Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

Let’s begin with some uncomfortable truths.

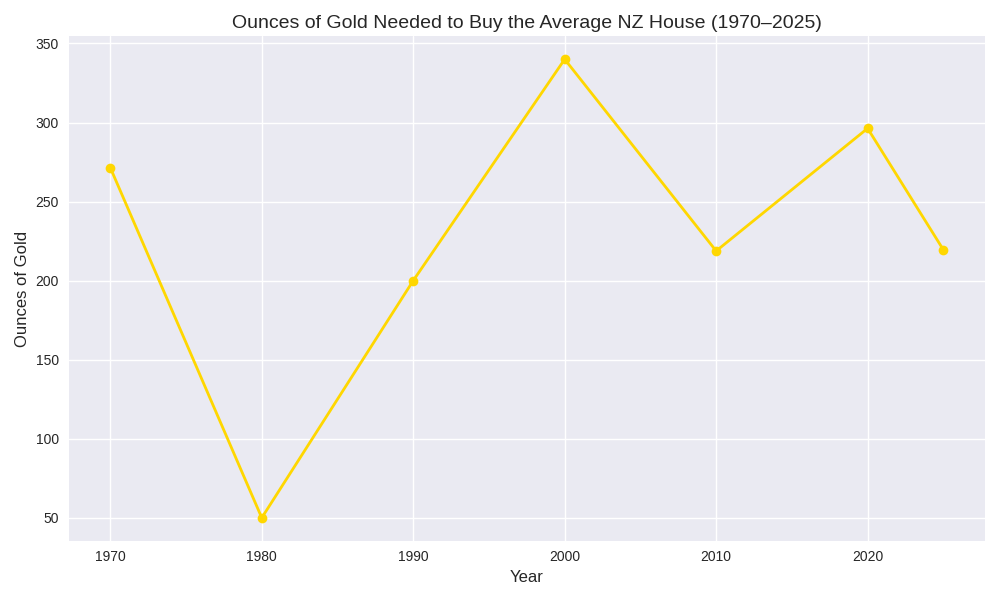

In real gold terms, NZ homes are about 18.5% cheaper today than in 1970, despite nominal prices rising dramatically.

Source: Image generated by Microsoft Copilot

Back in the ‘70s, when my parents bought their first home, Mum stayed home with us. Dad worked shifts at the dairy factory. It was possible to have a family with one breadwinner.

There’s an even more uncomfortable truth across the Western world today.

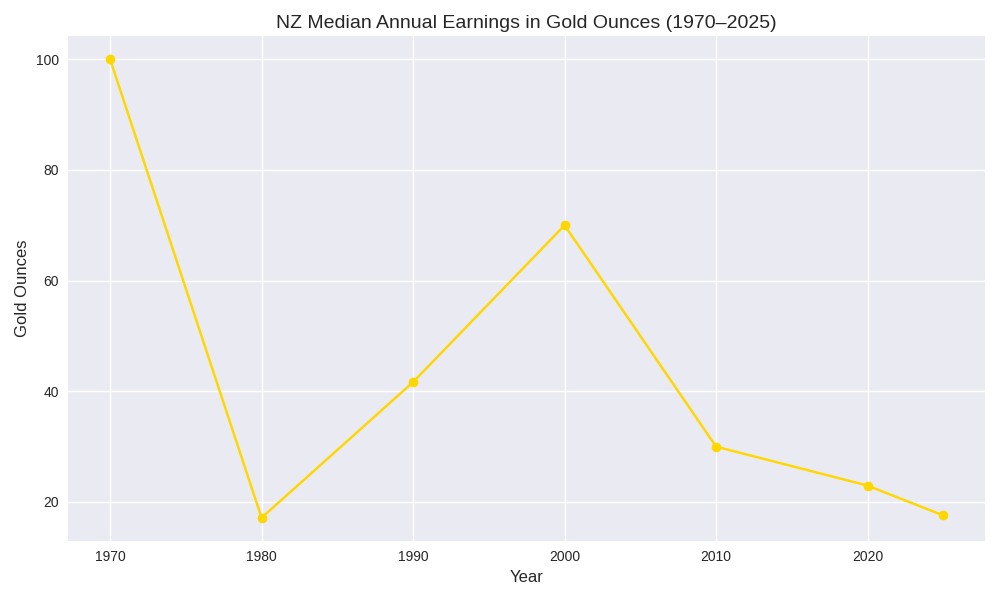

In gold terms, median earnings in 2025 buy 82% less gold than in 1970.

So, it’s no wonder that those earning salaries and wages feel they have been left behind. Their purchasing power has literally ‘fallen off a rock’.

Coupled with a decline in family values, this has serious downstream consequences. People delay having families because they can’t buy a home. We have a fertility predicament, an ageing population, and challenges to pay for super and healthcare.

The government responds by opening immigration. But since migrants also get older and face similar problems, many more are needed. Infrastructure cannot keep pace. Home prices keep climbing. Society is strained from within.

Why has this happened?

