If you’ve owned shares in Contact Energy [NZX:CEN] [ASX:CEN] over the past 5 years, it’s probably been a happy experience.

The share price has gone from a low of around $4.50 in 2016, to a high of around $11 in January this year.

You’ve enjoyed regular dividends along the way, probably around the 5% to 8% level, depending on your average entry price.

The share price did get a little ahead of itself, and it now sits around the $7.20 mark. Which is where the equity-raise offer pitches things at about $7.

I wanted to take a look at the Company for our readers. And consider the ins and outs of the raise for readers who like me may be a shareholder and investor.

Contact Energy [NZX:CEN] [ASX:CEN]

Contact Energy is one of NZ’s leading geothermal generators. Source: Hennessy

Contact is one of New Zealand’s largest electricity generators. In 2014, it generated 23% of the country’s electricity — second only to Meridian.

Attractive for ESG investors is that 84% of its generation is renewable. This obviously provides it greater share-price tailwind.

A recent boost for Contact came in the form of an announcement on Tiwai Point smelter. Earlier this month, owner Rio Tinto announced a deal with Meridian Energy to keep it open until the end of 2024. Contact stepped in to provide Meridian some of the electricity the smelter requires.

‘Contact will provide an average of 100 megawatts of baseload electricity through until the end of 2024 (assuming the smelter requires 572 megawatts of electricity),’ the Company said in a statement to the NZX.

To put that demand in perspective, Contact’s Clyde Dam station on Lake Dunstan is the largest in its network, providing up to 432 megawatts of power.

This is particularly welcome news for Contact, since over the past 5 years, revenue from generation has been shrinking. In fact, 5-year revenue growth comes in at -3.2%.

Contact also sits in a strategic position thanks to its geothermal assets. While hydro can depend on river levels, geothermal tends to be more efficient, consistent, and reliable. It can more easily accommodate changes in electricity demand.

Yet there remain concerns with Contact Energy’s current share price:

- The Tiwai Point smelter will stay until December 2024. Then it may close. This only buys time to give Contact (and other generators) time to adapt to lower demand in the South Island.

- Wholesale electricity prices are high and may not be sustainable. Especially as new sources of electricity supply emerge, such as solar and wind.

- For now, the dividend seems stable. But shareholders need to follow carefully results announcements (see below).

That said, as a primary renewable generator with a strong dividend history, Contact will likely remain favourable in a low interest-rate environment.

I’m a long-run Contact shareholder. And will be holding for the dividend — since my average entry price is only around $4.80.

Would I pay $7.20+ for the share?

Outside of a no-brokerage-cost equity raise — not me, personally. I see better opportunities offshore.

The current P/E is around 36

Yet were earnings to increase or the share price to fall — such that P/E sat below 25 — that may be a different story.

But for that to happen, either earnings would need to jump. Or the share price would have to tumble.

February 15 — 2021 Interim Results Announced

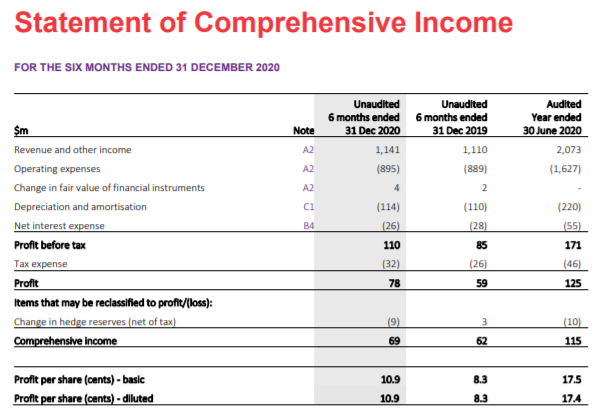

The results are somewhat favourable in a sector that has been pressured by Covid, falling usage, and dynamic electricity prices.

Take a look at the key areas of performance:

Source: Contact Energy Interim Financial Statements

Source: Contact Energy Interim Financial Statements

Revenue has increase slightly and the profit after tax is up 32% compared to the same period last year. This gives me some confidence that Contact is well-managed. It may be positioned to navigate difficult markets and take advantage of opportunity.

