Have you ever watched the movie Braveheart?

Well, if you have, then I’m sure you will remember this dramatic scene. It depicts the Battle of Stirling Bridge.

English knights on horseback are charging forward, lances raised, thundering across the battlefield.

Meanwhile, on the other side, Scottish rebels led by William Wallace stand waiting. They have no horses. They’re fully exposed. They look vulnerable.

At first glance, this feels like an unfair fight. The English have the full strength and power of a cavalry rush. Their momentum is fierce. It appears that they are going to trample and crush the Scots.

Nonetheless, in the face of terrifying odds, Wallace remains calm. He urges his men not to react, even as the enemy draws nearer.

Wallace says: ‘Steady. Hold.’

The English cavalry stampedes, rumbling closer. Closer.

Wallace says: ‘Hold!’

Source: Cinematic Scenes / Reddit

The enemy is looking invincible. Looking unstoppable.

Wallace says: ‘Hold!’

The ground is shaking. The galloping English horses are dangerously close now, kicking up dirt. The mood is one of shock and awe.

Wallace says: ‘Now!’

That’s when the Scots drop to a crouch. They grab long pikes made from tree trunks, lying hidden on the ground. They raise these weapons in unison, creating a porcupine effect.

The English knights crash head-on into the pikes. The impact is bone-crunching. Their horses are impaled, shrieking, collapsing. The English falter, losing their momentum.

Now the tide of battle turns. Now the Scottish rebels have the advantage. They swarm the English, overwhelming them with speed, surprise, and violence.

The Scots win.

What a twist, isn’t it?

On a dramatic level, this is an effective scene. But here’s the thing. Most of what you see portrayed on-screen is fictional. Historically speaking, the Battle of Stirling Bridge didn’t actually happen like this.

Still, through the magic of Hollywood, it works. It draws you in emotionally. This is because Mel Gibson (who directed the movie) relies on an old filmmaking trick. He understands that there’s an intensity to be found by showing instead of telling.

By scripting this battle in a cinematic way, William Wallace comes across as being courageous. He has nerves of steel. He doesn’t flinch, even in the face of overwhelming odds.

This is the entire point of the movie, isn’t it?

That’s why it’s called Braveheart.

Holding as a modern investor

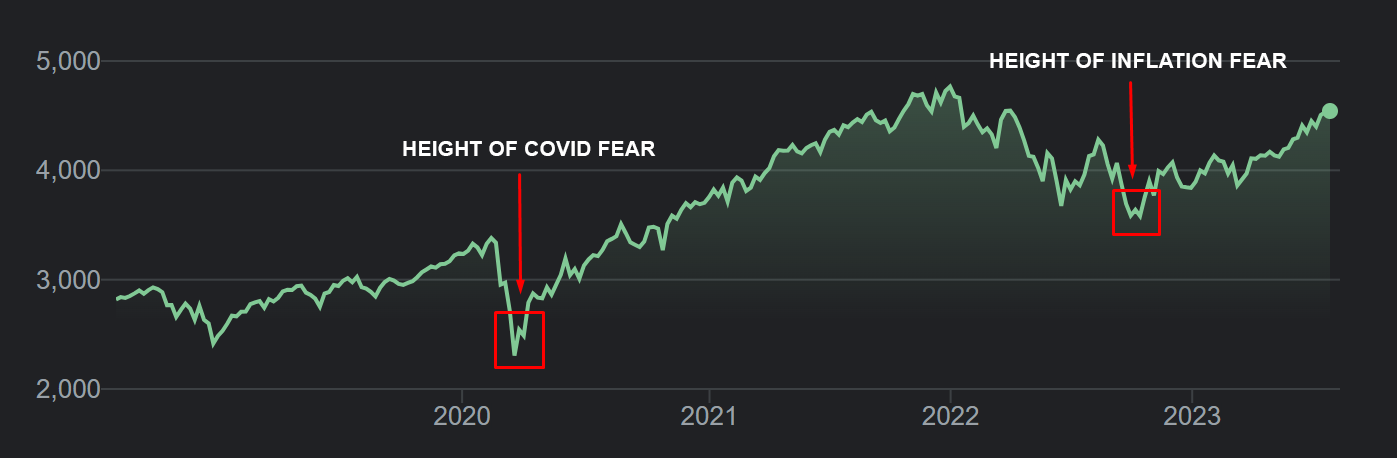

Source: Google Finance

Lately, I’ve been thinking a lot about how people react to volatility in the stock market.

