With high stock markets, people start asking if a correction or crash is due.

This usually tells experienced investors the market has a long way to go.

One of the chief reasons markets are strengthening now is this…

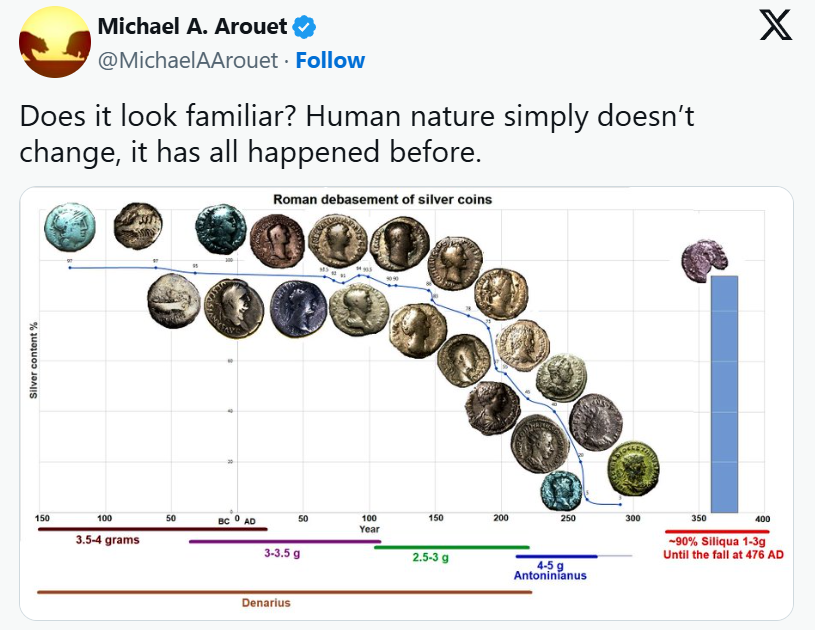

The debasement trade

Source: Michael A. Arouet / X

When I first moved to Auckland to study finance, I stayed at a low-cost hostel. The proprietor would water down the tomato sauce and milk to make the catering budget go a bit further.

Governments and central banks have much the same idea with cash. Low interest rates, relaxing credit, and plentiful treasury bonds give the illusion of economic security.

Back in my hostel days, we’d head to Georgie Pie to try and find some value.

