Gold is on the move.

What I mean is, in the last few years several central bankers have been repatriating their gold.

You see, countries store their gold reserves in different locations, and the vault at the basement of the New York Federal Reserve is a popular place to do this.

Back in 2013, Germany asked the US for some of their gold back.

They followed similar moves by Venezuela…Austria…Netherlands…and Turkey. Which has meant that foreign gold held at the New York Federal Reserve is now at a record low.

But central bankers are not only looking at repatriating their gold home, they are also stocking up on gold.

What countries are buying gold?

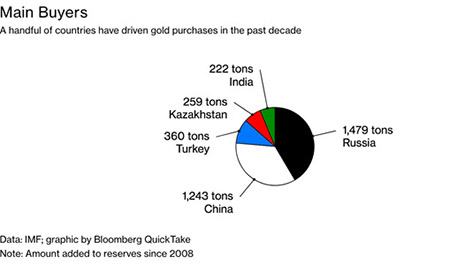

In the last 10 years, China, Russia, Turkey, India and Kazakhstan have been the main gold buyers, as you can see below.

|

Source: Bloomberg |

Central bankers usually add gold to their reserves to diversify, and to provide a hedge against inflation. According to Bloomberg, central banks now hold about a fifth of the gold ever mined.

In case you are curious, the Reserve Bank of Australia (RBA) recently released a clarification note on their gold holdings. Australia hasn’t bought an ounce of gold in the last 20 years, but holds 80 tonnes of gold. 99.9% of it is stored at the Bank of England, in the UK.

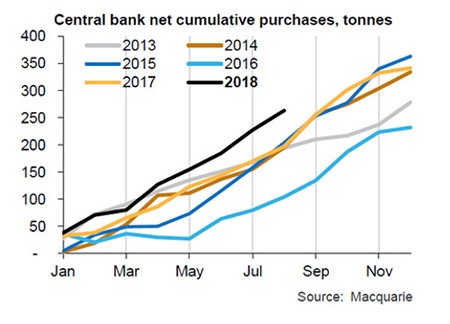

But this year central bankers are purchasing gold at higher levels since 2013, as you can see below.

|

Source: Bullion Vault |

Recently, two European countries shocked the gold market by buying gold for the first time in 10 years.

As Bloomberg reported:

‘The gold market was caught by surprise when two of eastern Europe’s biggest economies, Poland and Hungary, made rare purchases in recent months. Why central banks buy gold is often a major topic of market speculation. Were Poland and Hungary signaling worries about economic conditions? Were they cutting exposure to the dollar? Or maybe hedging against potential European Union sanctions?…

Why are the purchases by Poland and Hungary surprising?

They’re the first substantial gold purchases by any EU nation in more than a decade. “The gold market was used to, and expected further, central bank buying” by countries in Asia and the former Soviet Union, “but purchases from EU members, that was totally unexpected,” said Carsten Menke, a commodity analyst at Julius Baer & Co. in Zurich.’

[openx slug=postx]

Why are they buying gold?

What were the reasons that Hungary and Poland gave for buying gold now?

‘Hungary’s central bank governor, Gyorgy Matolcsy, said boosting gold holdings 10-fold in October was a way to make the nation’s wealth safer. It also helped bring the share of gold in its reserves in line with other nations in the region. While Poland declined to comment on its purchases, some analysts said gold’s recent drop to the lowest in more than a year helped make the metal more attractive.’

Yep, safety…and the fact that gold is cheap.

Gold rallied after the turmoil in 2008. It has somewhat dropped since, as you can see below. While the price of gold has remained steady since, the truth is that gold has lost some of its shine for investor in recent years, as stocks and property rallied.

|

Source: Gold Price |

Yet, what does this recent central bank gold shopping spree and repatriation mean?

For some insight I reached out to our in-house resource expert, Jason Stevenson. If you are not familiar with Jason, he heads the Gold Stock & Commodities Trader service.

This is what he had to say:

‘I think that the gold price really comes down to confidence in the financial system. When confidence in the financial system collapses, gold tends to rally. That’s what happened heading into the GFC and into the European sovereign debt crisis of 2011/12.

‘It’s worth noting that central banks are buying gold. You got to wonder why. Is it a hedge against their own money printing programs that destroyed free markets?’

As we have written before, central bankers have been engaging in quantitative easing and have lowered interest rates to record lows since 2008, all to promote a recovery.

Low interest rates have encouraged stocks and property to rally into one of the longest bull markets ever. But now central bankers are cutting quantitative easing programs and raising interest rates.

If money printing and low interest rates pushed property and stocks up, the opposite could bring asset prices crashing down. We are already seeing some turmoil in the stock markets as the US Federal Reserve raises rates.

Central banks are stocking up on cheap gold to diversify, and quite possibly to prepare for the next downturn.

It may be a good idea to do the same.

Best,

Selva Freigedo,