Today, I want to talk to you about the F-word.

Fear.

It’s dark. It’s ominous. It’s always there.

But do you know that fear is not just a word?

Do you know that fear is actually an acronym?

Well, here’s what it actually stands for:

- FEAR — False Evidence Appearing Real.

- FEAR — False Expectations Appearing Real.

- FEAR — False Emotions Appearing Real.

Still, acronym or not, fear is a bad feeling, isn’t it?

- At its worst, it’s like encountering an imaginary terrorist. A fanatic who ambushes you when you least expect it. Detonating a suicide vest, delivering shock and awe.

- When this happens, you’re left reeling from the bone-crunching impact. You choke up. Your brain freezes over. You’re struggling to think; struggling to breathe; struggling to survive.

- At this point, you lose all fine motor control. You might have trouble seeing straight. Heck, you might even have trouble with signing your own name with a pen.

- It’s like experiencing an earthquake. Everything is shaking. The acidic taste of nausea cramps your insides. Your heart is racing, beating so hard that you can hear your pulse thundering in your ears.

- Well, yes, this is what panic feels like. This is what fear feels like. You believe it’s real. Therefore, it crystalises and becomes hyperreal. More real than real.

Source: Mohamed El-Erian / LinkedIn

Of course, in April, fear is exactly what we saw on the American S&P 500:

- In the aftermath of tariff announcements on Liberation Day, the market experienced a doom loop. Many people freaked out. They thought it was the end of the world.

- So, they started hitting the SELL button on impulse. And during a four-day stretch, the market went into freefall. It plunged over 12%.

- Of course, what we saw during in April was also a scramble for liquidity. The tide went out. Some were swimming naked with too much leverage. They had to take cover before a margin call. They had to sell.

That was unnerving, wasn’t it? But, hey, remember what I said about fear being an acronym?

- FEAR — False Evidence Appearing Real.

- FEAR — False Expectations Appearing Real.

- FEAR — False Emotions Appearing Real.

Of course, when you stop and think about it, fear and greed are just opposite sides of the same coin, aren’t they?

- These are emotional constructs. Mental perceptions.

- What this means is that the collective mood can turn on a dime.

- And guess what? Such a turning point can actually happen when you least expect it.

Source: CNN

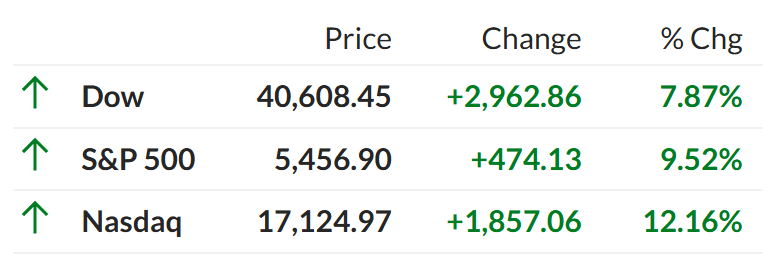

The performance of American indexes at the close of trading on April 9, 2025.

Source: MarketWatch

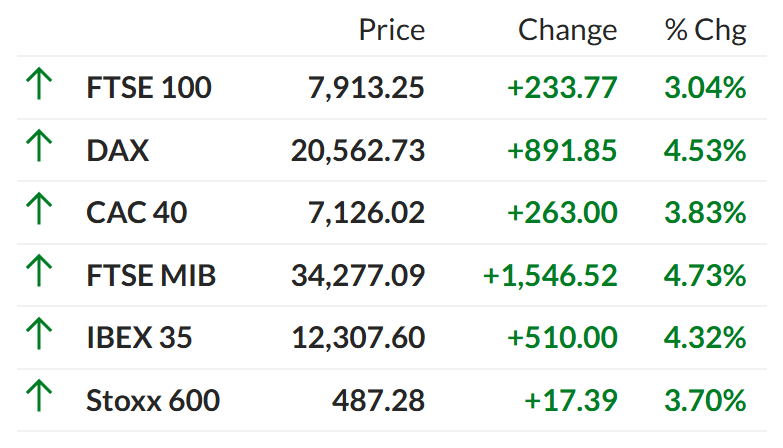

The performance of European indexes at the close of trading on April 10, 2025.

