Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

August has been a slower month for deployment as our value picks continue to move ahead.

We’ve seen 2 takeover acquisitions of portfolio companies at much higher prices than we paid for clients.

Industrial warehouses might be boring — but returns have not been.

Warehouse REIT [LON:WHR] was acquired for ~24% ahead of our average purchase price.

Dividend yield was ~5.6%. Source: Warehouse REIT

While we would have preferred to hold positions longer, the sales are opportune. Stronger currencies than the Kiwi dollar are welcome. We continue to see the rest of the world moving ahead at a faster pace.

Meanwhile, I hear our former PM’s book is already on offer in the clearance rack for the cost of a cappuccino.

They overspent on Covid. Now there’s a price to pay.

Fortunately, there’s a world of value beyond.

High-conviction value can deliver

Patient investors who buy well and hold strategically take money from impatient investors who sell too soon.

The market has also helped us out. We’re seeing:

1) Strong forward-pricing on lower interest-rate predictions.

2) Very positive earnings reports.

3) Burgeoning liquidity as cash returns to equity markets.

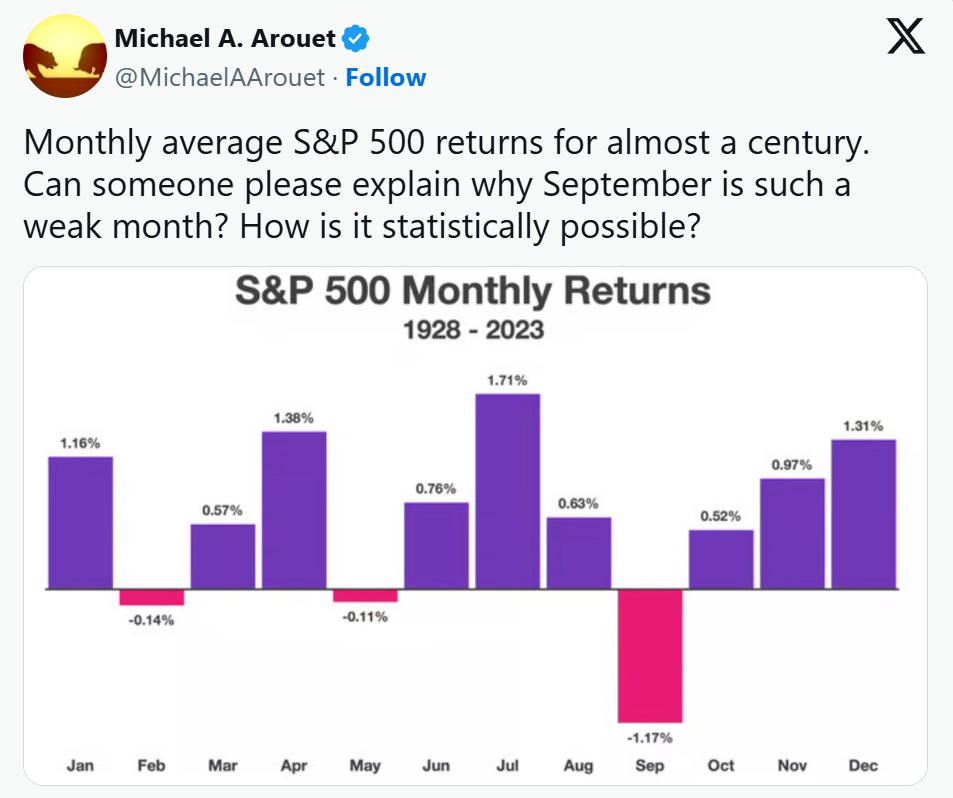

September is often a month for opportunity…

Source: Michael A. Arouet / X

Well, Michael, having spent time trading in Northern Europe, the end of summer is a depressing prospect. You can easily turn bearish. The close of the financial year also comes into view. Some of the upside that has been priced might be due a correction. Possibly an over-correction. (That’s my theory anyway.)

Here in New Zealand, as spring beckons, it can be a great time to buy offshore and lock in opportunity for Christmas.

Managed Account performance*

For the month of August 2025, we were up 5.09% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year (January 1 to August 31) we are now up 21.18%.

Our average annualised return since inception is 13.95% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 4.80%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 3.56%.

Our blended MSCI EAFE/S&P 500 benchmark was up 4.63%.

The road ahead

Yes, markets are quite high. But we are continuing to see value that is not well-priced.

I’m looking forward to September. On any meaningful correction, we intend backing up the truck.

It’s a good time to have funds available.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.