A friend of mine went to Sydney to speak at a conference.

He’d always wanted to visit Ayers Rock. So he travelled a couple of days before to do that.

He saw the rock. But when it came time to fly to Sydney, flights from Ayers Rock Airport had been cancelled.

This was a problem. Panic! He was due in Sydney the next day.

The only way to achieve that was to take the next flight from Alice Springs. A 6-hour drive across the desert.

He went to the rental-car desk at the airport and secured a vehicle.

They warned him that if he drove at night, there would be no insurance. The risk of hitting wildlife was too high.

Now, my friend was expecting a large 4WD.

All they had available was a tiny Suzuki Swift.

As he set off on the road to Alice Springs, it started to get dark. And as he progressed into the desert, it became very dark, with no sign of human habitation in sight.

‘I was driving on adrenaline,’ he later told me. ‘Fearing something would jump out in front of the car at any moment.’

Then he was alerted to a new problem.

After a few hours of driving, the fuel gauge was nearing empty.

How long could he keep going before he got stranded in the desert? And if that happened, how long could he last out there?

But Lady Luck was kind. A cluster of lights came into view just as his fuel-warning light pinged. Turned out a pub was open for a party. They had a petrol pump.

He made it to the airport and arrived in Sydney in time for his conference.

I tell you this story because it illustrates a powerful fear that people have around money — especially retirement savings.

How long will my savings last? And when can I eat my capital?

Here at Wealth Morning, we’re focused on helping people achieve an endgame — investing in hidden opportunities in the global markets.

It’s about doing that well enough so that you can achieve financial independence. Work becomes optional. Your wealth increases your income. And your money works harder than you do.

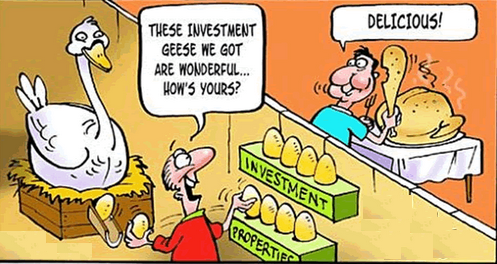

But, of course, this means creating a ‘golden goose’. A robust portfolio that throws off income via dividends. And hopefully achieves some capital growth.

If you eat the capital, you start killing the golden goose. Withdrawal by withdrawal.

Nobody knows exactly how long they’ll live. Or the healthcare expenses that may rock them in the late stages of life.

So here’s my approach…

Protect your capital

First, build a fortress against attack.

If creditors, the state, business associates or even family members are at risk of attacking you, put your assets in a separate legal entity — i.e. a Trust.

A Family Trust means you no longer own your assets. You can enjoy them, but they’re not amidst your personal property.

And you can set up a brokerage account to hold shares in a Trust. Or own property in a Trust. Your Trustees will hold the assets for you as a beneficiary.

Second, consider the risks that could destroy your capital.

Find out if you are able to insure against anything that could wipe out 10% or more of your capital. For instance, your home. Vehicle liability. Potentially health. I’m not entirely convinced on the value of health insurance in New Zealand for individuals with capital — but I am due to consider this in another post.

Insure against these things.

Set some goals

Do you aim to live to 102? Do you want to leave an inheritance for your kids or grandchildren?

This is going to affect your drawdown.

The key is to set some buffers. And stay comfortably away from them.

Let me give you an example. Clients of mine. Peter and Mary (names changed).

They’re in their late 60s. Mortgage-free home worth $850,000. Share portfolio nearing $1m. Insurances covering home, vehicle and health — hospital procedures only.

Over the past several years, their portfolio has delivered 12% per annum — combining dividends (4-6%) and capital growth (6-8%).

Let’s be conservative and say they can aim for an 8% return.

The portfolio gives them 80k before tax.

Their super/pension gives them another 32k.

They can afford their insurance — including health (which increases with age) — and a reasonable lifestyle without working. Nice.

But they want to do more. Life is short. Now, why not?

Sparkling new SUV — 75k.

European holidays. Business Class. 50k x 3.

Help kids into housing. 200k.

Can they draw down 425k over the next 20 years without killing the golden goose of their portfolio?

Let’s take a look.

Peter and Mary want to leave an inheritance for the next generation of their family not exceeding their family home (850k).

They want their funeral expenses covered. Inclusive of a buffer of 200k to cover hopes for longevity.

So their maximum drawdown from a $1m portfolio is 800k.

That is a useful figure. They can now use a retirement drawdown calculator to work out how much of the 800k portfolio they can ‘eat’ each year.

There’s quite a useful calculator here, where you can consider inflation and how much you want to have left. (As a guide, the target inflation rate of the RBNZ is up to 2% per annum).

According to this calculator, Peter and Mary could withdraw around 65k per year, maintain their lifestyle until age 97 and die with a 200k surplus — and surplus (along with their mortgage-free home) for the next generation.

Nice one.

But, of course, markets can change quickly. A downturn could upturn these calculations. Maybe some stress-testing should be added.

Yet this is a reasonable guideline. Peter and Mary are in a comfortable position. And that success can be replicated.

To avoid running out of fuel on the desert road of retirement, you need to protect your capital. You need to consider your goals and work out some buffers. But, most of all, you need to invest well — to maximise income and growth returns.

Check out our premium research for passive income ideas.

Go see that Rock. Drive an interesting road. And enjoy the ride.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.