The Contact Energy [NZX:CEN] equity raise

The Company believes New Zealand is at the transition phase from reliance on fossil fuels to renewable electricity. This move is supported by climate change necessity, society demand, and a favourable regulatory framework.

With a growing population, increasing demand from EVs, and the desire to move away from fossil fuel generation — Contact is building a new geothermal plant to provide more renewable energy.

Rob McDonald, Contact Chair, says this:

‘We believe the Tauhara geothermal project is New Zealand’s best low-carbon renewable electricity opportunity. It will operate 24/7, is not reliant on the weather and is ideal for displacing baseload fossil fuel generation from the national grid which will significantly reduce New Zealand’s carbon emissions.’

To help pay for the new plant, the Company is raising $400 million through a share issue, with $325m to be taken up by institutional investors and funds. And the $75 million to be offered to existing retail shareholders. The issue is underwritten and will be priced at $7 a share as the Placement Price. (The final price will be the lower of the Placement Price or a 2.5% discount to the 5-day VWAP of shares on the NZX).

It was announced on 16 February that the $325 million institutional offer has now been fully placed.

This just leaves the $75 million retail offer available to existing shareholders. Which I suspect may be oversubscribed given the ~6% dividend yield Contact currently offers, compared to the sub 1% rates at the bank.

That said, the Company does have the option to accept oversubscription. Which it may very well do with an eye to future projects.

Here are the key aspects I like in the SPP:

- Geothermal is projected to be New Zealand’s lowest cost renewable.

- The Tauhara development replaces the 68-year-old Wairakei power station with a larger, more efficient new technology geothermal station.

- Tauhara when complete will provide an estimated 152.5 MW (net export to grid).

- Strong wholesale electricity market fundamentals appear through to 2024.

- The Company has proven operational experience on the world’s second longest electricity producing geothermal field (Wairakei, since 1958).

- There exists a wider investment plan into North Island battery investment, hyrdro turbine refurbishment and decarbonisation via Drylandcarbon and Simply Energy.

- The Company has announced a new dividend policy, which will see an ordinary dividend of 80-100% of average Operating Free Cash Flow.

- This expects an ordinary dividend of 35 cps. At the SPP price of $7, this targets a yield of 5%.

As a Contact shareholder, I will probably apply for an allocation for the passive income strategy component of my portfolio. Which is a significant objective of my investing.

On a combined basis, the Equity Raise (assuming $400 million is raised) represents approximately 7.7% of Contact’s market capitalisation. So I will seek to avoid dilution of at least that amount in my holding.

Note: Investors should be aware of the key risks. These are extrapolated in the offer document. Crucially, there are risks of economic downturn dampening demand, oversupply in the electricity market, increased regulatory risk, increasing competition, risks of infrastructure damage and risks in completing the project itself.

Any dividend offered by Contact may rise, fall, or be cut altogether. And the share price is also prone to rises and falls on the company’s outlook and results.

Where could Contact Energy [NZX:CEN] go from here?

- Contact is expensive — and their equity raise doesn’t offer much discount.

- Though the dividend and renewables focus are very attractive.

- Be careful of share price growth without underlying earnings growth.

The oligopoly moat factor does increase the value of this company in New Zealand. And there could be further upside with societal move to EVs and population growth. But for a business with relatively high share price in relation to earnings, the savvy investor should consider with caution.

This is the sort of analysis we do in our Lifetime Wealth Investor research. In fact, we’ve just added several new businesses that we suspect could break out this year. I invite you to join us and take a look here.

Regards,

Simon Angelo

Editor, Wealth Morning

Important disclosures

(This article is general in nature and should not be construed as any financial or investment advice. To obtain advice for your specific situation, please consult an Authorised Financial Adviser.)

Simon Angelo owns shares in Contact Energy [NZX:CEN] via Wealth Manager Vistafolio.

Already a Member? Sign In Here

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.