- Home / Updates Latest Alerts Portfolio How to Buy Global Stocks Global Trading Masterclass Wealth Talk Customer Service My Account

-

Have We Hit the Bottom Yet? How to Find Value as the Market Rebounds

There was a hydro power station near where I grew up. They’d release the dam into the river at certain intervals, making for an exciting white-water kayak. The last time I took it, the swirling rapids threw me out into the maelstrom. And we nearly lost the kayak.

Source: NZ Extreme White Water

With billions in fiscal and monetary stimulus now damming in the world’s major economies, I wonder how markets will fare when there’s a release? When economies open again, will markets be in for a wild ride?

You can send every household in the land a cash windfall, created via the mechanisms of central banks. But in lockdown, they can spend very little.

Once they get out, things may be different. Providing they still have a job.

Perhaps we’ll see a repeat of the GFC run-up. Where the top 1% of wealth holders grew their net worth by pouncing on bargains. While the rest of the population saw their share of national wealth decline.

Economists may tell you ‘money printing’ stimulus is fine. Because there’s no inflation during a recession — or depression. That isn’t what happened last time. Inflation may operate like that hydro release. Powering rapid rises in certain streams of quality assets.

For those suffering drawdown shock as portfolio balances have slumped — and for those looking to get in — an old quote of Charlie Munger is timely:

‘The big money is not in the buying or the selling, but in the waiting.’

Finding a floor based on slowing virus cases

I’m buying shares every week now. In my own portfolio and those I manage for wholesale investors. Some say this is premature. That we’re in for a bleak recession and far from the bottom. Next quarter earnings and GDP will be massively down. Maybe prices need to absorb that.

But with panic-sellers out and the weight of trading moving toward long-term investors, we need to consider the glimmers of a post-COVID recovery.

I may be wrong — but the research I’m doing suggests a floor may have been reached.

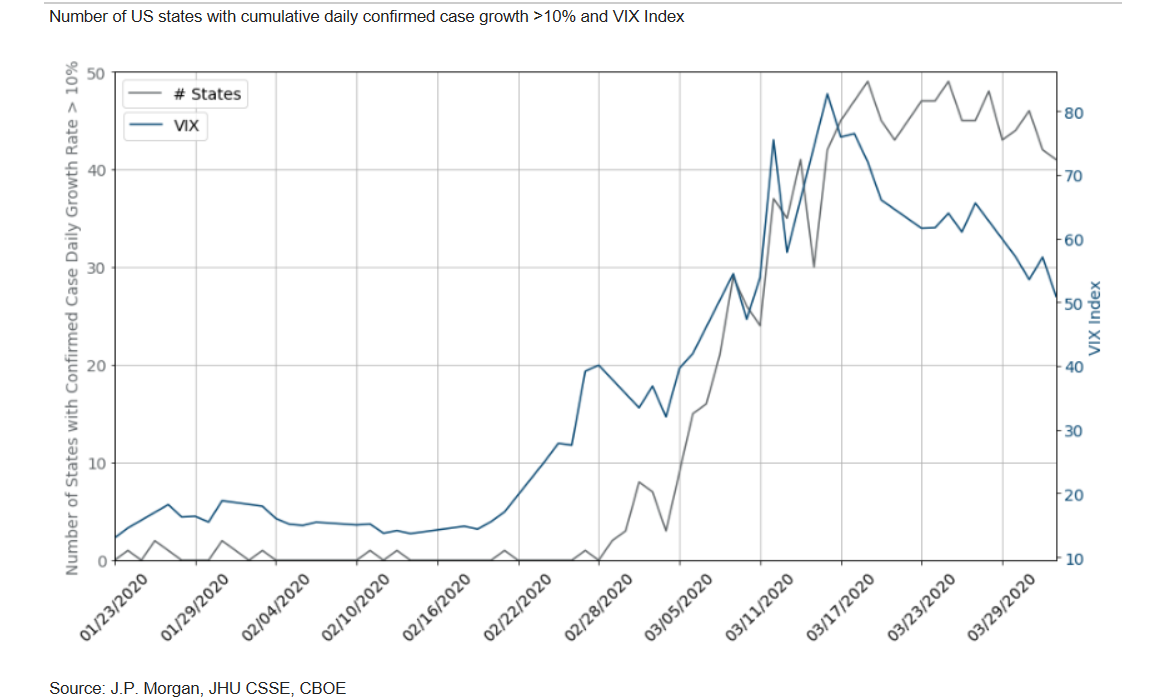

We’ve been seeing a slowdown of virus cases. Analysis from J.P. Morgan finds a link between the spread of cases globally and the VIX Index — the fear index we covered on March 25.

With virus curves starting to flatten around the world, VIX fear is falling off sharply. Markets are cautiously rebounding again.

This may suggest we are not going to see the 40%-plus levels of discounts we saw in the GFC.

Rather, 30% may well be the floor.

With this view in mind, we’re adjusting our ‘Buy Up To’ prices in today’s portfolio recommendations.

The end of the pandemic

As we’ve said before, this market risk event has a finite end.