- Certainly, there’s no hiding it. We’ve had our fair share of shock-and-awe events over the past few years. We’ve experienced a pandemic scare. Then an inflation scare. Then a tariff scare.

- When faced with such moments of intense stress, human emotions tend to go haywire. I’m talking about strangled breaths. Sweaty palms. Tunnel vision.

- When you’re stuck in that moment, everything feels amplified. It’s not just real, but hyperreal. And it can be hard to think straight, especially when you’re being bombarded with terrifying headlines.

Source: Peter Mallouk / X

Mind you, it’s not that the world has become any more dangerous today. It’s just that our 24/7 news cycle has become more insistent, more immediate.

- Language is often exaggerated and sensationalised to draw viewers in. You will find that a negative headline gets 60% more clicks than a positive one.

- The tragedy of this, of course, is that if we engage in too much fear, we end up missing the big picture.

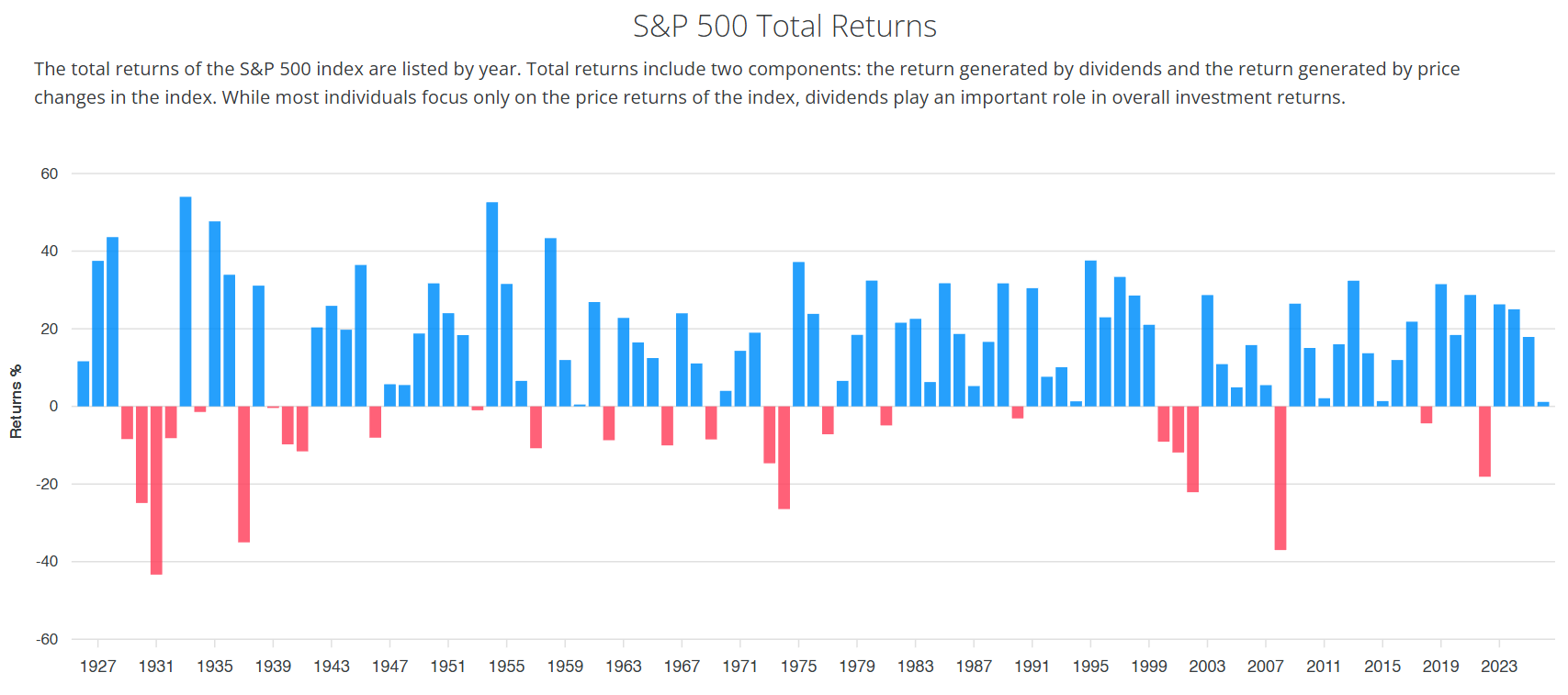

Source: Slickcharts

When I look back on 100 years of investment data, I see something striking. The market has delivered more good years than bad years. Why?

