When we lived in Europe, it was always on my list to go to Venice.

Even on the trips we made to Italy. Driving from France and crossing the winding mountain roads into the north of the country.

But it never seemed to happen. There was always some other town to go to. Or attractive place to stay that favoured the car. And the children.

When we moved back to New Zealand in 2018, I regretted having still not made it to Venice.

Then, in early 2020, when Covid was beginning in China but unknown to the world, we were en route to Japan. And I met an old friend at the airport. I hadn’t seen her for many years.

She was now living with her family in Venice.

So I began planning a trip…

A few months later, the global coronavirus crisis began. We were in lockdown. And flights everywhere and anywhere were grounded.

So I bought an oil painting:

‘Venice’ by Escha van den Bogerd

Even today, the possibilities of global travel are much limited. Expensive. And carry risk.

Yet there are many, many people like me and my family. Wanting to fly again. To go to new places. To see old friends. And reconnect with family.

If there is one sector that has been taken to the brink, repriced, but still offers huge potential recovery growth — it is the travel sector.

Tech, resources, property, value, retail, and other sectors have recovered — partly, fully, and some beyond. But travel and aviation remain among the few still soft areas. By share prices.

Are they the last cab off the rank to ride further recovery growth in 2021? And should you consider boarding now?

Auckland International Airport [NZX:AIA] and Air New Zealand [NZX:AIR] are local sector plays.

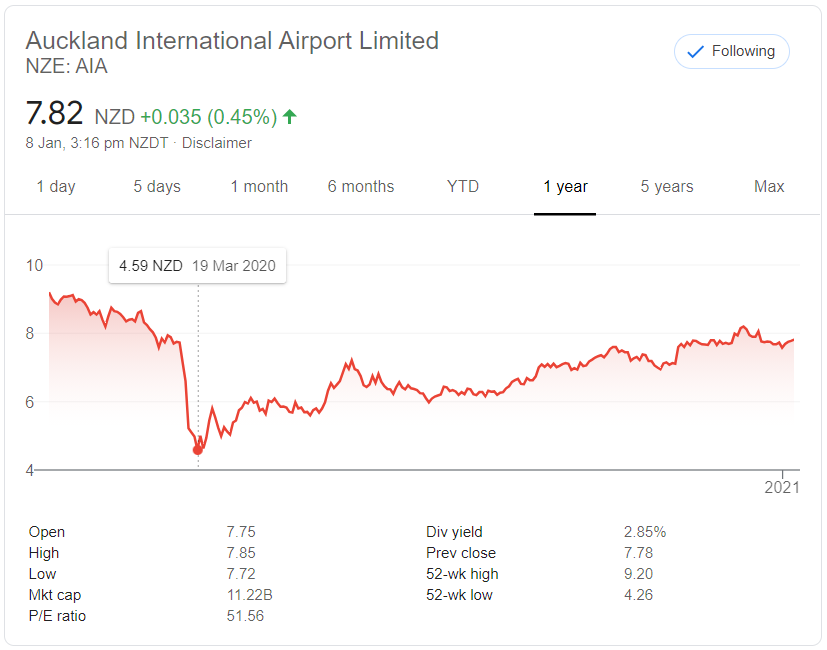

Here’s how they’ve fared since Covid stopped international travel:

Source: Google Finance

Auckland Airport has recovered from a low of around $4.50 to within its pre-Covid range in 2019 of $7.50 upwards.

In November 2020, figures revealed that passenger numbers through the airport had fallen 70% on the same period last year. The bulk of the passengers were domestic. Yet even domestic travellers were down around 38%.

So how and why has Auckland Airport managed to regrow its share price?

Remember, seasoned stock market investors are looking 6 to 12 months out. The airport is expecting an Australian travel bubble and a gradual reopening of all international travel. There will likely be pent-up demand.

But the overriding force is probably the property assets the airport controls. At time of writing, the share price reflects a Price to Book ratio of 1.6. Meaning investors are paying only a 60% premium on these assets. While they get the airport business and the potential restoration of dividends next year.

Meanwhile, large institutional investors appear to have continued interest. BlackRock [NYSE:BLK] alone owns around 4%.

Yet would I buy these airport shares now? It’s been a substantial part of my portfolio for years. I resent the loss of dividend. But there doesn’t seem to be outstanding value on the table right now.

What about Air New Zealand?

This is a more tenuous play, since airlines aren’t made up of strategic Auckland property assets. They lease planes. Exist in a competitive sector. And have been absolutely hammered by Covid.

The current glimmer of hope is the restoration of the domestic sector. Travel bubbles. And the roll-out of vaccinations.

But those factors do not seem to provide enough impetus to restore the share price toward the $3+ mark at which it used to trade.

The airline could have a hard rebuilding road ahead. It will likely emerge a smaller business. And while there may be value below $1.50, it would appear there are even better value options in this sector overseas.

Airlines and travel businesses with the buffer of millions more regular customers.

In fact, we’ve just found one in our Premium Research. It is our pick amongst this sector. Within these distressed, value stocks. And the Company we have found could offer growth upside with less risk downside. Learn more about this opportunity here.

It’s an opportunity that might just get you or I to Venice and beyond…

Regards,

Simon Angelo

Editor, Wealth Morning

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.