Source: MarketWatch

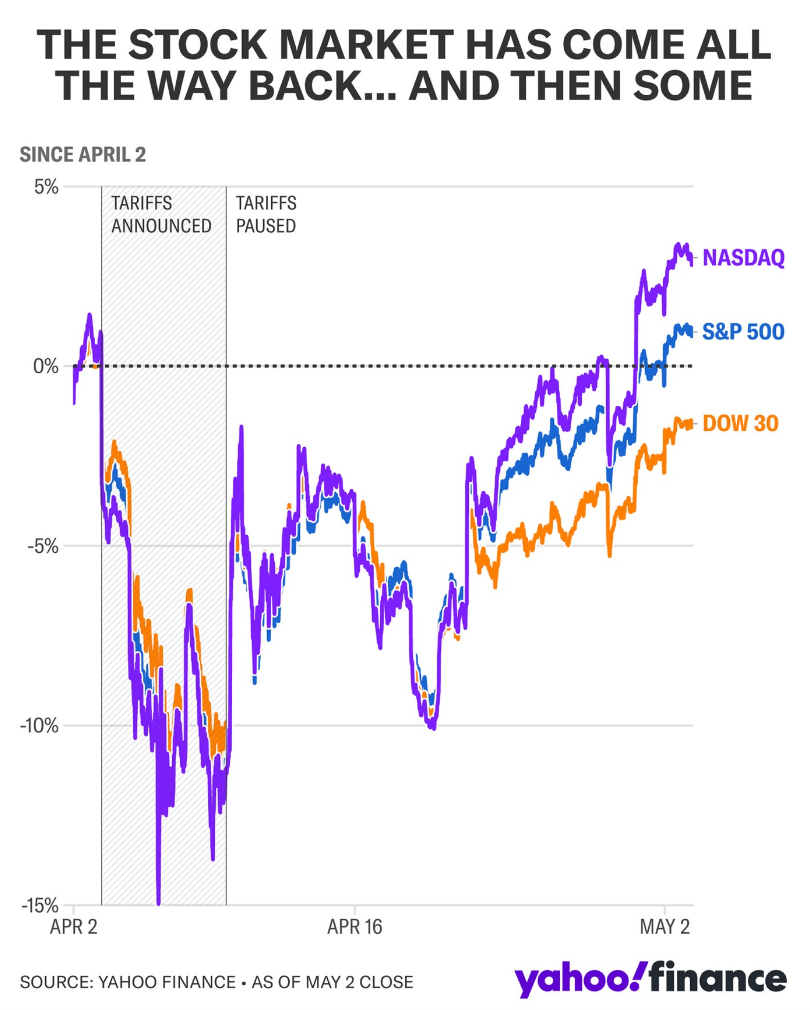

Source: Yahoo Finance / Instagram

Staggering? Absolutely. Now, given what we’ve seen, here are a few things to consider:

- During this time, would it have been better for the average investor to avoid selling? To just hold on tight? To just knuckle down? Well, yeah. In retrospect, this seems clear.

- Meanwhile, for the more courageous investor with spare cash, would it have been helpful to deploy funds? To buy the dip? To cost-average? Oh yes. Again, in retrospect, this seems obvious.

- But here’s the thing. When fear is in overdrive, most people can’t think straight. They won’t. In fact, you will find that common sense is the rarest commodity of all.

So, what’s the antidote to such fear? Well, you have to be a genius to deal with it. And apparently, the French general Napoleon had a simple definition for such a genius:

‘The man who can do the average thing when everyone else around him is losing his mind.’

This is so simple yet so true, isn’t it?

- After all, if you can do an average thing like using a pen to calmly sign your name in the middle of an earthquake, well, that might just qualify you as a genius.

- Of course, that’s easier said than done, isn’t it? During times of market upheaval, emotional stability is the very thing that’s in short supply.

I believe most financial advisers know this. When experiencing turbulence, they are aware that their clients are losing their minds. So, to pacify their clients, they will tend to say something like this:

‘I know you’re fearful. But I think the best thing for you to do during this difficult period is not to look at your portfolio. This will stop you from going stir-crazy.’

Okay. Sure. But is this practical advice? Yes? No?

- Well, frankly, I actually don’t think it’s 100% doable. Because it goes against human nature.

- I mean, who doesn’t want to look at their portfolio while the world is on fire? You can’t help it. It’s your money. It’s your precious. Of course you’d want to look at it!