It will do some damage. But once economies are open again, that damage will be mitigated by government stimulus and some compensatory money.

Unemployment will rise. Property markets may tank. But the business machinery that drives the world — listed on stock exchanges — should start to surge back into life.

There are two crucial end points. Both rely on herd immunity.

Herd immunity is where enough people become immune to the virus that it is no longer able to spread in a damaging way.

There are two routes to this. Either a vaccine, where large numbers of people get immunised. Or gradual sweeping of the virus across the population – which would have both devastating effects and the build-up of immunity in those that recover.

Since the spread of infections is likely far greater than anyone has estimated or reported – especially in China — it is likely we’re closer to herd immunity than we may realise. Meanwhile, lockdowns are slowing cases and allowing the health system time to ramp up drugs and treatments.

Bill Gates, interviewed on Fox, noted that the virus death toll probably wouldn’t reach the worst-case scenarios many experts had predicted.

He mentioned social distancing procedures as an effective tool in slowing cases. Though he reiterated the endgame solution of a vaccine: ‘It is fair to say things won’t go back to truly normal until we have a vaccine’.

We are monitoring listed companies in the race to produce this vaccine

One of the initial front runners appears to be Vaxart, Inc. [NASDAQ:VXRT] a US biotech firm that has announced that it will be among the first to carry out Phase 1 clinical trials in the second half of 2020.

The stock is up 516% this year.

I am tempted to add Vaxart as a recommendation here.

Yet, it is highly speculative given the business is revenue-negative. And in the race to produce a crucial global vaccine, the chances that a $121m market-cap business will lead the way are slim indeed.

By all means do your own research and take a punt on this stock if you have a very aggressive risk appetite. Do keep in mind that the target price, by even bullish analysts following this stock, is only $2 — suggesting there could be only another 15% of gains in the near-term.

Of course, if by some miracle they do lead the way with a COVID-19 vaccine, this stock could produce returns in the hundreds — if not thousands — of percent.

But for the bulk of our Lifetime Wealth investors, we need to balance speculation with the preservation of capital.

Which is why our coronavirus upside recommendation remains fixed on Sanofi [EPA:SAN]. A large-cap pharma which has proven itself as one of the world’s leader in vaccines.

Further updates on their progress follow below:

Portfolio update

Sanofi [EPA:SAN] bucks the market indexes and resumes share price growth — with targeted dividends of around 4% in place.

Sanofi has multiple exposures to coronavirus treatment and recovery paths.

There is the partnership with Regeneron Pharmaceuticals to test FDA-approved Kevzara as a treatment for patients who have been hospitalised from coronavirus infections.

Progress is looking strong. They are now moving to Phase 3 testing ‘to evaluate if Kevzara prevents deaths and reduces need for mechanical ventilation, supplemental oxygen, or hospitalization for COVID-19 patients’.

Sanofi is also working with the US Department of Health — The Biomedical Advanced Research and Development Authority (BARDA) — to test a preclinical-vaccine candidate for SARS for COVID-19 using its recombinant DNA platform.

‘Addressing a global health threat such as this newest coronavirus is going to take a collaborative effort, which is why we are working with BARDA to quickly advance a potential vaccine candidate,’ David Loew, global head of vaccines at Sanofi announced.

Sanofi’s recombinant DNA technology produces an exact genetic match to proteins found on the surface of the virus. It allows the firm to produce large quantities of the coronavirus antigen, which can then be formulated to stimulate the immune system to protect against the virus.

In partnership with Translate Bio [NASDAQ:TBIO], Sanofi is working on a separate programme to develop a mRNA vaccine. The company aims to put a vaccine into a Phase 1 clinical trial between March 2021 and August 2021.

mRNA vaccines are a new form of vaccine, which trick the body into producing some of the viral proteins itself. They work by using ‘messenger RNA’, which is the molecule that puts DNA instructions into action.

They are faster and cheaper to produce than traditional vaccines — and can allow for quick responses to pandemics.

For these reasons and the size and robustness of the business — we’re focusing on our Sanofi recommendation in the war against coronavirus. And increasing our ‘Buy Up To’ recommendation.

AVJennings [ASX:AVJ], our discount Australasian homebuilder, saw more insider buying. Director Bruce Hayman bought 100,000 shares at 42.5c on 1 April, bringing his total holding up to 185,000. Bruce has been a non-executive director in the business since 2005.

We are retaining buying guidance on this business during this time. But we must remind subscribers of heightened risk in the Australasian housing markets, with an increasing unemployment trend fast appearing.

Our new pick, Charter Hall Infrastructure [ASX:CQE], enjoyed a lucky break shortly after we recommended. Scott Morrison announced more support for childcare in Australia. Providing survival support for the sector and keeping centres open, especially for essential workers.

From this Monday, the government will pay childcare centres at around 50% of the usual fees based on attendance numbers in February — before numbers plummeted.

As we outlined, the sector comes with significant risk in a lockdown world. And even after, usage patterns may face permanent change.

But the sector is a strategic one for the Australian economy. And the government has just reiterated this.