Source: Justin14 / Wikimedia Commons

Lessons from inflation

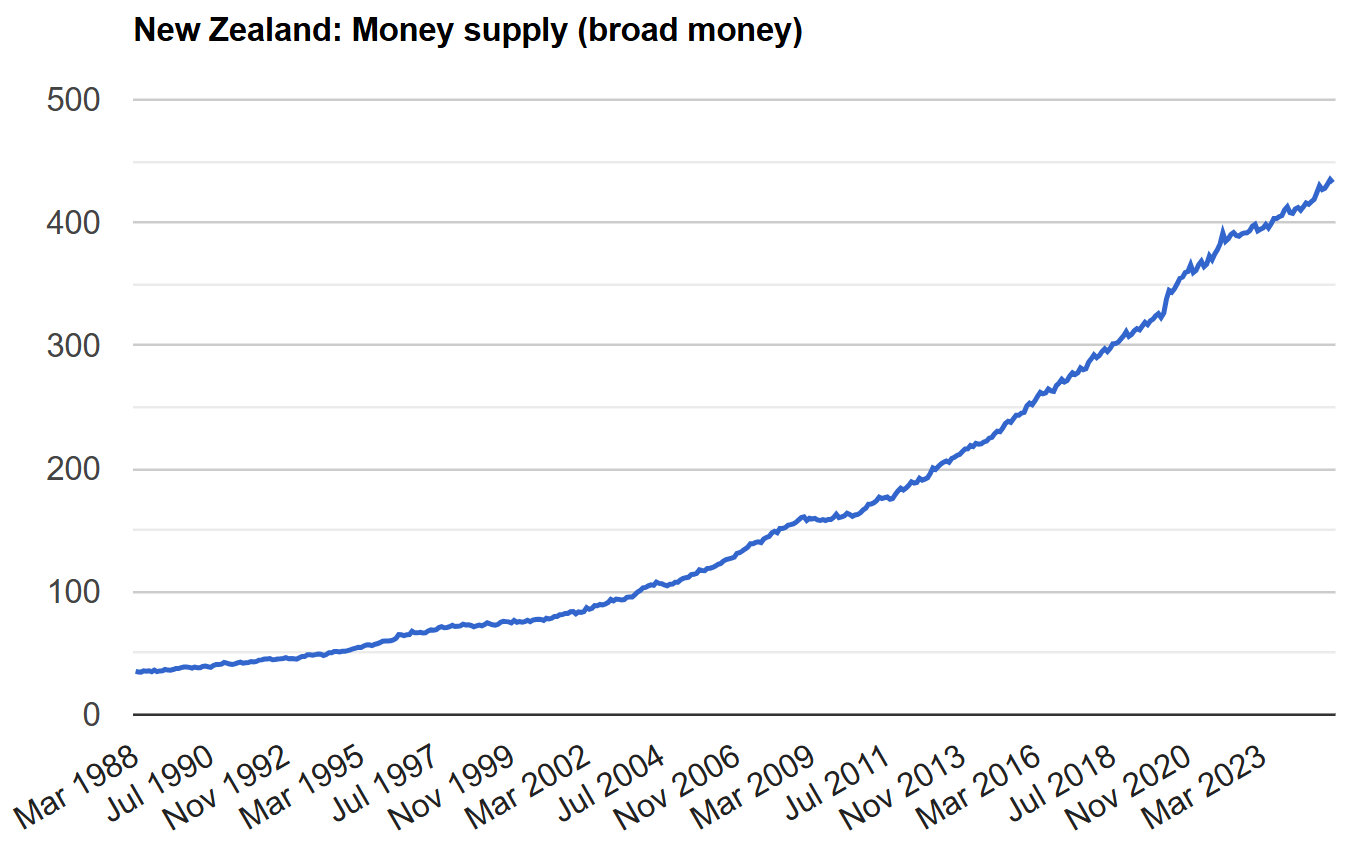

If the dramatic increase of the money supply during Covid reminds us of something, it is this: invest in hard assets. Keep investing when the inflation storm hits. Build and protect your wealth.

Source: The Global Economy / RBNZ

While population grew 58%, the money supply ballooned over 1,000% — a disconnect that fuels asset inflation and erodes purchasing power.

Incomes have not kept up with asset prices. Here’s what needs to be done:

- Government tightly controls its spending and avoids monetary debasement.

- Private business is unshackled to make things better, faster, and cheaper in the economy.

- A safe haven for global capital is created. NZD is seen as less risky.

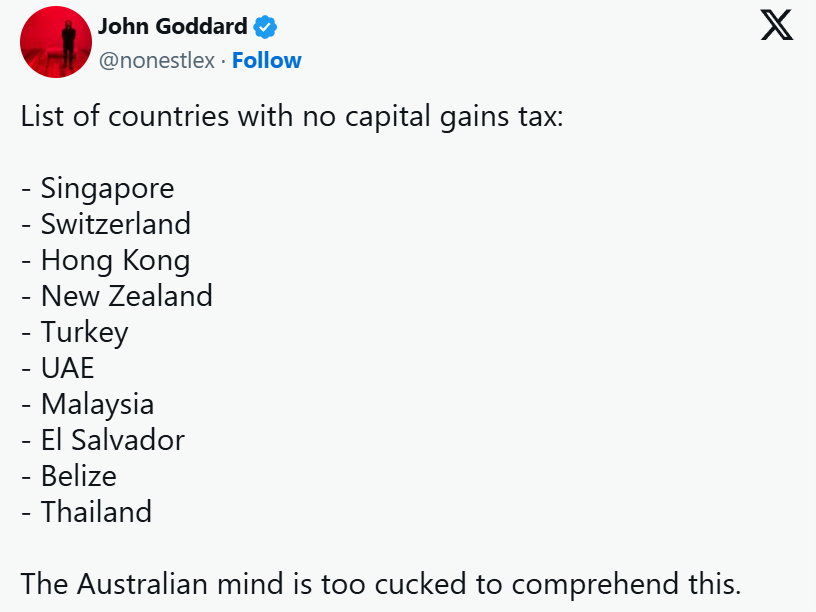

But no. Labour — aligned with more radical partners — is exploring capital or wealth taxes to attack asset protection.

‘Everyone else has them,’ they proclaim.

Source: John Goddard / X

As with several of the countries above, the incentive to grow capital brings surprising wealth to remote places with small populations. Do they not see this?

Investors need economies that can flourish

While it may seem simple — save and invest in productive assets before your money is debased — there’s a deeper scenario at play.

For assets to grow, you need economies that produce real growth.

Over the past few years, New Zealand property prices have dialled back, even with constrained supply.

The sharemarket is only just beginning to turn — signalling the economy should improve over the next 12 months.

