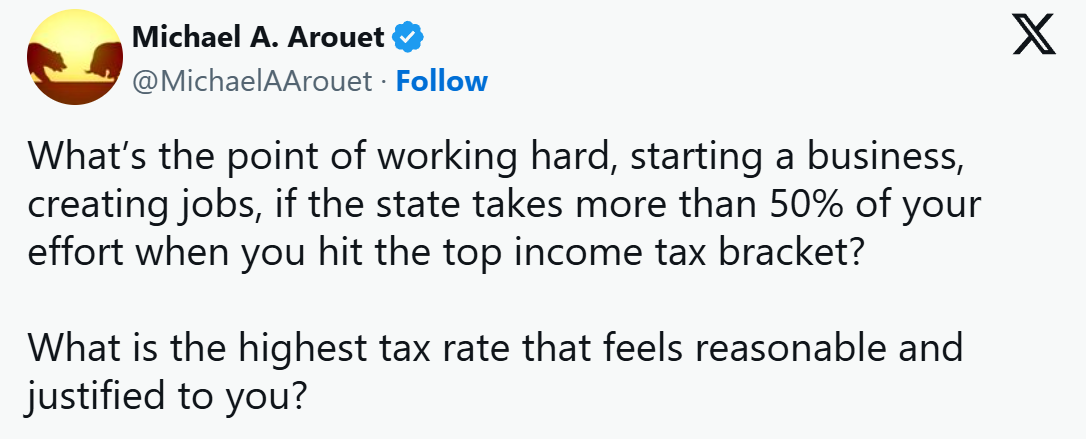

A couple of years ago, before the government changed, this was all over the news:

Source: 1News / X

Translation: Group of people who made it with lower taxes now virtue-signal higher taxes for everyone else.

Here’s the thing with tax. It disincentivises behaviour. So you should tax what you do not want, not what you do.

Let’s not forget: handing over up to 50% of your income to strangers is a modern invention — and historically, a rare one.

Don’t get me wrong. I believe in contribution. But I also believe in accountability. Without the latter, the former becomes theft dressed as virtue.

Yes, a functioning government matters. But it can’t fund much without growing wealth — and wealth only grows when you incentivise it.

Without incentive, you have stagnation and decline.

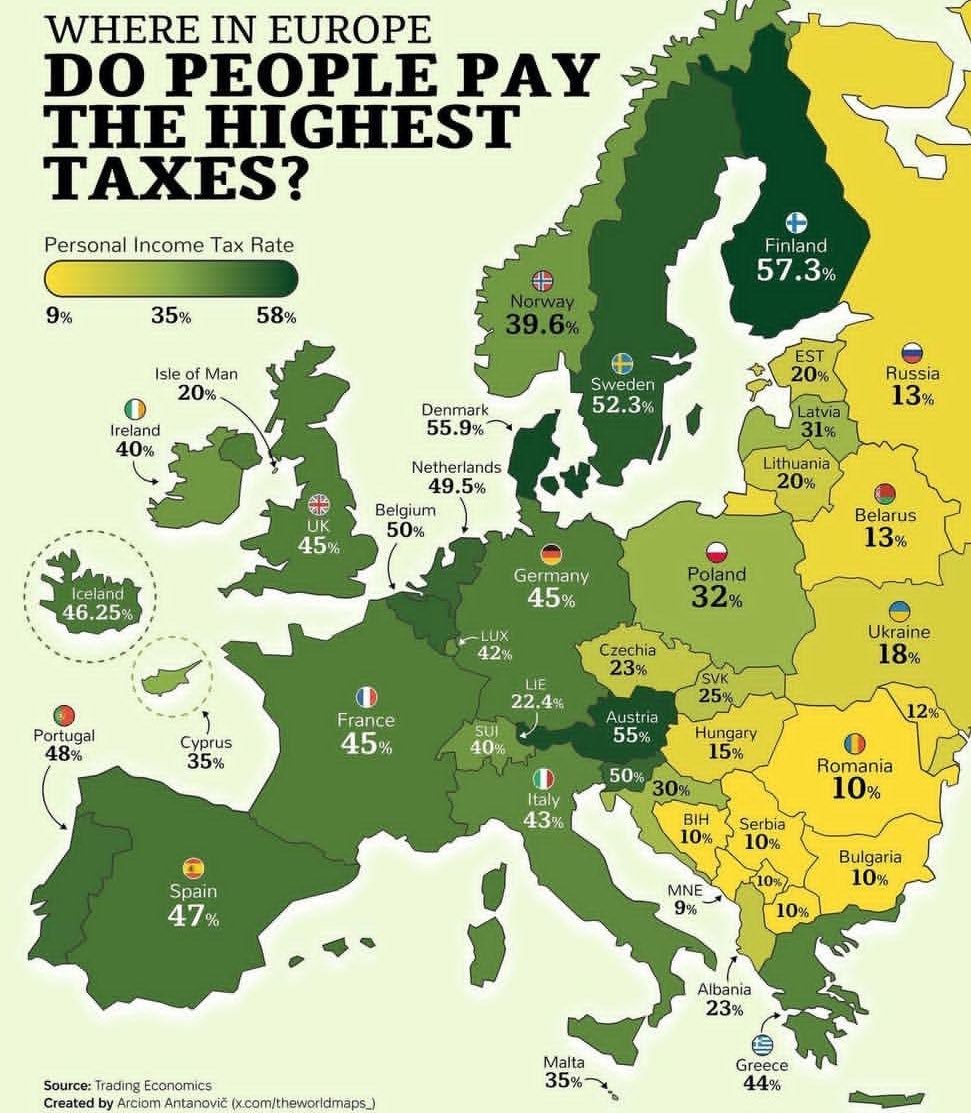

Europe’s stagnation is not a mystery

High taxes and sprawling bureaucracy have stifled innovation — and growth has migrated elsewhere.

