Simon Angelo worked for the world’s first regulated Bitcoin fund in 2016. He currently works at a trading desk for Wholesale Investors. His work in offshore finance and global banking gives him some insights on the future of money.

When Bitcoin was a special opportunity

In October 2016, when I started working with the Bitcoin fund, a Bitcoin cost around NZD $900. Today it sits at around NZD $62,000.

Back then, the principals of the fund saw Bitcoin rather like the oil futures they had traded in the 1980s.

These were the early days of deregulation in the oil industry. Oil reserves were depleted. Demand from China was coming on stream. More oil production would be needed. The price could only go up.

It was a market with plenty of volatility, illiquidity, and scant regulation. It was all pretty chaotic. Yet there were global forces at play. These would give rise to an oil and commodity bull market, bursting a dam of money.

Bitcoin Fund office, circa 2016. Source: Supplied / Simon Angelo

In 2016, they saw similar potential for Bitcoin, just as they’d seen for oil back in 1987.

There was a long runway ahead. A destination where the technology becomes widely adopted. And the potential for Bitcoin to change money as we know it.

Were they right?

Yes, there’s been an overall Bitcoin bull market. The price has grown almost 7,000% since 2016 — though there’s been plenty of volatility.

Yet much of the wider mainstream adoption they predicted hasn’t happened. Like other cryptocurrencies, Bitcoin remains a mainly speculative instrument.

Does this mean Bitcoin and other cryptocurrencies still have a bigger part to play in the future of money? What about the alternatives?

Banking and currency

Modern banking has come a long way.

With the click of a mouse and a confirmation on your phone, you can send funds around the world. This can be to other bank accounts, to brokerage accounts, or even to global smart-card services and digital wallets.

But for those seeking privacy or protection of their wealth, banking alone can fall short.

On the privacy front, okay, the ordinary punter doesn’t typically expect Swiss-style bank secrecy. Though even that is limited these days for requests made under CRS and FATCA rules.

Most alarming was the freezing of accounts for protest groups during the Canadian trucker convoy protests in 2022. This crossed the line from tax-related access to access for political purposes.

To my way of thinking, this tarnished the reputation of both the Canadian dollar and the Canadian banking system.

Increasing and invasive bureaucracy can actually limit trust in the banking system. It risks driving more people into ‘offgrid’ instruments like cryptocurrency.

A robust financial system should retain strong property rights separate from the state. Where access is limited only to tax enforcement via transparent court orders.

Unfortunately, the creep of bureaucracy has been a theme of our time.

What about CBDCs or other digital currencies?

According to a 2021 survey, central bank digital currencies were currently being looked at by 86% of central banks around the world.

60% were experimenting with the technology.

14% were deploying pilot projects.

The Reserve Bank of New Zealand says a CBDC ‘would help maintain New Zealanders’ trust in money…

[and] support financial inclusion.’ Source: Wikimedia Commons

The RBNZ has embarked on a 4-stage process and is currently at stage 2; ‘exploring high level design options for the CBDC, and their costs and benefits.’

The primary objectives of CBDCs are to help maintain trust in local currency, maintain price stability, and ensure safe and resilient payment systems.

Some analysts have pointed out that CBDCs could actually reduce trust in currencies, since they could be open to more government manipulation.

The Canadian trucker convoy protests saw about 280 bank accounts frozen without court orders under the Emergencies Act.

For people using CBDCs, the question is then what checks and balances would be in place to prevent bureaucrats simply turning them off?

Perhaps, for instance, you’ve been found mobilising a protest they deem political wrongthink. Even dangerous. Could your CBDCs be frozen or penalised at the click of a bureaucrat’s mouse?

Again, we come back to the most crucial aspect of money: It needs to be trusted.

If people have doubts about their government, or their public service, they might be unlikely to trust a CBDC. Willingness to embrace and accept it may be low.

It’s the same situation with the plethora of digital currencies out there. Who backs them? How can you trust them?

That’s the beauty a cryptocurrency like Bitcoin has (as opposed to a digital currency). It is backed by the incontrovertible verification system of the blockchain.

Which brings us to the other essential quality of money…

Will it hold its value?

In Argentina, lack of trust in the government’s fiat currency — the peso — is entwined with another key problem.

Last week, inflation topped 140%. That means much of what you go to buy now costs more than double compared to just a year ago.

People give up buying new things and head to the second-hand or thrift market for items as simple as a pair of jeans.

An Argentinean friend of mine told me about his local hardware store with no pricing on the shelves. ‘You have to take everything up to the cashier to get the latest price.’

Well, trust is so low in the peso it may now face its demise.

Clouds and protests surround Casa Rosada, the official workplace of the president of the Argentine nation. Source: Pixabay

The country’s presidential front-runner, former financial analyst Javier Milei, has pledged to scrap the central bank and dollarise the economy.

As we were going to press, it was announced that Milei had won the presidential elections in provisional results.

If he goes ahead with his pledge on the currency, this could be a game changer. No country Argentina’s size has previously shed their currency for the US dollar and conceded their monetary policy to Washington.

A switch to the US dollar would be a radical step, no doubt. Yet already locals try to get their hands on as much USD as they can buy.