Economic growth relies on improving productivity and population growth. Investors are ultimately relying on that too.

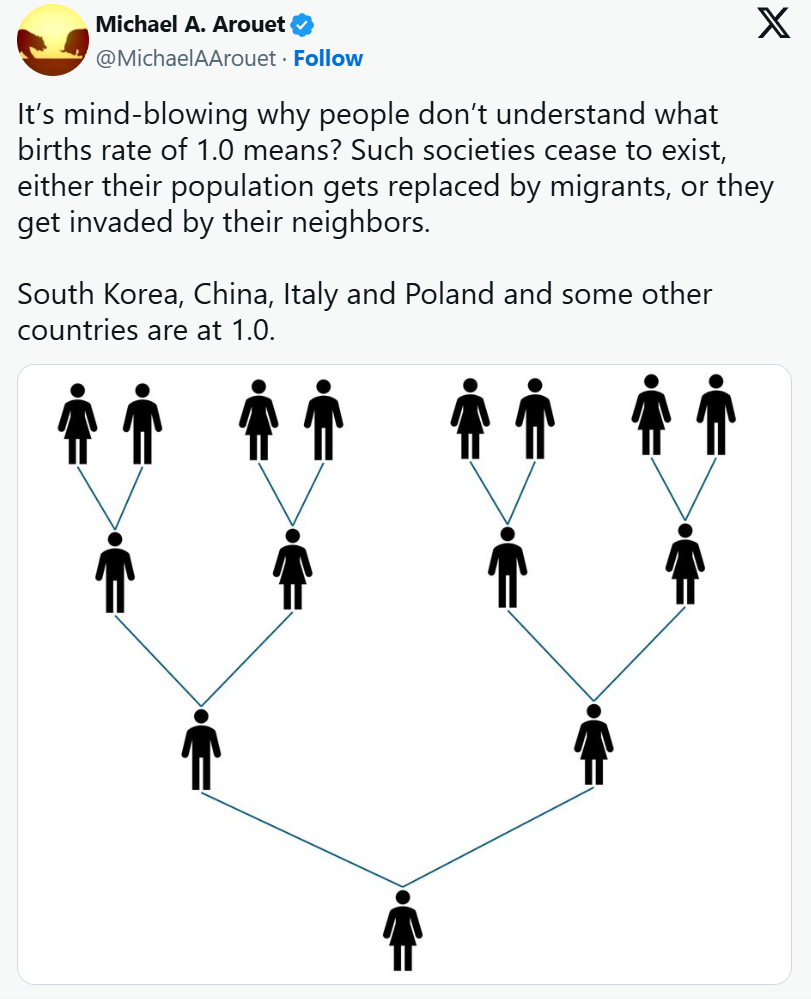

Unfortunately, in many developed (and some developing) economies, we’re now facing this:

Source: Michael A. Arouet / X

Here in New Zealand, we’re not at this point yet. But without positive net migration, we face unaffordable super and healthcare. Of course, migrants themselves age, and what is really needed are more babies.

Poland’s new president, Karol Nawrocki, just signed a draft bill that would exempt parents of two or more children from paying income tax on earnings of up to USD $35,400.

It’s true: family incentives have had mixed success so far. Their effect takes time to emerge. They need to act in tandem with lower home prices (freeing up zoning and building), and crucially, a change in education and culture.

Just as economic debasement erodes wealth, cultural debasement erodes purpose.

The cultural challenge

Unfortunately, we still indoctrinate people with counterproductive ideas. And in some cases, the taxpayer is forced to fund radical groups to do just that.

We’re seeing a rise in narratives — some taxpayer-funded — that discourage growth and enterprise.

For example:

- ‘The climate is going to cook us anyway, so don’t have kids.’

- ‘The traditional family is an outdated concept.’

- ‘Businesspeople are greedy.’

- ‘Some minorities need special privileges over others.’

- ‘Western civilisation is based on oppressive structures.’

But the antidotes to our demographic and economic challenges are quite simple:

- Train for an in-demand job.

- Start a family.

- Build a business.

- Create more in-demand jobs.

- Vote to protect freedoms.

A pathway to renewal

The electorate is changing. People with these values have larger families. Their offspring are now entering voting age. Young men, especially, are voting for change.

Charlie Kirk was a watershed moment for a new generation. The foundation faith of Western civilisation — Christianity — is on a revival trend in America, with a 41.6% increase in Bible sales since 2022.

