Quantum Wealth Summary

- What you need to know: Technology has usually been regarded as the best-performing sector over the past decade. But investors often overlook the hidden opportunities that exist beyond tech.

- Why it matters: One food company has outperformed both Apple and Microsoft since 1996, posting an astonishing return of 781,863%.

- Here’s the state of play: We investigate whether it makes sense to step outside of technology and capture unusual openings in food.

The story of humanity is the story of farming.

Once upon a time, most people worked in agriculture.

Cultivating crops. Raising animals. Managing forestry.

Indeed, agriculture was the single-most important activity in the economy.

But somewhere along the line, this stopped being true. And the role of farming has shrunk dramatically over the years.

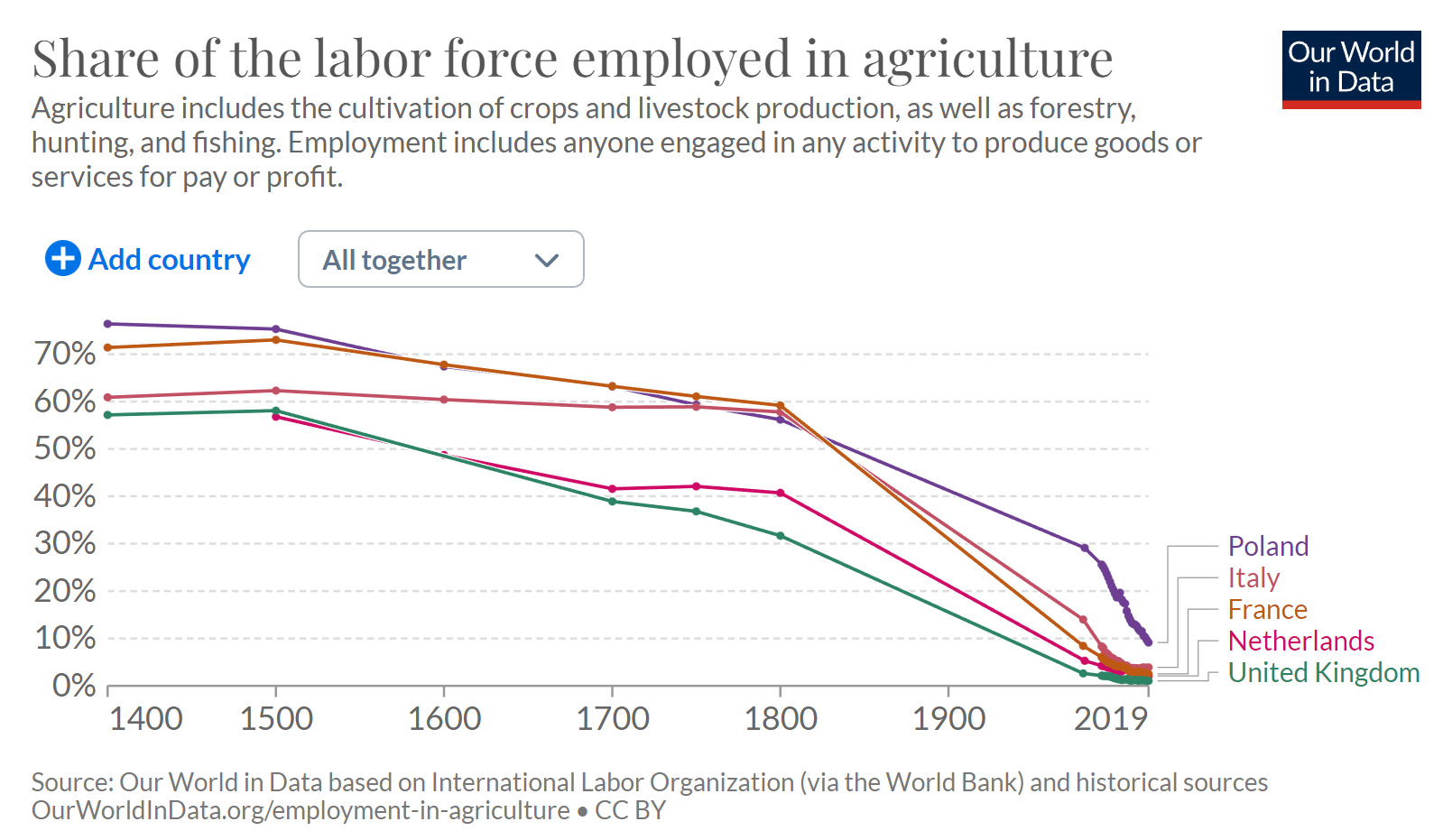

Here are some real-world examples:

- In Poland, in 1400, over 75% of the population worked in agriculture.

- By 2019, that number had declined to around 9%.

- In the UK, in 1400, over 57% of the population worked in agriculture.

- By 2019, that number had declined to around 1%.

Source: Our World in Data

Look at the graph above. You don’t need to be a professor to notice one striking fact. The biggest plunge happened from 1800 onwards.

Why? How?