You may hear that Fonterra is the largest player in the NZ economy. But its contribution only represents just over 3% of GDP.

Economic ‘Queen Bee’. Source: Denisbin / Flickr

By tax take, the NZ government today expends about 33% of GDP.

It is the one body that has the power to create money at no cost to itself. Naturally, it will increase in size as waste, incompetency, and bureaucracy expands.

Oh, but the Reserve Bank Act is charged with keeping inflation in a tight band and preserving some modicum of spending power, right?

Well, that didn’t seem to stop rapid monetary expansion when push came to shove during the pandemic. And I doubt it will stop them again.

What is the solution?

On the monetary front, it would be helpful to protect against debasement. At one time, money was linked to gold.

Perhaps if the Reserve Bank had to mint 1-ounce gold coins to support every new tranche of paper money, we would be in a better position.

There have been many fine gold sovereigns minted to hold value over the years. A memorable one is the Krugerrand from South Africa.

Source: Südafrika Goldunze 1977 / Wikikmedia Commons

Modern money today expands on credit. For that reason, assets that benefit from leverage have increased in real terms much faster. For example, property prices and the cost of a university education.

The lower the interest rate, the more detached these prices may become from their real value.

Technology and productivity are the one panacea. These forces can drive costs down. For example, the cost of electrical appliances is much lower today than in the 1970s by any measure.

What can investors do?

Sharemarket investors are focused on generating real return over the long run while generating passive income in the shorter term.

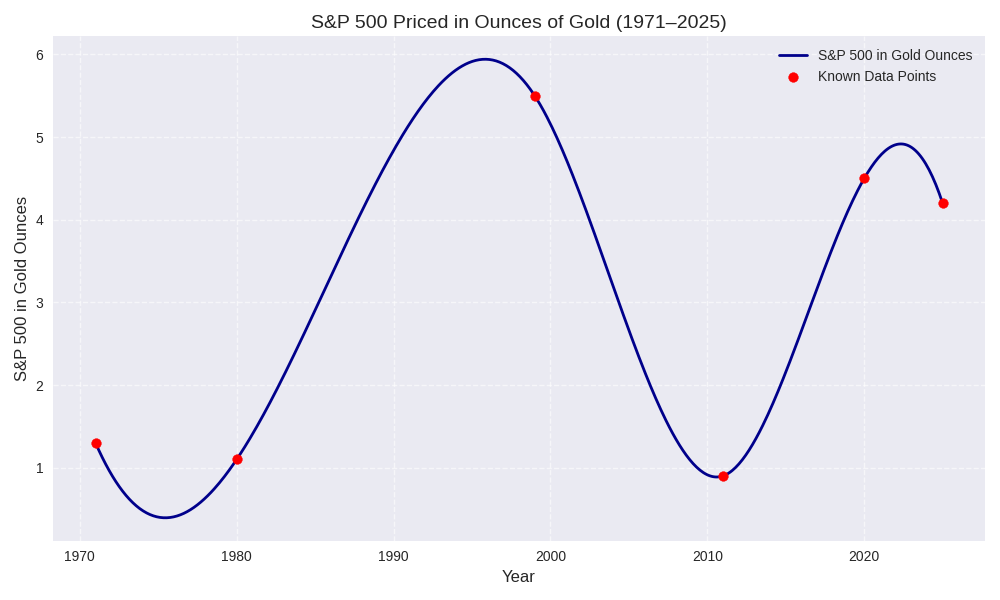

- S&P 500: Averaged 11.3% annual return over the past five decades.

- Gold: Averaged 6%–7.8% annual return, depending on the start date.

For example, a $1,000 investment in gold in 1971 would be worth around $37,000 today, while the same amount in the S&P 500 would exceed $100,000.

There has been volatility, but over the long run, productive business has kept ahead of gold.

Of course, gold does better during times of high inflation or instability. Stocks do better when there’s economic growth, technological innovation, and compounding can be realised.

But this tends to suggest stocks have done something neither home prices or wages have done. They’ve been a pacing challenge to gold.

Our wholesale portfolios

We run high-conviction portfolios in global equities as a true partnership. We invest in the same stocks in our own portfolios as we do for our wholesale clients.

While one headwind at the moment for many of our clients is a weak NZD, we still see opportunity in front of us.

- US manufacturing is surging with new investment, spurred by tariffs.

- Previously undervalued holding General Motors [NYSE:GM] is up over 16% in October.

- Listed real estate provides the next opportunity, as downward pressure remains on interest rates.

- Specific situations in rare earths, gold mining, and alternative financials continue to catch our interest.

Managed Account performance*

For the month of October 2025, we were up 1.29% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year (January 1 to October 31), we are now up 26.26%.

Our average annualised return since inception is 13.92% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 0.21%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 1.86%.

Our blended MSCI EAFE/S&P 500 benchmark was up 0.46%.

The road ahead

With total average returns across our portfolios now heading towards a 30% rise from January, our long-term value strategy is shining.

Opportunity remains ahead as we deploy judiciously.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.