Charter Hall offers some margin of safety. The business is based on owning the land and buildings — not the centres themselves. So, in a worst-case scenario, there may be other property opportunity.

The weight of closure risk seems to have been averted — at least for now. At the time of writing, we are up around 30% on this stock.

Tassal Group [ASX:TGR], our salmon-and-prawn farm play also saw insider-buying support. Directors Allan McCallum and Jackie McArthur acquired around 380,000 and 816 shares respectively at $3.02 on 31 March.

Coverage Timing

Now, we did get an email from Tony asking why we commenced coverage of Charter Hall Infrastructure at a price on 26 March — prior to publication on 29 March. I should explain this for the benefit of all readers.

The research and addition of stocks into the portfolio begins the week leading up to the recommendation when we first see value.

Unfortunately, our publishing schedule means any recommendation is not actually published until Wednesday.

The gap between the publishing time and the portfolio addition time may cause a gain or a loss to be shown. At these times of heightened volatility, that gap can be significant. Prices can move either way and quickly at such a time, which is why we note that ‘Buy Up To’ prices are guidelines only and subject to market volatility.

In the future, we will be monitoring to ensure our entry prices are closer to those on the publishing date.

Top-Ups

Readers will also be seeing multiple entry dates on existing recommendations.

As we are suggesting ‘Buy Up To’ guidelines, we also follow these within the portfolio, adding top-ups as we see value in our monitoring.

For the sake of simplicity, these top-ups are equal weight.

Here is our current portfolio with ‘Buy Up To’ prices updated:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 220p 8-Jul-19, 17-Mar-20, 23-Mar-20 268.70 Open 218.80 11.20 -14.4% ASX:WBC Westpac Banking Corporation Medium Buy up to A$17 6-Aug-19, 2-Mar-20, 16-Mar-20 22.11 Open 16.10 0.80 -23.6% LSE:NRR NewRiver REIT plc High Buy up to 70p 6-Aug-19, 16-Mar-20, 23-Mar-20 99.93 Open 61.70 10.80 -27.4% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$9.00 8-Aug-19 10.98 Open 8.93 0.25 -16.4% ASX:TGR Tassal Group Ltd Medium Buy up to A$3.80 21-Aug-19, 2-Mar-20, 10-Mar-20 3.89 Open 3.70 0.18 -0.3% NYSE:GM General Motors Company Medium Buy up to $22 28-Aug-19, 9-Mar-20, 17-Mar-20 26.57 Open 21.58 0.76 -15.9% BIT:IGD Immobiliare Grande Distribuzione High Buy up to €4.00 25-Sep-19, 10-Mar-2020, 17-Mar-2020 4.44 Open 3.65 0 -17.9% LSE:AV Aviva plc Medium Buy up to 280p 10-Oct-19, 9-Mar-20, 17-Mar-20 307.43 Open 266.70 0 -13.2% EPA:SAN Sanofi S.A. Medium Buy up to €90 14-Nov-19, 13-Mar-20 77.55 Open 83.14 0 7.2% NZX:GXH Green Cross Health Ltd High Buy up to $1.20 7-Jan-20 1.19 Open 1.12 0 -5.9% TYO:7731 Nikon Corp High Buy up to ¥1000 16-Jan-20, 3-Feb-20 1335.00 Open 1020.00 30 -21.3% ASX:KSL Kina Securities Ltd Speculation Buy up to A$1.00 17-Feb-20, 17-Mar-20, 23-Mar-20 0.91 Open 0.96 0.064 12.9% ASX:AVJ AVJennings Ltd Medium Buy up to A$0.50 2-Mar-20 0.50 Open 0.40 0.012 -17.6% ASX:CQE Charter Hall Social Infrastructure REIT Medium Buy up to A$2.30 26-Mar-20 1.59 Open 2.13 0 34.0% LSE:WHR Warehouse REIT Medium Buy up to 95p 27-Mar-20 87.60 Open 91.00 0 3.9% LSE:GGP Greatland Gold plc Speculation Position closed 8-Jul-19 1.60 12-Feb-20 5.79 0 261.9% Current as of 7 April 2020 at 9pm GMT.

As I look at rising markets today, it seems again we’re moving off the floor. And the white water is starting to surge again.

But there will be dip opportunity again. Once we start to see the brutal impacts of virus lockdown hit earnings and economic data.

Be brave. Remain thoughtful. And stay ahead of the stream.

Regards,

Simon Angelo

Editor, Lifetime Wealth Investor

PS: An exciting new announcement. We’re going Live. A new addition to your Lifetime Wealth subscription is coming….

For some time, we’ve been working on a way to engage readers even more and provide timely discussion on market events that can impact your wealth.

Tomorrow, look out for our new Wealth Talk radio podcast. We’ll be giving you premium interviews and chat coverage on the global markets.

As a Lifetime Wealth member, you’ll have access to a growing archive of all our podcasts. All you need to do is sign into the Members Area of our website — and as an additional benefit, you’ll also receive priority entry on submitting your questions for our radio show.

Look out for this new feature soon!