‘How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.’

—Robert G. Allen

Talk to your neighbour. Talk to your accountant. Talk to your pastor.

It’s obvious that we live in unsettled times.

So, what are we most concerned about?

Well, here are the burning issues at the moment:

- Income. Debt. Inflation.

- Crime. Conspiracy. Scandal.

- Uncertainty. Anxiety. Anguish.

Yes, it feels like a lot to digest, doesn’t it?

- More and more, we’re hearing debates about the haves and have-nots; the winners and the losers; the privileged and the underprivileged.

- To add fuel to the fire, the ideological gap between the Left and the Right has never been wider. The Left wants more central planning to redistribute wealth in the name of equality. Meanwhile, the Right wants more deregulation to boost wealth in the name of free enterprise.

- Globally, I can see that the pendulum of power appears to be swinging to the Right.

But is this emotional upheaval actually new? Or it this simply a case of déjà vu? Have we been here before?

- Think back to the 1970s. It was a restless decade, marked by the OPEC oil crisis, the Watergate scandal, and the end of the Vietnam War. Public trust in government had eroded, plunging to an all-time low. Meanwhile, a counter-culture rebellion happened, inspiring terrorists like Carlos the Jackal, as well as serial killers like Ted Bundy.

- Now, look closely at the 2020s. You will see eerie parallels to the 1970s. The Covid pandemic, the inflationary crisis, and the culture war have proven to be corrosive for our society. And once again, public trust in government is broken.

- If you follow an Abrahamic faith like Christianity or Islam, then you might believe that all this represents the End Times. However, if you follow a karmic faith like Buddhism and Hinduism, then you might simply see this as another stage in the cycle of life.

- In the words of J.M. Barrie’s Peter Pan: ‘All of this has happened before, and it will all happen again.’

What does the big picture of wealth look like?

