Good grief. It’s the silly season again, isn’t it?

Once again, my social media feed is being clogged up by folks arguing about the economic impact of the American presidential race.

‘The market will crash if Biden is elected.’

‘The market will only boom if Trump is re-elected.’

Source: VOA News

Well, gee whiz. A lot of threats and ultimatums there.

For sure, political partisanship has always existed on the online landscape — but I have never seen the discussion being as angry as it is today.

Each time one side digs up evidence to prove a point, the other side will counter with accusations of fake news. The name-calling and insults soon escalate. It’s abysmal.

So, in an age where any fact can be proven or disproven with a bit of cherry-picking, who do you believe? What do you believe?

In my humble opinion, the final judgment should still come down to hard data. That means putting emotions aside. Accepting only what we can reliably measure and prove.

The long-term market trajectory

Ruchir Sharma, the chief global strategist at Morgan Stanley, has taken a close look at market performance over the years. He says:

‘My research, which reaches back to the 1860s, when the two-party political system began to dominate, shows that the market has no clear bias in favor of either party and that market volatility in the run-up to an election is perfectly normal. The market is an economic barometer, not a political one.’

This finding seems to back up what legendary investor Benjamin Graham believed:

‘In the short run, the market is a voting machine, but in the long run, it is a weighing machine.’

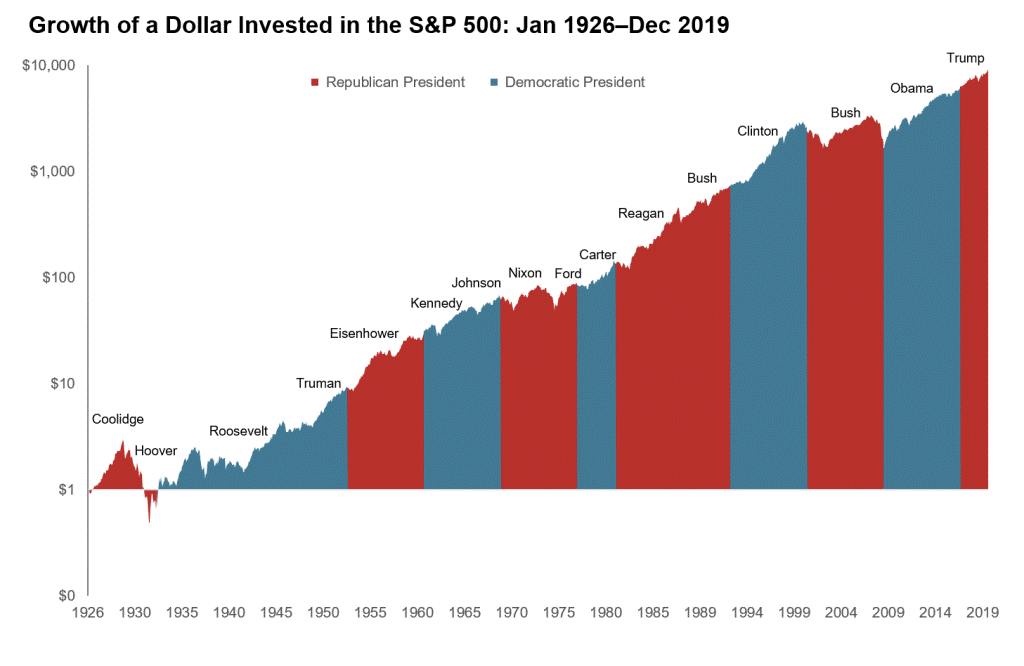

Source: Kings Path Partners

The economy has steadily marched on, regardless of power transitions in the White House. When you look at the big picture, you can see what the long-term trend really means:

- The market appears to be neither moral nor immoral. It is amoral.

- The market appears to be neither Republican or Democrat. It is apolitical.

Cognitive bias

So, given that the macroeconomic data is so consistent, why do people still believe that one political candidate can make or break the market?

