 2009 Great Financial Crisis:

A striking graph, isn’t it? Quite simply, it’s fascinating to look at.

After the GFC, the stock market not only recovered its losses, but it rallied sharply and went on to achieve further growth.

To put this into perspective, Tim Ferris and Peter Mallouk once made a really profound observation. They said that even if you had bought stocks on the day BEFORE the crash, you still would have enjoyed a profit of more than 200% by now. Yes, you would have effectively DOUBLED your assets.

That’s to say nothing of another apocalyptic scenario: if you chose to buy stocks on March 9th 2009 itself. Yes, that’s the DAY OF THE CRASH. The day the Dow sank to its lowest level — 6,547.05 points.

What if you were one of these investors who chose to buy? Entering the market just as everyone else was exiting in a panic? What if you had held on to these stocks since then?

The magic of an economic rebound

Well, the answer is obvious.

As of October 11th 2019, the Dow is sitting at 26,816.59 points. That’s a 400% leap in value. Uh-huh. QUADRUPLE. And we’re just talking about the law of averages here. There are actually individual companies that performed much, much better than the index itself.

Netflix is an often-cited example of this. Gosh, it’s hard to miss this streaming giant. It posted a return of over 5000% since March 2009. Truly remarkable.

And here in New Zealand, our very own Xero [ASX:XRO] hasn’t done too shabbily either. It’s soared by over 7000%. Very nice.

But, frankly, I think that a2 Milk [NZX:ATM] has to be the true breakout star. Since March 2009, it’s delivered a return of over 16,000%. An eye-watering achievement.

Now, given the current investing environment, it’s quite possible that these goliath companies may have hit the ceiling in terms of growth. It’s hard to see them posting such numbers ever again.

The road ahead?

And yet…this begs the question: if there is a ‘hard reset’ in the economy again, will this actually be a golden opportunity for us to find value? Will there be other phoenix-like companies rising from the ashes, ready to shine and prosper?

The world works in cycles. Always has. Always will.

The key to being an astute investor is to study history. Recognise where we have been and where we might be going. Understand that there will be renewal and rebirth.

So don’t despair if you think we’re on the brink of another recession. Don’t be fearful if you think it might be 2 minutes to midnight. Remember: if you play your cards right, this might just the sweet opening you’ve been waiting for…

Regards,

John Ling

Contributor, WealthMorning.com

PS: As part of our Lifetime Wealth Investor research service, my colleague Simon Angelo has his finger firmly on the pulse of the global markets. He’s identified key stocks in the US, UK, Australia and Singapore that you really need to take a closer look at. Click here to find out more about this exciting opportunity.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.