‘We do not seek to separate, but to revitalise an old friendship and renew the greatest civilisation in human history.’

—Marco Rubio at the Munich Security Conference

Every now and then, a leader of rare quality rises in the halls of human history.

US Secretary of State Marco Rubio is one of them.

On Valentine’s Day, he spoke at the world’s leading platform for global security. To heads of state, military leaders, and diplomats. Then to many millions more as his speech trended across social media.

Source: Marco Rubio / X

We invest almost exclusively in Western developed countries.

Like Rubio, we rely on a shared heritage based on truth, duty, fairness, and freedom.

We rely on the rule of law and the prospect of untrammelled entrepreneurship to grow our investments.

Now here is something many fail to realise. Western civilisation may be the oldest culture there is. It has been forged across centuries of history and wisdom. From Ancient Greece and Rome, to Christianity’s recount of the very beginnings of human history around Mesopotamia.

It has been challenged and nearly destroyed in places by radical forces — most recently communism. Yet its principles have also found new appeal in the rising economies of East Asia.

On the investment front, Rubio is most concerned with the loss of supply chains in the West:

‘Deindustrialisation was not inevitable. It was a conscious policy choice, a decades-long economic undertaking that stripped our nations of their wealth, of their productive capacity, and of their independence. And the loss of our supply chain sovereignty was not a function of a prosperous and healthy system of global trade. It was foolish. It was a foolish but voluntary transformation of our economy that left us dependent on others for our needs and dangerously vulnerable to crisis.’

One thing is unmistakable. As a client recently observed: ‘The Americans are dead serious about restoring manufacturing.’ That resolve is setting off a new era of investment opportunity, amplified by innovation and technologies we haven’t seen in decades.

As investors, we rely on compounding — and a paradigm shift of this magnitude can be transformative.

The Matthew Effect

The Bible contains the best definition of compounding I have ever come across (Matthew 13:12):

For the person who has something will be given more, so that he will have more than enough; but the person who has nothing will have taken away from him even the little he has.

When considered alongside the Parable of the Three Servants, the message is timeless.

Léonard Gaultier, Parable of the Talents (The Worthless Servant Cast into the Outer Darkness)

Source: National Gallery of Art / Wikimedia Commons

The first two servants put their capital to work. They take risks, apply judgement, and grow what they were entrusted with.

The third servant does nothing — he preserves nominal value but destroys real value through inaction.

For investors, the lessons are clear:

- Deployment beats hoarding.

- Prudent risk-taking beats fear-driven paralysis.

- Capital left idle loses purchasing power.

Each servant receives a different amount, but the master evaluates them on what they did with their share, not on how much they started with.

The third servant’s downfall isn’t incompetence. It’s fear. Fear of making a mistake leads him to the worst mistake of all: doing nothing.

In markets, this shows up as:

- Sitting in cash for years.

- Waiting for ‘certainty’.

- Reacting to headlines instead of fundamentals.

- Avoiding opportunities because they feel unfamiliar.

The parable’s message is blunt. Fear-based inaction destroys long-term potential. Growth requires initiative.

The first two servants don’t just protect capital — they grow it. They take initiative, make decisions, and accept the responsibility that comes with investing.

That’s the essence of long-term wealth creation:

- Allocating capital to productive assets.

- Embracing innovation.

- Compounding over time.

- Understanding that returns follow action, not hesitation.

The Rule of 72

To put the Matthew Effect into motion, the Rule of 72 is one of the best yardsticks I know of. It tells you how quickly something doubles when it compounds.

For example, at an average annual return of 12% growth, it doubles in about six years.

A small difference in return creates a huge difference in outcomes over time.

For an investor, the math can be life-changing:

- An investment of $500,000 at age 40 could well be over $2 million by your early 50s.

- $2 million at a running yield of 5% could provide passive income of $100,000 a year without disturbing the capital.

As that continues to grow, you could live anywhere and be financially free.

Disciplined, value-driven investing is how we help clients put these principles into practice.