- Well, this happens because entrepreneurs are a stubborn bunch of people. They keep plugging away, day and night. Inventing new products. Launching new services. Starting new trends. And in doing so, they snowball wealth. The stock market is a reflection of this.

- So if you know a small business owner who has failed multiple times and yet keeps on trying, well, then you’ll come to appreciate why human progress is not so easily extinguished.

- People will keep on dreaming. Keep on innovating. Keep on moving forward.

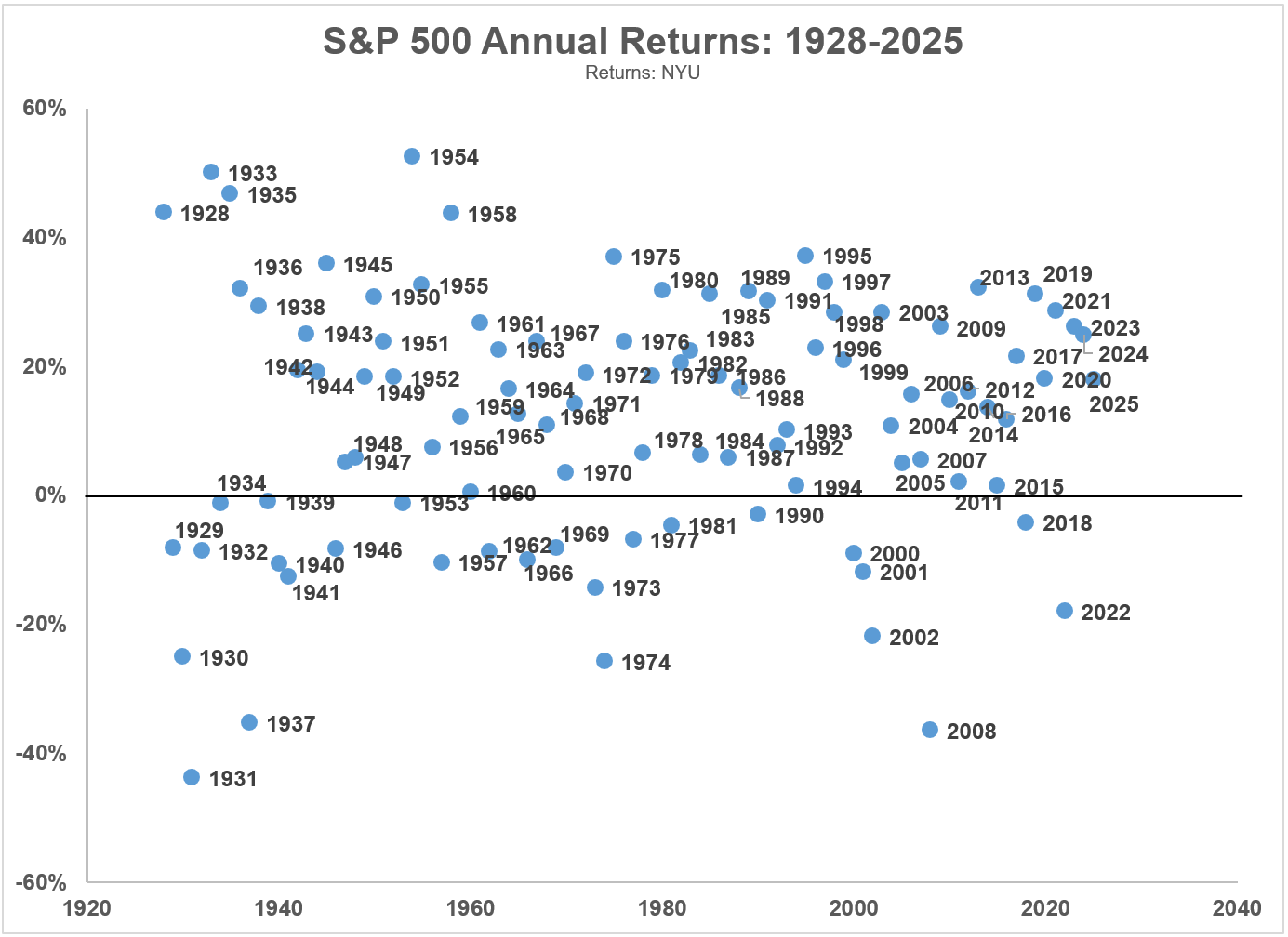

Source: Ben Carlson / A Wealth of Common Sense

This brings me back to the issue of volatility in the market.

- Yes, we’ve had more sunny days than rainy days. And it’s always reassuring to know that human progress wins out eventually. But that doesn’t mean that prosperity moves in a straight line.

- When you invest in stocks, you must know that there’s always an element of uncertainty baked into the future. You’re dealing with a whole range of possibilities. You will get upswings and downswings; bull markets and bear markets; moments of euphoria and moments of depression.

- The reason the stock market outperforms in the long-term is because it is volatile in the short-term. Returns can be wildly variable.