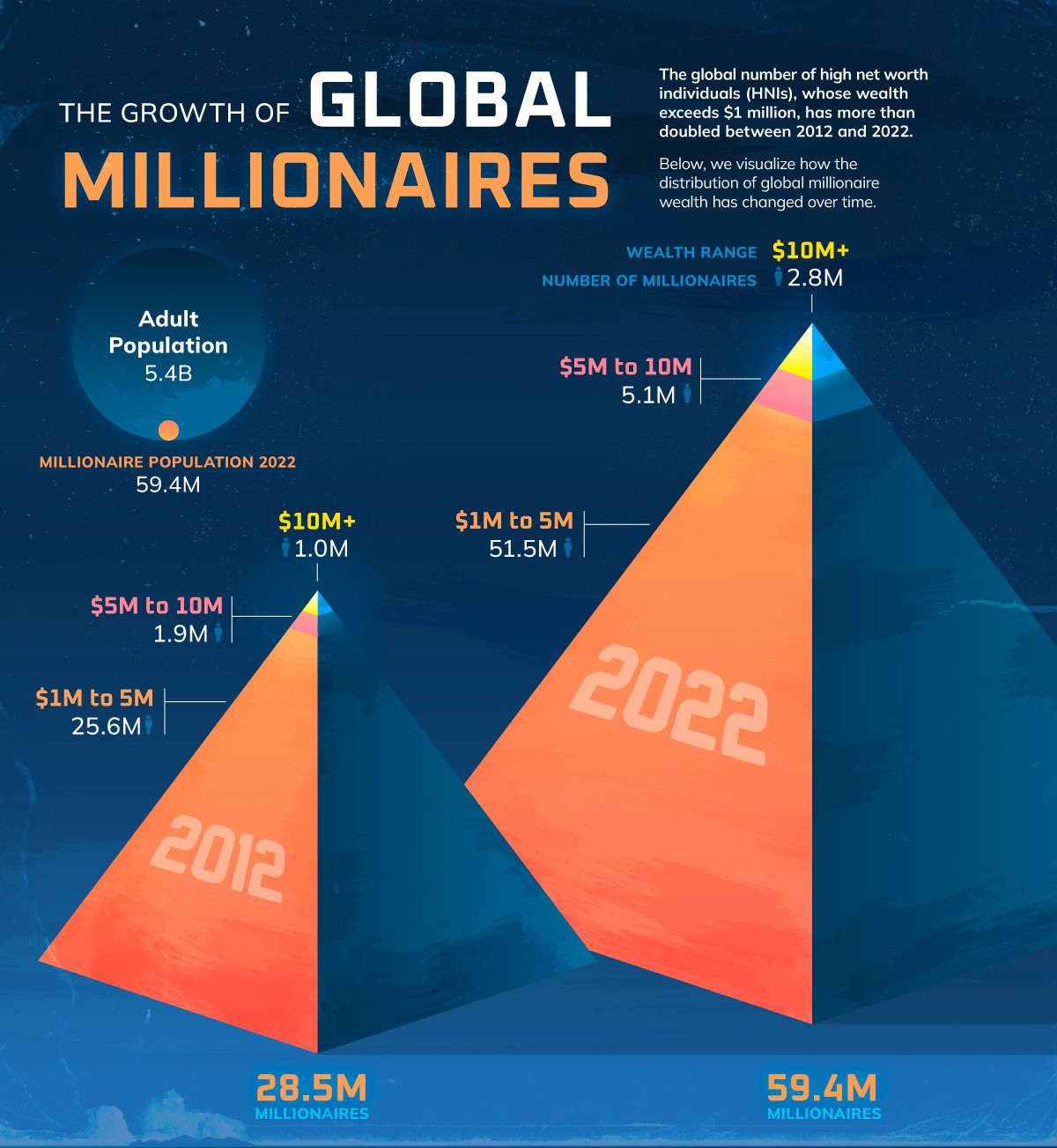

Source: Visual Capitalist

The news keeps saying that our wealth gap is getting larger. But what if I told you something contrarian? What if I told you that our wealth gap is actually getting smaller? What if our collective prosperity is actually accelerating?

- Well, if we choose to look beyond the negative headlines, one hidden trend becomes obvious — we’re living in a time of great upward mobility for wealth.

- Between 2012 and 2022, the number of millionaires in the world has doubled. It’s grown from around 28 million to 59 million. This has happened despite the Covid pandemic and the inflationary crisis.

- To put this into perspective, in 2012, only 0.6% of the world’s adults were millionaires. However, by 2022, that number had risen to 1.1%.

- Here’s something even more remarkable. By 2027, one forecast suggests that the number of millionaires will grow even more. It will reach approximately 86 million — which is a 45% increase from 2022.

Thomas Piketty, who wrote the book Capital in the Twenty-First Century, explains why this is happening:

- Over the long-term, the rate of return on capital (r) is greater than the rate of economic growth (g).

- Here’s what it means in plain English: what you invest in (r) will grow faster than what you work for (g).

- So, with all things being held equal, investing in a dividend-paying stock may yield a better growth opportunity than working for a fixed wage.

