The big news last week was the action on Wall Street.

Down 800 points. Down another 500 points. Up 280 points.

The culprit for this volatility, according to the headlines, is rising interest rates…

‘U.S. markets drop sharply as investors are spooked by rising rates. Trump blames “crazy” Fed.’

Washington Post 10 October 2018

‘Wall Street plunges on rising rates’

The Australian 10 October 2018

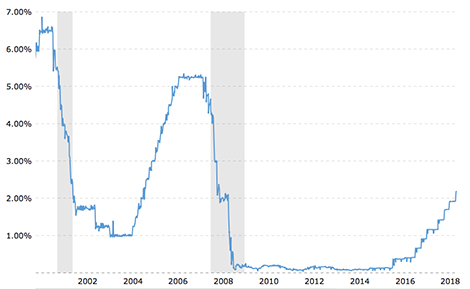

The ‘crazy’ Fed has been steadily dialling up the US cash rate since December 2015…rising from 0.25% to 2.2%

The Donald has got it all wrong. The Fed was crazy for keeping rates bumping along the ‘near-zero level’ for so long.

|

Source: Macro Trends |

The Fed’s very accommodative interest rate policy unleashed the animal spirits…debt levels went crazy.

Since 2008, the US has (collectively) thrown another US$15 trillion on their debt heap.

Total US debt is nudging US$70 trillion…three and a half times the size of the economy that supports the debt.

The Fed must surely realise the ‘low for longer’ strategy has painted them into a corner…damned if they do and damned if they don’t.

Ultra-low interest rates served two purposes…

Firstly, by encouraging every layer of society to ‘gear up’, additional dollars were pumped into the system…providing the illusion of economic growth.

Secondly, it forced investors into a bidding war for income producing assets.

The Fed’s policy rewarded borrowers and risk takers at the expense of savers.

The end result of the Fed’s latest bout of craziness is an even greater debt level than what caused the crisis in 2008 AND the biggest asset bubble in history.

This is Ben and Janet’s legacy. It’s now up to Jerome Powell to clean up their mess.

The Fed has been in this ‘crazy zone’ before…with dress rehearsals in 2000 and 2008.

If you cast your eyes back to the US cash rate graph, you’ll see the Fed’s response on both occasions was to drop the cash rate…like a stone.

In 2000, rates fell from 6.5% and in 2008, the starting point was 5.25%.

Both times the drastic cut in rates had the desired effect…people took the bait and borrowed. The Fed ‘saved the day’ by ‘borrowing from tomorrow’…appealing to peoples’ ‘I want it now’ programming.

In this, the third of the Fed’s bubble trilogy, the US cash rate is nowhere the 5–6% of previous pre-bubble busting times.

And that’s the Fed’s dilemma. It knows the chances of getting anywhere near a 5% cash rate is ‘Buckley’s and none’.

The amount of debt in the system puts a limit on how far rates can rise.

With each 0.25% rate increase, the debt servicing vice tightens on indebted US households and corporates.

There’s only a few more turns of the cash rate screw left before the cries of pain become howls.

Without a decent cash rate buffer, the Fed knows it can’t rely on the old ‘drop the rate quick’ trick when the next crisis hits.

Dropping rates from the high 2% to low 3% range down to zero will have about as much impact as being slapped with a feather.

Making the cost of debt marginally cheaper is not going to help next time round.

Not enough people will have the capacity to borrow in the quantities needed to stave off an economic depression…irrespective of how low rates go.

And, that’s only one half of the predicament the Fed has created. [openx slug=inpost]

Investors are chasing yield with these low rates

The other problem with rising rates comes from investors who chase yield.

With every rates increase, the risk versus reward of being invested in shares comes into sharper focus.

When rates were nearly zero, investors chased anything paying 2% or more…irrespective of credit worthiness.

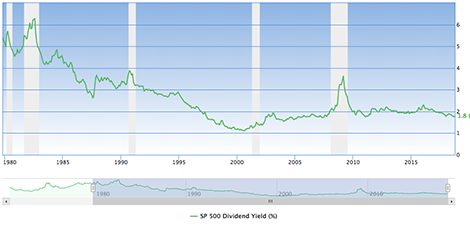

The following chart is of the S&P 500 dividend yield…currently it’s 1.8% per annum.

|

Source: Guru Focus |

Hmmm…as an investor you now have a decision to make.

Remain invested in the market (one that is, by any historical measurement, over-valued) and received a dividend of 1.8% OR sell up and invest in Government Guaranteed cash (with no risk to capital) and receive 2.2%.

Little wonder there’s been some frenetic activity around the market exits last week.

The conundrum for the Fed is the more it tries to buy itself a buffer for the next collapse, the tougher it makes it for borrowers to meet repayments and the easier it makes it for investors to sell.

With hindsight, the Fed should have moved much earlier to increase rates.

This would have slowed down the rate of debt accumulation and taken some of the speculative fever out of the market.

The fact they didn’t take this course of action shows just how out of touch these economic theorists were with reality.

And I say ‘were’, because I think the current Fed chair, Jerome Powell, looks like he’s cut from a different cloth.

Firstly, he is NOT an economist…hallelujah. Hopefully, he won’t be wedded to those serial bubble blowing models.

Secondly, with the release earlier this year of transcripts from the Fed’s 2012 meetings, we learned (as reported in Bloomberg) that, then as a Board Member, Jerome Powell, had concerns about continuing with more stimulus (emphasis is mine)…

‘At the [2012] meeting, Mr. Powell believed the [stimulus]proposal would boost sluggish economic growth but voted to proceed “with a certain lack of enthusiasm.” He added, “I am somewhat uncomfortable with the road that we are on.”

‘He added, “There is no credible threat of deflation, recession or financial crisis, any of which could present a compelling case for action and the use of all of our tools.”

‘Mr. Powell said his reservations focused on the mid-to-long term and not the next six months. “My concern is that for very modest benefits, we are piling up risks for the future and that it could become habit forming,” he said.’

The future we piled up with risks is now here…and it’s Jerome Powell who has to deal with it.

And what is the risk?

Stanley Druckenmiller (legendary hedge fund investor and multi-billionaire) said it succinctly …

‘If I were trying to create a deflationary bust, I would do exactly what the world’s central bankers have been doing for about six years.

‘The government should get out of the business of manipulating long-term interest rates.’

Bloomberg 3 May 2018

The Fed is at least trying to build a buffer for the coming deflationary crisis…but Japan and Europe have hardly moved from zero. Neither of them have anything to cut next time.

Central banks — with their seriously misguided policies — have taken us to a place from which there are no good outcomes.

How and why they did not learn the lessons from the previous bubbles — 2000 and 2008 — is, in due course, going to be the subject of much debate.

But what good is that?

The time for wisdom is before the event…not after it.

Wise up now.

With every turn of the Fed interest rate dial we’re getting closer to the deflationary bust.

Watch what the Fed does with interest…no pun intended…as this is not going to be a laughing matter.

Regards,

Vern Gowdie

Vern Gowdie has been involved in financial planning in Australia since 1986. In 1999, Personal Investor magazine ranked Vern as one of Australia’s Top 50 financial planners. His previous firm, Gowdie Financial Planning, was recognized in 2004, 2005, 2006 & 2007, by Independent Financial Adviser magazine as one of the top five financial planning firms in Australia. He is a feature editor to Money Morning NZ and is Founder and Chairman of the Gowdie Family Wealth and the Gowdie Letter advisory services.