The real impact of world events can be seen in currencies. And certain stock prices. As millions of traders vote their fear or greed in what’s happening around the world.

But the mood of the investing public is volatile. It can change in a heartbeat.

Two areas of volatility have been hitting the portfolio we run here at Wealth Morning. Fallout from the US v. China trade war. And Brexit.

To date, we’re managing both, with holdings in the portfolio reaching double-digit growth in two months. Of course, past performance is no guarantee of future performance. But volatility does create opportunity to profit.

The mainstream financial press are primarily journalists. Not traders who are up half the night at a trading desk as we often are. And many of these reporters spend their time speaking to those with vested and political interests.

If you follow the mainstream news, you may think Brexit is the end of the UK. You might miss some of the best value market opportunities we’ve seen in a decade.

While Brexit is the popular choice, what we’re seeing now is that it is far from the choice of the ruling ‘Remain EU’ class. And when people are about to lose their power, they will do anything to try and prevent that.

Of course, the other mainstream financial news verdict (opinion) is that the US v. China trade war is a terrible mistake. Hotheaded Trump is going to pull the global economy into recession. And wipe out the economies of many countries.

When you dive into the facts, it’s been clear for a long time someone has to hold China to account. And China will be the one who will either lose or reform.

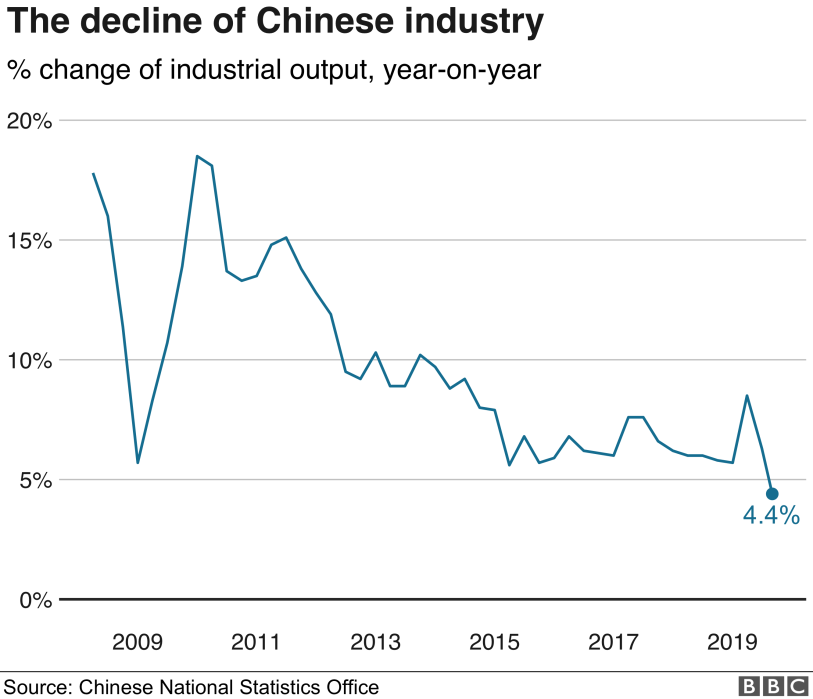

How bad is China’s slowdown?

Manufacturing in China is falling off a cliff.

Take a look at recent figures from the Chinese National Statistics Office:

Now, some analysts believe China over-reports good numbers and under-reports bad. I’m not sure whether that’s true or not. But the writing is on the wall. China is slowing down. And fast.

