There is a trend unfolding. The US (among others) are looking to diversify — actually remove — supply-chain manufacturing from China. This could bring about a change in the global economic order. Where low-cost manufacturing can no longer be a complacent driver of return.

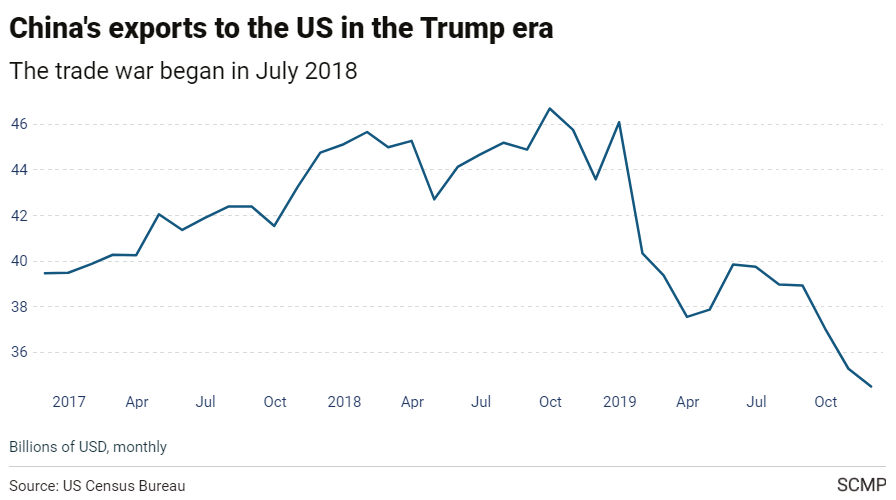

Take a look at what’s happened to Chinese manufacturing exports to the US since the trade war in 2018. Consider now how much worse relations are since the coronavirus hit. And the fact that even phase one of Trump’s deal looks ready to break.

Remember, once manufacturing moves out of China, it is hard to get it back. Tariffs of 25% or more make factories uncompetitive. They close down and lose their investment.

Now, we do not invest in China. I’m sure there’s still money to be made in some areas. But in our Lifetime Wealth approach, we must consider ownership and protection of investor capital. If the Communist Party of China can ultimately own or influence any company on a local exchange — this is not for us.

Innovative companies in the US and Europe, able to manufacture locally and drive increasing return on capital through productivity, could be an ideal investment pick.

Through my network, I came across this American tech business with a fascinating angle…

Already a Member? Sign In Here

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.