I returned, and saw under the sun, that the race is not to the swift, nor the battle to the strong, neither yet bread to the wise, nor yet riches to men of understanding, nor yet favour to men of skill; but time and chance happeneth to them all.

—Ecclesiastes 9:11, The Holy Bible

A while ago, I wrote a story about a man named Ronald Wayne.

It was an intriguing story, with a twist so bizarre, it beggars belief.

You see, way back in 1976, Ronald Wayne was the third co-founder of Apple, alongside Steve Jobs and Steve Wozniak.

This should have been a golden opportunity for Wayne. A one-in-a-million shot at fortune. The glitz and glamour of an emerging Silicon Valley awaited him.

Unfortunately, Wayne suffered from a serious case of the nerves. He didn’t believe in Steve Jobs’ vision. He didn’t believe that Apple would ever succeed as a company. All he saw was doom and gloom.

Wayne’s anxiety consumed him. And he soon made a hasty exit. He cashed out on his 10% stake in Apple for the princely sum of $2,300.

Was this the mistake of a century?

Well, yeah, in hindsight, it probably was.

By my calculation, if Wayne had held on to that 10% stake in Apple, it would be worth upwards of $300 billion today.

Instead, if the anecdotal reports are to be believed, Wayne currently only has a net worth of $400,000 today.

Crikey. Talk about a missed opportunity here.

If only Wayne had a little more faith. If only.

Ronald Wayne in 2022. Source: Wikimedia Commons

So, can we chalk up Ronald Wayne’s error to bad luck?

- Well, of course, there was a strange poetry — indeed, a strange symmetry — in the way that Wayne’s journey unfolded.

- At first, Wayne enjoyed the equivalent of a positive lightning strike. That’s when he met Steve Jobs and Steve Wozniak. That’s when they started Apple together.

- But then, shortly after, a negative lightning strike occurred. That’s when Wayne lost confidence in Apple. That’s when he decided to leave, selling off his 10% stake in a rush.

- Ask yourself: what are the chances? I mean, just stop and think about it. The chances of two lightning strikes happening — for good and for bad — are so statistically remote, it borders on the incredible.

- Few of us — in our entire lifetimes — will ever find ourselves in a situation as unique as what Ronald Wayne went through. It’s unbelievable, isn’t it?

Fate. Destiny. Luck. Call it what you will. It’s always tempting to chalk up someone’s financial success (or financial failure) to divine circumstances beyond human control.

- But wait. Hold on. Not so fast. What if we stopped focusing so much on luck? What if we started focusing more on self-responsibility? Would that make a difference?

- Well, that’s what I want to do. Right now, I want to talk about another man who, coincidentally, also has the name Ronald. But this is a completely different guy, with a completely different journey, in a completely different part of the country.

An undated photo of Ronald Read. Source: Wikimedia Commons

Forget the glitz and glamour of Silicon Valley. Say hello to the humble rural lifestyle of Middle America.

- Our hero here is Ronald Read. He spent his entire life in Vermont, and he seemed pretty content to do so.

- What you need to know is that there were two main phases to Read’s career. In the first phase, he worked as a gas-station attendant and mechanic. Then, in the second phase, he worked as a janitor in a department store. If the anecdotal evidence is to be believed, he never earned more than $45,000 a year.

- Read lived frugally. He drove a second-hand Toyota Yaris. He mended his own clothes with safety pins. His main hobbies were chopping wood, collecting stamps, and collecting coins. He only ate out at cheap restaurants.

- Indeed, Read carried himself with a modesty that made him invisible to most. But here’s the extraordinary part: by the time Read died in 2014 at the age of 92, he had amassed a fortune of nearly $8 million.

- This is mind-blowing, especially given the fact he didn’t have a finance degree, and he never went anywhere near Wall Street. Apparently, all he did was read financial publications, which he borrowed from his local library. He appeared to be entirely self-taught.

