A few years back, I came across a well-qualified IT professional who lost his job. Over the course of a year, he tried to get another job in New Zealand. His field was specialised. But he had a strong track record and was only in his late 30s.

His final solution was to move his family to Australia – where he was able to find employment.

It seems that, in a country of under 5 million people, you can sometimes run out of opportunity. Unless you’re prepared to retrain and go where there’s demand.

Structural changes in the labour market are about to hit us harder than ever before. There are two threats to more and more jobs:

1) Automation of work

A McKinsey Global Institute report has estimated 375 million jobs worldwide will vanish by 2030. Another Oxford study in 2017 predicted job losses of up to 47% within 50 years.

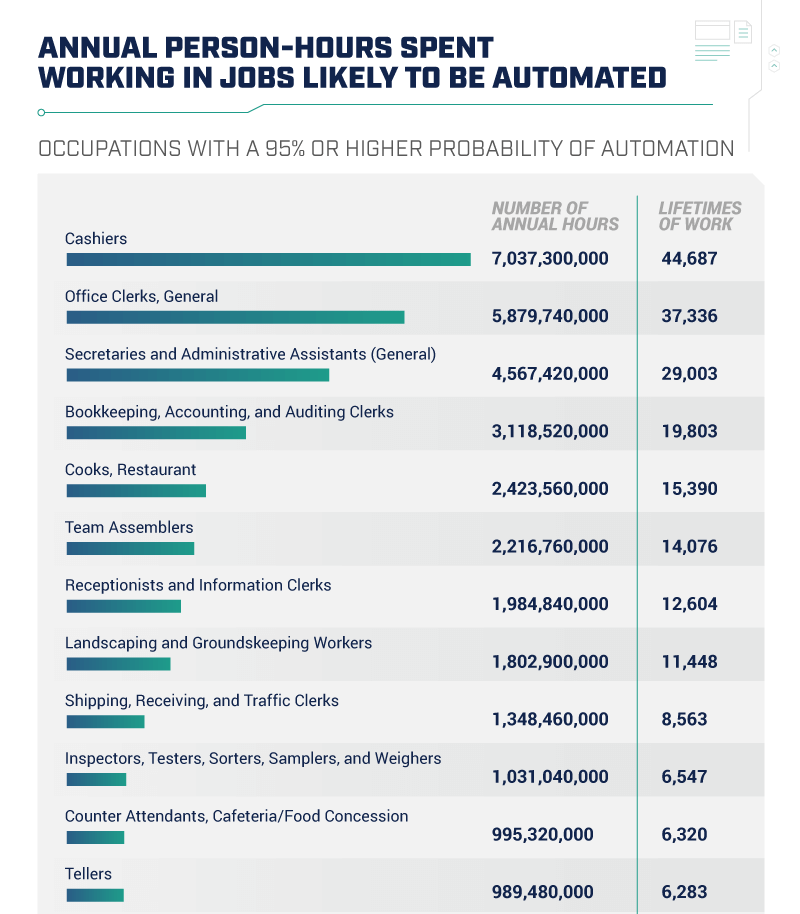

The US Bureau of Labor Statistics has looked at which jobs are most likely to be in the firing line of automation. Here’s the top 12:

Source: BLS.GO

2) Globalisation of work

For the best part of two decades, I owned a professional services business in Auckland. To begin with, we used local freelance designers. Then, as the business became more competitive, we started to outsource around the world. The Philippines for design and animation work. Eastern Europe for web programming.

We not only discovered that we could get a world-class standard of production; we could sometimes get it for 50% or less than the local going rate.

Jobs that don’t need face-to-face contact can easily be outsourced globally, especially those that can be carried out and delivered online.

While automation threatens the livelihoods of blue-collar workers, globalisation also floats many white-collar professions on the international market.

The real rate for the processing areas of accounting, law, graphic design, animation, web design and programming could fall to less than the New Zealand minimum wage.

How do we navigate this?

Guaranteed Basic Income

Some economists advocate a Guaranteed Basic Income (GBI) — or Universal Income.

All residents of the country are guaranteed a minimum income. It appears many developed countries could afford to guarantee around $20,000 per year by adjusting taxes and other benefits.

The advantage of this is that it gives people more choices around work. You don’t have to accept a lousy job where you could end up earning less than being on benefits.

And in the coming jobs bonfire, this could save society.

New industries and nationalism

The greatest job growth over the past hundred years has come from countries developing national industries and competitive trade advantages.

On the global stage today, we see the victims of globalisation fighting back. The rust belt in America electing Trump. The periphery removed from London’s success backing Brexit. And increasing populism across Europe.

At the same time, we see opportunity in new industries. A move to renewable energy. Increased demand in health and aged care. Information and communications technology. Financial advice for a changing world.

Follow the money. When livelihoods are threatened, people will vote. And the more nimble and able will retrain and adapt.

Richer countries will be better able to protect their economies from the ongoing ravages of globalisation.

Countries like Australia and New Zealand have an advantage in commodity exports. Logs. Food. Iron ore. The ability to feed tens of millions more people beyond their lands.

Retaining these advantages requires a low population density. Not giving into the easy money of heavy net migration that goes beyond needed skills shortages. This short-term money has tempted past governments. And alongside inability to build enough homes, it has contributed to the alienation of many younger people from urban housing markets.

For our readers

You can protect yourself from increasing job uncertainty by building a portfolio that could deliver your basic income needs.

To achieve this, you need to target the sector opportunities poised for growth. With the scale and profitability to share the gains through regular dividend distributions.

In our premium newsletter, Lifetime Wealth Investor, we look at how to build such a portfolio.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.