So, given this situation, perhaps a better way to handle it is to use what I like to call the Sleeping Beauty technique. It’s a form of mental projection. How does it work? Well, I want you to imagine this:

- What if you fell asleep on April 1st?

- What if you had a very long snooze?

- What if you missed Liberation Day and the immediate aftermath?

- What if you only woke up from your nap on May 1st?

- What if you looked at your investment portfolio at that point?

- Well, what would you see? More importantly, how would you feel?

Well — surprise, surprise — here’s the profound thing:

- You would have missed an entire month of angertainment and drama-queening.

- For example, you never would have known that the market had just experienced one of the biggest four-day drawdowns in history.

- At the same time, you would never have known that the market had just experienced one of the biggest nine-day rebounds ever.

- Most importantly, you never would have been tempted to hit the SELL button at any point. Remember: you slept through all of it!

- Liberation Day? What Liberation Day? If you had woken up from a long sleep, you never would have understood what the fuss was all about. Looking at your portfolio, you never would have guessed that it had experienced such wild downswings and upswings.

- So, this is why I think that the Sleeping Beauty technique is such a powerful one. It reminds us that much of what we see in the market — the drama, the noise, the volatility — might not matter as much as we think.

- Certainly, it might all end up looking quite small and insignificant in the long run.

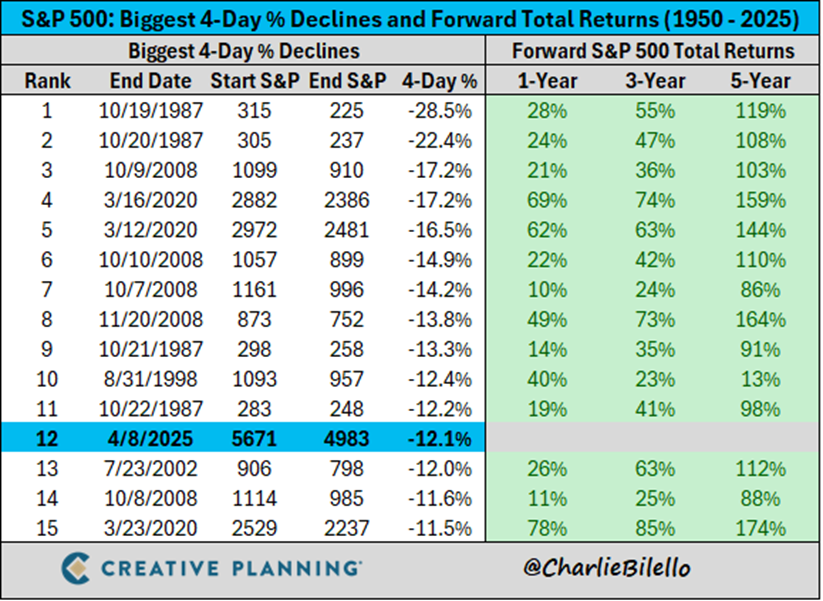

Source: Charlie Bilello / X

Now, here’s another important point to consider. The historical data over the past 75 years shows us that sharp four-day declines on the S&P 500 are actually not that uncommon:

- In fact, the last time we experienced a drawdown like this was during COVID.

- Some people felt that what we saw in 2020 was a ‘scamdemic’. Yes, you might argue that the virus was real, but perhaps our response to it was unreal. It was unfounded paranoia. Oversold. Overdone.

- The market seemed inclined to agree. This is why it shrugged off the fear. It continued marching ahead. Onwards and upwards. The 1-Year, 3-Year, and 5-Year forward returns were positive.

So, is our current tariff fear yet another scamdemic? Much ado about nothing? Maybe that might come down to perception:

- At this point in time, it’s easy for someone to say, ‘The market will crash because of Donald Trump’s insanity.’

- Meanwhile, it’s just as easy for someone else to say, ‘The market will boom because of Donald Trump’s brilliance.’

- Who is right? Who is wrong? Well, depending on your political compass, you might favour one explanation over the other.

- But ultimately, here’s what I believe: the market doesn’t care about anyone’s beliefs. The market is completely neutral. Totally agnostic. It exists only as a wild and untamed animal. It’s a force of nature that hungers only for growth and yield. It will operate on its own terms, in spite of human bias.

- What’s our job as investors? Well, quite simply, it’s to do as Napoleon suggested. Focus on being average while everyone else is losing their minds. That magical trait alone is enough to pay dividends over the long run.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.