What we should ask of our leaders is to ensure human flourishing is incentivised. Of course, the first step is to dismantle indoctrination and waste. This would see a government with surplus and a more valuable currency.

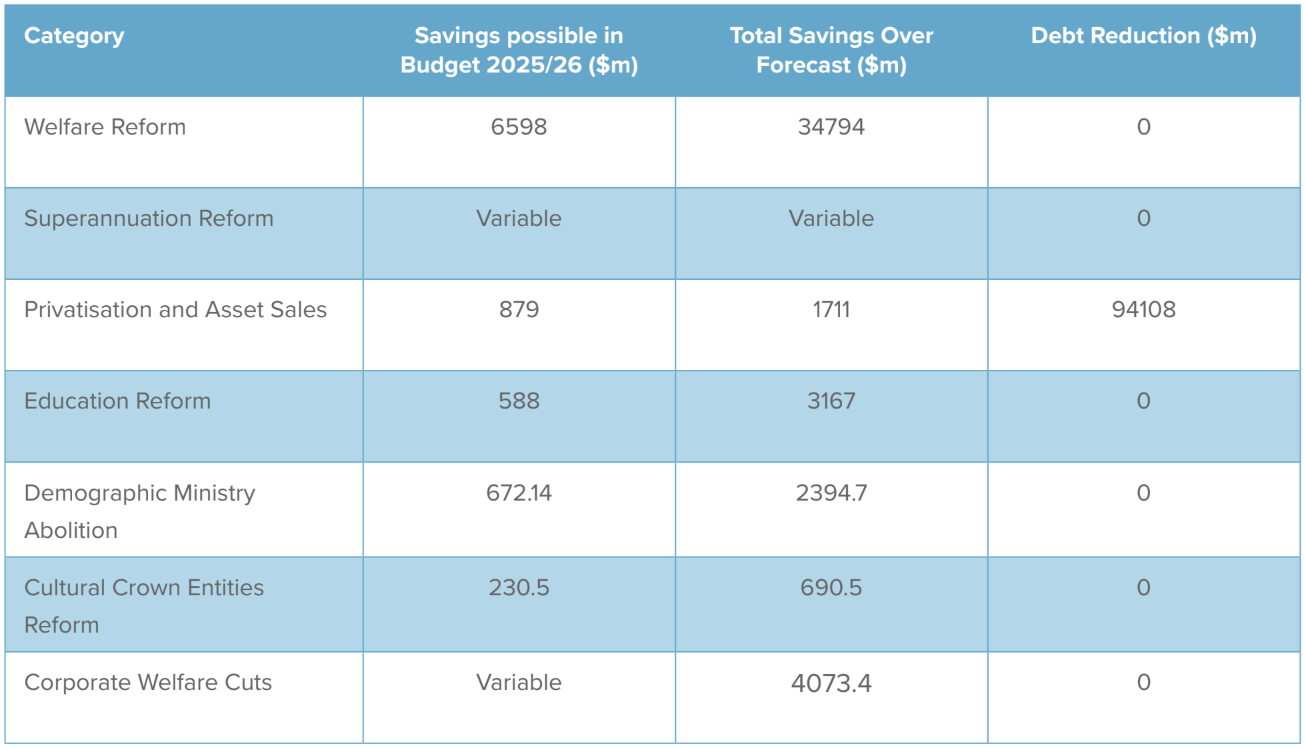

Back in May, the Taxpayers’ Union produced A Pathway to Surplus. They proposed more than $35 billion in savings and $100 billion in debt reduction:

Source: New Zealand Taxpayers’ Union

While I don’t agree with all aspects, this analysis alone would reduce the need for 30% of taxes — enough for exemptions on families with two or more kids. It would also cut the national debt by more than 50%. Interest costs are slashed.

With low taxes, lean government, and far less risk of monetary debasement, you build economic strength. The New Zealand dollar could become the Swiss franc of the South Pacific.

Coupled with a removal of the barriers to homebuilding, and education focused on prosperity — not indoctrination — you’ll see a quiet flourishing.

Of course, the level of bravery and strength required to push back against vested interests, stupidity, and the desire for control would require the heroic. This is no time for weak, afraid people.

Fertile ground awaits. But only if we have the courage to till it.

Quantum Income Strategy

Wealth Morning offers value-driven investing in developed markets — with a keen eye for what others miss.

We build strong, income-rich portfolios for Eligible and Wholesale Clients. Our Principals invest their own money in the same strategy. You retain full ownership and custody of your assets.

If you’ve invested before, built wealth, or meet wholesale criteria, we’d like to offer you a free consultation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.