Quantum Income Strategy

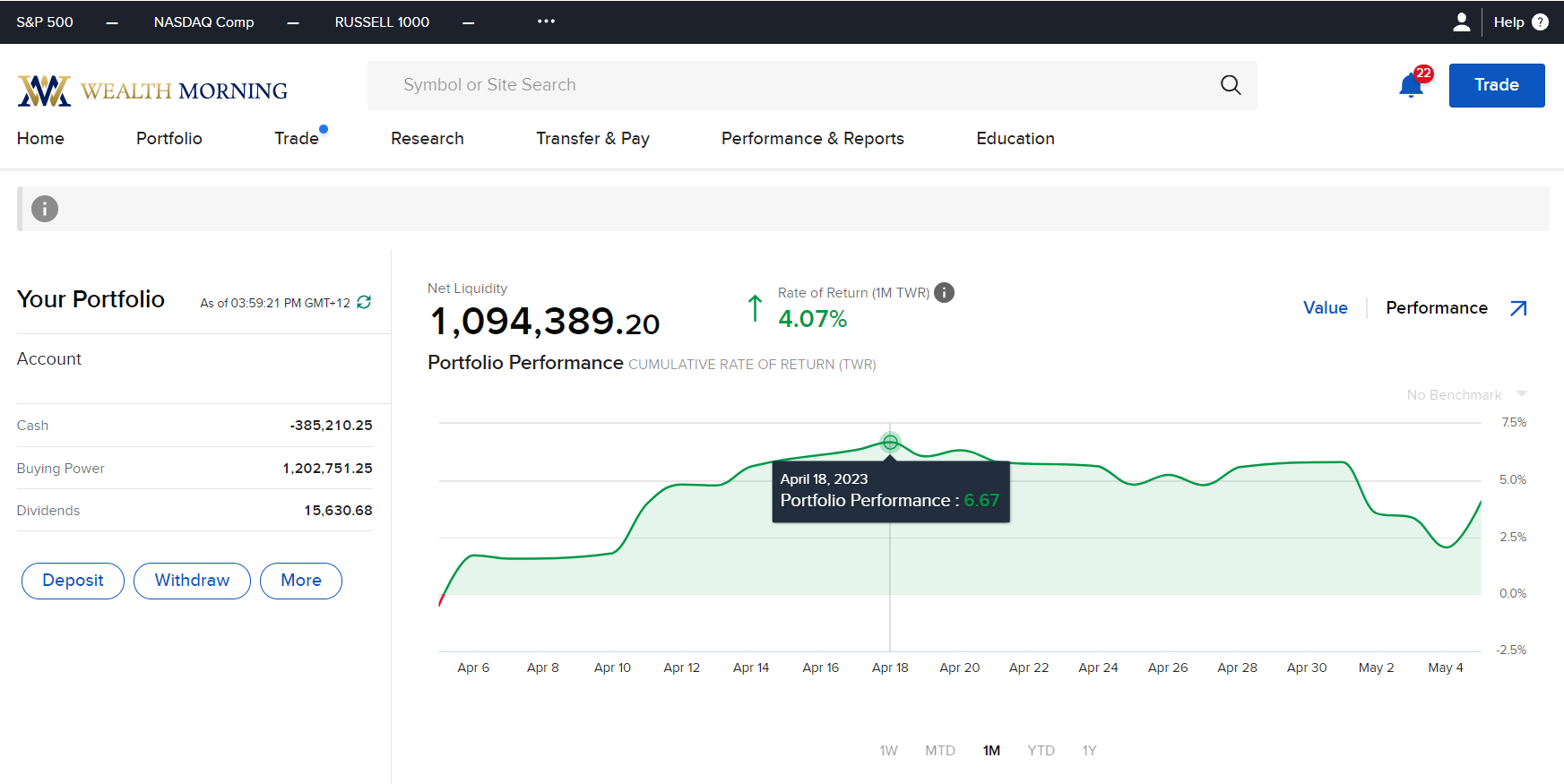

Wealth Morning offers value-driven investing in developed markets — with a keen eye for what others miss.

We build strong, income-rich portfolios for Eligible and Wholesale Clients. Our Principals invest their own money in the same strategy. You retain full ownership and custody of your assets.

If you’ve invested before, built wealth, or meet wholesale criteria, we’d like to offer you a free consultation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.