Part of it has to do with the way we’ve been socialised as human beings. We’ve been brought up to believe in storylines and narratives; heroes and villains; good and evil.

Therefore, archetypes loom large in our imagination. We are locked into binary choices. Either/or. Because of this, we tend not to see the wider spectrum of human experience very well. We don’t understand shades of grey.

Psychologists call this cognitive bias. And there are two kinds that impact us the most:

- Anchoring bias — the tendency to anchor our beliefs on the first piece of information we get.

- Confirmation bias — the tendency to stick with information that validates our own point of view.

For example, if we don’t like Biden, we might be inclined to blame him when we step outside and get soaked during a rainy day.

However, if we like Trump, we might be inclined to credit him when we step outside and enjoy the warmth of a sunny day.

In both cases, neither Biden nor Trump actually have a direct impact on our lives. They just serve as mythological totems for our own personalities.

Call it a self-fulfilling prophecy, if you will.

Crash or correction?

But, hey, enough psychoanalysis. Let’s get back to the current state of the economy.

Consider what Steve Kalayjian from TickerTocker said recently:

‘The S&P 500 is fine now, but if Biden wins, there will be a sell-off. If Trump wins, you’ll see the Dow and S&P easily climb to new highs. I see a decline of 5% or more.

‘I don’t think the Democrats are being forthright with the policies they are prescribing with the Green New Deal, Supreme Court, and new tax policy both corporate and individual.’

A 5% sell-off is certainly plausible.

But…is 5% really that significant? Or even newsworthy?

Source: Google Finance

In September 2020 alone, we saw the S&P 500 dip over 9% over the course of 21 days.

Few of us could reasonably blame this slide on either Biden or Trump. This event happened simply because September has historically been a sluggish month for stocks. In this case, the dip was cyclical.

So perspective is important here. When experts use the word ‘crash’, they are talking about a market drop of 10% or more in just a single day. And when they use the word ‘correction’, they mean a similar decline over days or even weeks.

What happens on November 3?

Given what we already know about Biden and Trump, it’s highly unlikely the market will crash simply because one of them emerges victorious on November 3. After all, we already understand what each man stands for and what they will likely do in the White House over the next four years.

However, we might experience a sharp jolt of anxiety if we don’t get an outright winner on November 3 — which is possible because of all the wrangling over mail-in ballots and swing states. Some pundits believe it could take up to a week for the votes to be fully counted, given the extraordinary circumstances of Covid-19.

But, even so, a correction feels more plausible than a crash.

History serves as a guide. Remember what happened back in 2016 when Trump defeated Clinton in a shock result? The S&P futures actually slumped 5% on election night — but the markets jumped 1% when the trading opened the next day.

We could see that kind of short-term volatility again — which will settle down before we know it.

Order vs chaos

I’ll let the Joker from The Dark Knight have his say on the matter:

‘You know what I’ve noticed? Nobody panics when things go according to plan. Even if the plan is horrifying! If, tomorrow, I tell the press that, like, a gang banger will get shot, or a truckload of soldiers will be blown up, nobody panics, because it’s all part of the plan. But when I say that one little old mayor will die, well then everyone loses their minds.’

Indeed, that sums up the age-old conflict between order and chaos.

But, jokes aside, the market doesn’t tend to stay frozen in panic mode for very long. Even when faced with short-term disruption, investors will adjust. They will find an equilibrium. They will move forward.

The market is more resilient and adaptable than most of us give it credit for. It has already priced in most of the possibilities in the presidential race.

I have faith that the long-term trajectory is clear. The stock market will remain the best vehicle for generating wealth — and it will stay that way regardless of what happens on November 3 and beyond.

Regards,

John Ling

Analyst, Wealth Morning

PS: Forget 2020. We are already looking ahead at 2021. Will this be the year that our global economic recovery kicks into high gear? To prepare for this profitable surge, we have gathered over 20 exclusive investment ideas in our portfolio, ranging from property to mining to tech. Sign up for our Lifetime Wealth Investor Premium Research today.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.