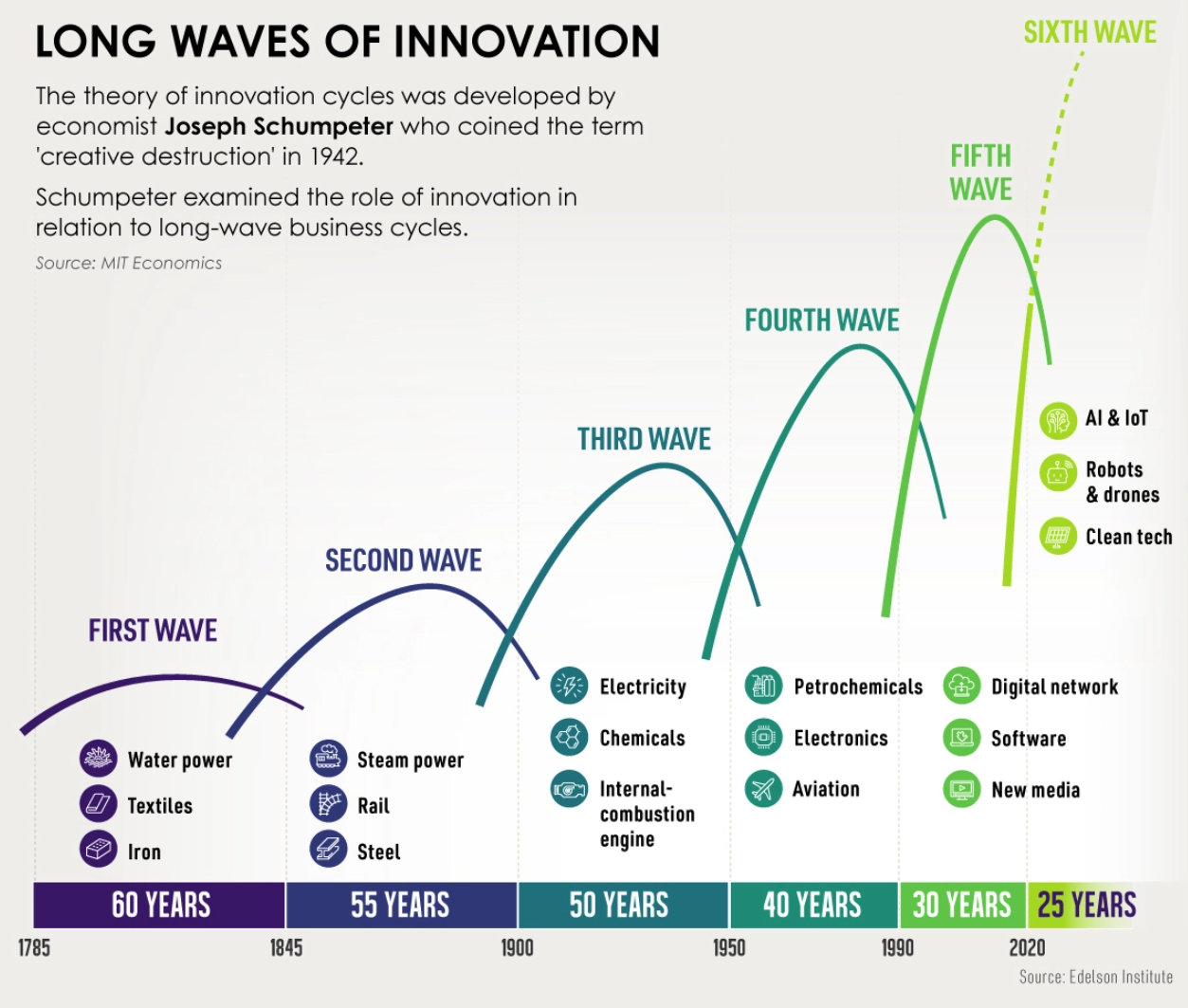

Well, the Industrial Revolution arrived. The impact of this was huge. It transitioned the planet from an economy based on agriculture to an economy based on manufactured goods and services:

Source: Visual Capitalist

To date, we have experienced five long waves of innovation. A sixth is currently underway. All this has disrupted our society in several critical ways:

- Urbanisation. As cities have grown, more people have moved away from rural areas to find opportunities in urban centres. This has led to a decline in the number of people engaged in farming.

- Technological advancement. The use of machinery has replaced the use of human labour. Fewer people are needed to work on farms. And those who still work on farms are now required to have specialised skills and training.

- Consolidation. Farming operations are increasingly being centralised into large, corporate-owned entities. This has pushed smaller family-owned farms out of business. As a result, the supply chain is now vertical instead of horizontal.

- Strained relationships. New social classes have emerged. The industrialists and bureaucrats who drive our modern economy are increasingly based in the cities. This has led to conflict as the farmers rooted in the rural areas face alienation and displacement.

So, here lies the great dilemma of our age:

- Everyone needs to eat. Everyone needs to drink. It’s a fact of life.

- Yet only a tiny proportion of our population is now responsible for producing food for the vast majority of us.

- Entire urban generations have grown up with little to no understanding of where our food comes from — or what it costs to make it.

Interestingly enough, even though New Zealand has a large agricultural sector, it appears that our money managers don’t actually seem to value food all that much.

As of 30 September, 2022, here are the five-largest stock holdings in the New Zealand Superannuation Fund:

- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

You can see that tech has a dominant presence in the Super Fund. This is what powers our pension payments. It’s not hard to understand why:

- Since 2008, American figures reveal that the information technology sector has delivered an annualised return of 13.19%.

- Meanwhile, the consumer staples sector — which contains food — has delivered an annualised return of 9.66%.

So, you can’t blame our money managers for going where the growth is. However, is this approach actually short-sighted and myopic? Are investors missing out by being too obsessed with tech? Well, consider this:

- One food company has actually outperformed both Apple and Microsoft since 1996, posting an astonishing return of 781,863%.

- Over a 25-year time period, this Company might actually be considered the most successful member of the S&P 500 index.

- Such an outstanding accomplishment seems to go against the grain. This contradicts the commonly held belief that food is an underachiever.

- We investigate whether it makes sense to step outside of tech and capture unusual openings like this…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.