- We call this the ‘risk premium’. You can think of it as hazard pay. The reward that investors receive in return for being willing to endure that uncertainty.

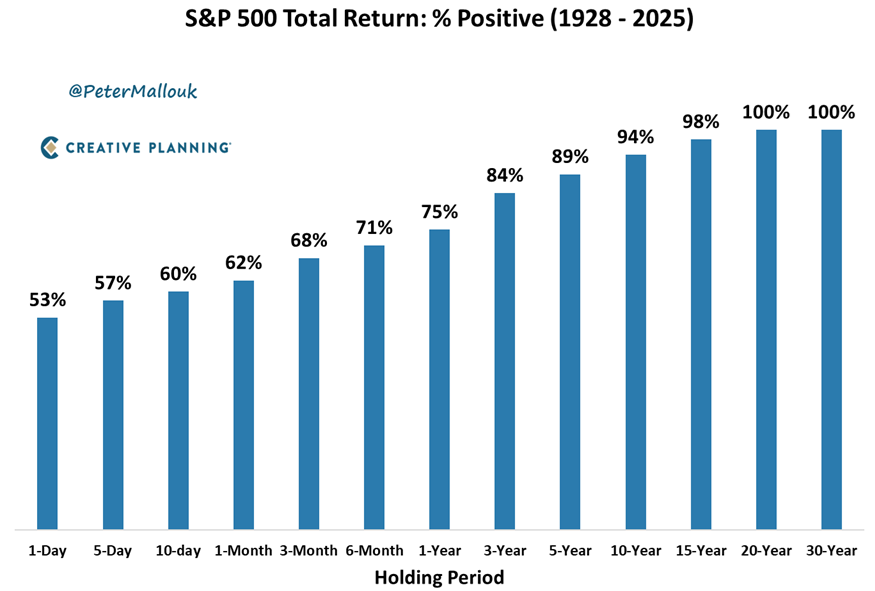

Source: Peter Mallouk / X

Historically speaking, there’s a 75% chance that the stock market will be higher in one year’s time. But then you have to remember: there’s a 25% chance it may not be.

- Dealing with that level of ambiguity takes resilience and courage.

- Can you be like William Wallace? Can you stare down a stampeding threat? Can you hold your ground without flinching?

- Let me tell you. It ain’t easy. Not everyone has the emotional fortitude to stand firm. During market corrections, you will quickly find out who has ‘diamond hands’ and who has ‘paper hands’.

Indeed, the ability to stay calm and collected amidst fear is perhaps the single most valuable skill any investor can have.

- In the words of Charlie Munger: ‘The big money is not in the buying or selling, but in the waiting.’

- This is why I believe that a good investor doesn’t chase hot trends. Instead, a good investor is someone who has a balanced worldview, as well as a strong stomach.

- They don’t listen to noise. They listen for signals. They know how to hold when it matters most.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback. It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.