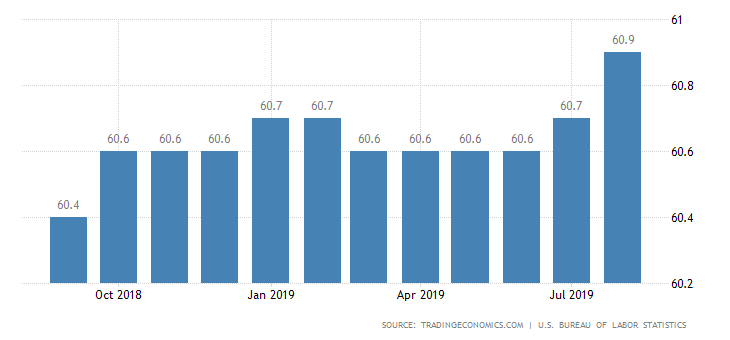

On the other side, what we are seeing since the trade war, is a steady increase in the US employment rate:

Of course, the trade war is bad for countries like New Zealand and Australia

Here in New Zealand, we are surplus-commodity exporters focused on China. There seems to be a correlation with the slump of the a2 Milk Company [NZX:ATM] share price with the full impact of the trade war being realised.

This is a company dependent on the prosperity of the Chinese consumer to buy their diet-superior a2 milk.

In addition to this, a competitor, Bellamy’s Australia, is currently the subject of a takeover bid by a Chinese dairy giant. This could see that company forming a more competitive local presence.

But that’s another story.

When you look at the big picture, there is a long export mistake of concentrating on one market. And failing to support other industries when that market becomes lucrative.

Taps get turned off. And now the Australasian economies are looking vulnerable.

So Trump should never have taken on China, right?

If you’re still dubious about the need for someone to challenge China on trade, read Peter Navarro’s book, Death by China.

Navarro is an economist who currently serves as Assistant to the President, and Director of Trade and Manufacturing Policy.

He calls out the world’s largest exporter on many predatory practices. Illegal export subsidies. A manipulated and undervalued currency. Counterfeiting, piracy and theft of American intellectual property. Lax health and safety standards. Unlawful tariffs and quotas. Unfair pricing and dumping practices designed to push out foreign rivals.

‘Great Walls of Protectionism’ to keep out foreign companies from setting up shop in China.

Perhaps he goes too far in this book? Many of the findings are shocking, but they appear to be grounded in fact.

Most shocking is his story on the production of fake rice.

Chinese ‘black heart’ companies were found to be adulterating rice to sell to poor villagers. This appears to be discovered when the tallies of rice farming production versus sales of rice did not match.

Navarro explains how the scheme works:

‘In this particular con game, the faux rice manufacturers first mash up a blend of regular potatoes and sweet potatoes and mould the mash into the share of rice kernels. Synthetic plastic resin is then added so the grains hold their shape; the giveaway is that you can boil the faux rice for hours and it remains crunchy. As noted by an official from the Chinese Restaurant Association, eating three bowls of this Frankenstein mashup is the same as swallowing an entire plastic bag.’

So if companies are getting away with fake rice in the domestic market, the mind does boggle as to what some may attempt on the global export markets.

It is noted in the book that Obama constantly mentioned the need to challenge China in many areas — but ended up doing little.

So perhaps the aggressive opposition to some of Trump’s global trade policies are more idealistic than anything else? It makes no logical sense to allow large countries to continue to run massive deficits with you.

And for those who really care about climate change, curbing highly pollutive manufacturing in China will do far more for greenhouse gases than putting a halt to transport by car — where efficiencies continue to grow.

Interestingly, the US stock market — where we continue to see opportunities — is not as lashed by the trade war as you might expect. One of our recommended holdings has a significant export business into China and is continuing to grow earnings. There is upswing in the share price and signs of a breakthrough.

Many of the trade-war concerns within share prices also lift each time there is a positive announcement on US-China talks.

China is being pushed slowly but definitely into talking. A deal may be possible, where China can save face and America exercise some humility.

As I write this, talks are set to resume on October 10th.

It’s taking time. But tensions do seem to be thawing. The ultimate deal will be one that addresses the US trade deficit, IP theft and forced transfer of technology.

The benefit for the world? Allowing China to reach its potential on a more honest and level playing field.

The benefit for investors? I reckon it’s time to buy instruments that could gain from potential resolution.

Invest well and the future looks great.

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.