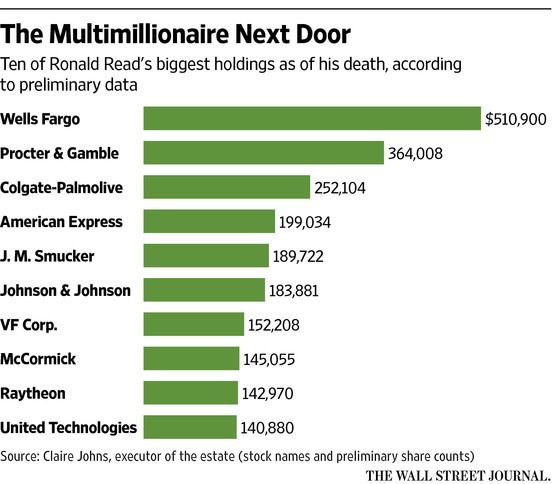

Source: The Wall Street Journal

So, what was the secret of Ronald Read’s success? Well, his investment philosophy was deceptively simple. He put together a portfolio of at least 95 stocks, and he pursued a buy-and-hold strategy.

- This means that Read didn’t chase any trends. He only focused on buying good old-fashioned blue-chip companies. I’m talking about boring businesses like Wells Fargo, Procter & Gamble, and Colgate-Palmolive. The main attraction? Well, they paid steady dividends.

- Read held these stocks for decades. Through market booms and market busts. Through upswings and downswings. He allowed time and compounding to do the heavy lifting for him.

- Read never cashed out. Instead, he simply reinvested his dividends, using them to buy more shares. This, in turn, generated even more dividends, which he used to buy even more shares. Lather, rinse, repeat.

- What I find fascinating about Read’s investment strategy is that he never bought into tech companies like Apple. He appeared to be a Luddite. He didn’t understand computers, so he avoided them entirely.

- Still, over the long run, his aversion to tech innovation didn’t seem to hurt his chances. He did just fine. He captured his slice of prosperity anyway.

Ultimately, in the end, people only knew how rich Ronald Read was when he died.

- He reportedly left $1.2 million to his local library, and $4.8 million to his local hospital.

- Everyone in his town was left stunned by his generosity. This simple man with a modest rural lifestyle turned out to be a multimillionaire. Like I said earlier, mind-blowing.

So, what can we learn from this extraordinary story?

- Well, Ronald Read’s journey wasn’t about luck. It was about patience, discipline, and the quiet compounding of small decisions made over time.

- You can directly compare this with Ronald Wayne’s journey. Yes, luck played a big role here in Wayne becoming the third co-founder of Apple. He was the right man in the right place at the right time. And yet, despite his initial luck, Wayne flunked out early. Which meant that he never benefited from the power of compounding at all.

I find that the disparity between Ronald Wayne and Ronald Read couldn’t be sharper.

- One man was given a golden ticket in Silicon Valley, the high-flying mecca of tech and innovation. Meanwhile, the other man received no golden ticket at all in Vermont, a rural backwater in the middle of nowhere.

- So, which journey is more profound? Well, if I had to choose between the two Ronalds, I must say, I feel much more of an emotional connection with Ronald Read. I find his earnest simplicity to be appealing. I find his underdog status to be inspiring.

I dare say, Read lived a life that served as a quiet rebuke to the myths of modern finance. He didn’t have a big salary. He didn’t have insider knowledge. He didn’t have an exotic day-trading strategy.

- In an age obsessed with instant gratification, Read’s story feels absolutely radical. But it also feels totally liberating. Because to me, it’s proof that simple people living simple lives can achieve extraordinary wealth.

- Maybe the greatest lesson of all is this: the secret to success isn’t really a secret at all. In fact, it’s actually hiding in plain sight. All you really need is time, discipline, and the courage to be boring.

- Ronald Read embraced this strategy wholeheartedly. What kept him going was simple rural tenacity. Perhaps more of us should aim to do the same.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback. It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.