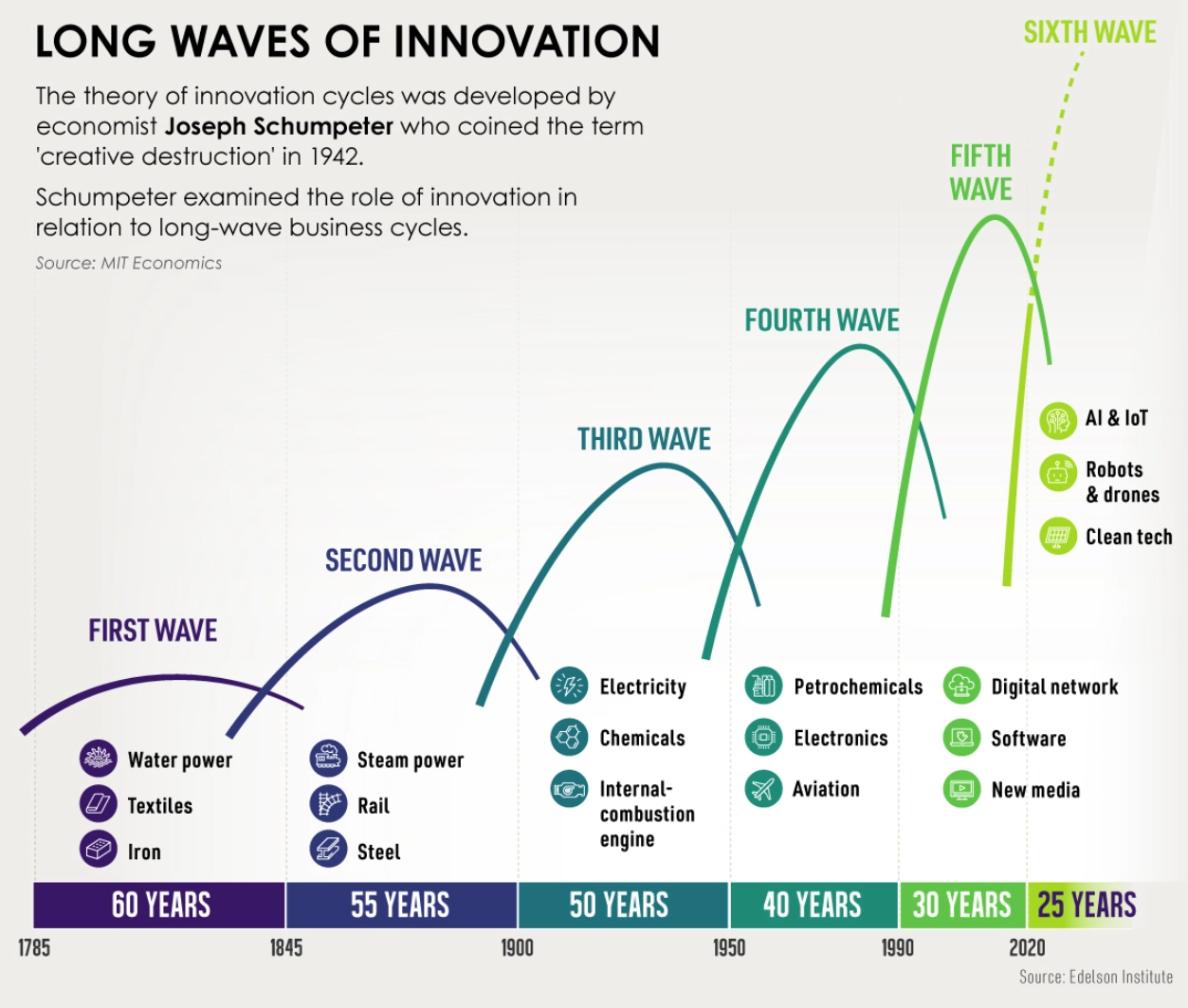

Source: Visual Capitalist

The compounding nature of capital, as well as successive waves of innovation, has been extraordinary. Here are some facts from A Wealth of Common Sense:

- 1,000 years after Jesus walked the earth the world was barely any richer. It took 500 years for income to double from there. Then between 1820 and 1900, the world’s income tripled. It tripled again in a little more than 50 years. It took only 25 years for it to triple again, and another 33 years to triple yet again.

- Just 200 years ago, 85% of the world’s population lived in extreme poverty. 20 years ago it was 29%. Today only 9% live in extreme poverty.

- Since 1995, 30 of the world’s 109 developing countries have seen economic growth rates that amount to a doubling of income every 18 years. Another 40 countries have had rates that would double income every 35 years, which is comparable to the historical growth rate of the U.S.

- Retirement still is a relatively new concept. In the past most people simply worked until they died. In the year 1870, for those who lived past age 65, the labor force participation ratio for males was close to 90%. Today it’s less than 20%.

Of course, progress isn’t sexy. It doesn’t grab headlines. It doesn’t generate clicks. But, still, you can’t deny the steady march of progress:

- The pace of change over the past century has been breathtaking. My own family has gone from peasants to refugees to working class to middle class within just four generations.

What is most striking for me is the democratisation of wealth:

- What used to be restricted to the domain of royals and aristocrats is now increasingly available to the rest of us. The gilded doors are being thrown open. Investment vehicles are becoming more accessible by the day.

- So, forget King Charles or the Kardashians. The true rock stars of wealth today are the regular folks. The self-made people who have planned well and invested well.

- These entrepreneurs have benefited from the longest bull run since the Second World War. It has allowed them to build up net financial assets of between $1 million to $5 million. These people now make up 86% of the millionaires on Earth.

Source: Amazon

So, what exactly does a self-made millionaire look like? Well, one of the best books on the subject is The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, published by Thomas J. Stanley and William D. Danko. They explain some key facts:

- Most millionaires actually live in middle-class and blue-collar neighbourhoods.

- They reject overt status symbols of luxury.

- They have a habit of spending less than they earn.

- They don’t take excessive risk. They save and invest steadily for years, focusing on building long-term wealth.

- In other words, most millionaires are modest, practical, and unassuming. For them, attaining financial independence is far more important than keeping up with the Joneses.

It’s time to think differently

Self-made millionaires tend to be resilient:

- They are regular folks who have painstakingly built up their wealth instead of inheriting it.

- Indeed, despite what the news may wrongly portray, these people are helping the world to change for the better. They are investing in companies that are creating new jobs, new products, new services.

- In fact, if there’s a problem out there, you can bet your bottom dollar: there’s already an entrepreneur working hard at figuring out a creative solution for it. And that, in turn, will generate even more wealth in the long run.

- Yes, the economic disruption that we have experienced lately is emotionally unnerving — but for those with strong stomachs, a brighter horizon may beckon.

At Wealth Morning, we run what may be the only active night-trading desk in New Zealand for our Eligible and Wholesale Clients:

- Every week, we aim to buy into exceptional companies in the Australia, the USA, the UK, and beyond.

- Our focus is on sectors that offer the perfect balance of growth and income.

- Our mission? To capture pockets of outstanding opportunity where we can.

- Where others see doubt, we see clarity — and we aim to use it as an springboard to build a better future.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.