Property prices are listed in USD to protect against inflation.

Clearly, if a currency is to be trusted and accepted, it also needs to be stable.

This is the flipside with cryptocurrency. Values are volatile. If you were to settle on a house purchase with Bitcoin — then Bitcoin suddenly drops 10% — you’d find that house now costs 10% more when paying that way.

Which is why these cryptocurrencies have upside for trading and investment, as opposed to being a reliable medium of exchange.

Furthermore, there are thousands of cryptocurrencies. Most need significant processing power and some time to transact. So they have intrinsic limitations when it comes to becoming the real future of money.

Inflation and the future

Today, although interest rates are higher on savings, after tax, the greasy pole of inflation makes it hard to keep pace.

By definition, protecting your wealth means you may want to put longer-term funds into productive assets like stocks or property. The lesson from crises throughout history, including the Second World War, is that quality businesses can still produce, sell, and grow their value over time.

Bitcoin and cryptocurrencies do not fit into the category of productive assets. This is because their main use today is as a speculative investment and alternative store of value.

That store of value, like gold, is based on limited supply. But unlike gold, the cryptocurrencies themselves could be subject to competition and regulation. Not to mention the inherent volatility.

So, would Bitcoin interest me as much today as it did in 2016?

Well, back then, at $900, a 7,000% return was possible in five years.

But at ~$62,000, it is hard to even see $100,000 over the next five years. Holding coins over this time would also carry risk and, unless lent out, usually no yield.

Meanwhile, trust in fiat currency comes down to its ability to store value and act as a reliable medium of exchange around the world.

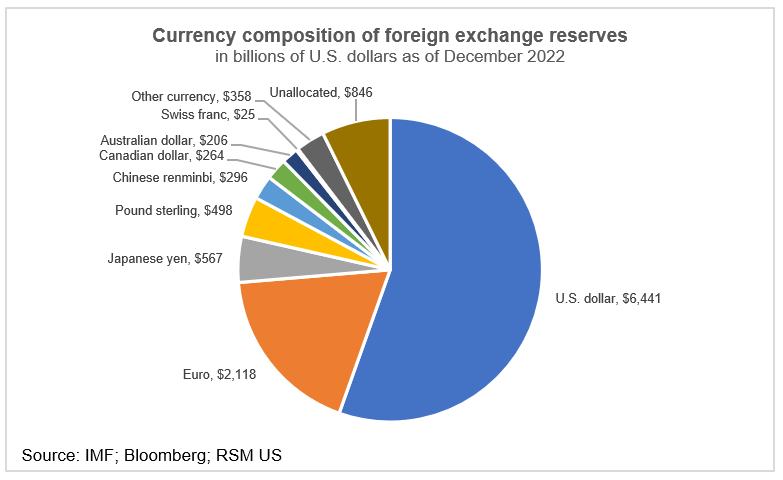

This is the reason why the US dollar continues to reign supreme as the world’s reserve currency. Some say it is under threat by a potential BRICS dollar that could be backed by gold.

It is hard to see the reality of this threat. The BRICS countries have divergent interests. The US dollar is backed by the world’s largest single base of taxpayers.

Thus far, the Federal Reserve has been amongst the more successful in tackling inflation. It is currently down to 3.2% in the US, gradually nearing the target of 2%.

Yes, the proportion of US dollar reserves held globally has reduced. The main reason for this appears to be the emergence of another large and reliable currency in the euro.

If our local currency weakened or looked to be threatened by out-of-control inflation, unfair manipulations of a potential CBDC, or a manifestly corrupt government, I would probably be looking for a more reliable currency such as the US dollar or euro to transact and hold wealth.

Further, holding listed assets in these currencies can help investors to diversify.

The future of money comes down to faith and trust. Like so much else does in life.

We cannot prove that our close family members love us absolutely. But we have faith that they do. Spouses promise as much at the wedding altar.

Source: Pixabay

As the US dollar declares: ‘In God We Trust’. Adopted as the official motto of the United States in 1956, it denotes that ‘the political and economic prosperity of the nation is in God’s hands.’

Long may that remain, for when too much is placed in the hands of man and bureaucracy, all trust can soon erode.

For now, the real future for money is likely in the expansion of financial products that offer access to quality currencies and quality assets denominated in them.

For example, smart cards that allow you to transact offshore currencies in a cost-effective way. Brokerage accounts that allow you to hold offshore assets for growth and income. And the ability to access various currencies via lending margin on the assets you hold.

Of course, many of these sort of products will be suitable for more sophisticated investors only. Any leverage adds risk. And most people should always have a suitable level of emergency funds available at all times.

Perhaps the future for Bitcoin and oil will intersect again.

Supply of both appears limited. Appetite is strong yet uncertain. But prices are currently high, making it hard to foresee the sort of breakout we saw in 1987 or 2016.

We report in more detail on the future of money and the assets of the future in our premium news subscription: Quantum Wealth Report.

Like what you read at Wealth Morning? Do consider supporting us by subscribing today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary. It is general in nature and should not be construed as any financial or investment advice. Readers should seek independent advice from a licensed Financial Advice Provider for their own situation.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.