Source: Michael A. Arouet / X

Yes, indeed. Why work so hard? Why create jobs? Why innovate for the future?

Without innovation and productivity, you just fall further behind…

Source: Michael A. Arouet / X

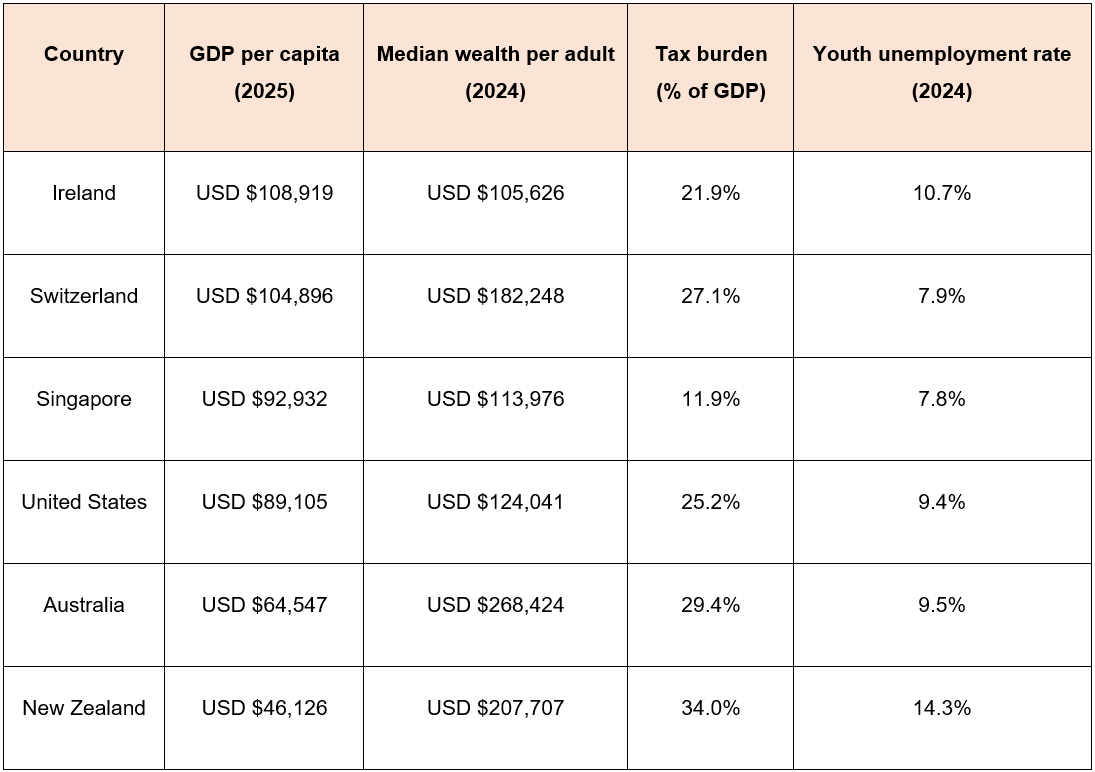

Countries at the top of the GDP-per-capita league tend to have a low tax-to-GDP burden:

New Zealand stands out for its high median wealth per adult, despite relatively modest GDP per capita. This disparity likely stems from one of the fastest-growing property markets globally between 2000 and 2021 — highlighting a misalignment in economic incentives.

Instead of fuelling investment in productive enterprises, tax breaks — combined with housing shortages and some of the world’s highest net migration rates — drove property values sharply upward.

Let’s be clear: the housing shortage was largely manufactured. There was no shortage of land — only a shortage of political will to reform zoning and streamline building approvals.

The government’s 20% Investment Boost is a smart move for business

Investing in new assets? You can immediately write off 20% of the value as an expense — a direct incentive to upgrade, expand, and innovate.

Of course, it could go further. Trump’s Big Beautiful Bill sees similar at 100%.

Furthermore, company tax in New Zealand is too high. We don’t want to be taxed more. We want taxes to incentivise people to succeed.

With AI and increasingly protected global trade shaping the economic landscape, the creation of meaningful work must remain the central incentive.

Source: Caffeine Addict / X

In particular, you want to avoid the above. Youth unemployment is almost 19% in China. It’s around 14% in New Zealand.

No job means a lack of purpose. ‘Pretending to work’ is unproductive.

It’s a textbook case of crowding out: expansive government stifles private enterprise and innovation. As public sector roles offer higher pay, talent gravitates away from business — and the nation grows poorer.

Our Upcoming Coffee & Capital Event

To explore 2026’s opportunities, we invite you to our next live event!

We’ll cover:

- Your questions.

- The AI boom.

- Geopolitics.

- Commodity crunch.

- Inflation threat.

- US-led bull market.

COFFEE & CAPITAL

Friday, 27 February 2026

11:00am to 12:00pm

❌ This Event Is Now Sold Out

Fields Café (Function Room)

4 Appian Way, Albany, Auckland

$37 per person / limited spaces

Includes any menu item, coffee

[ Special Member Price ]

For Managed Account clients & Quantum Wealth subscribers

❌ This Event Is Now Sold Out

$27 per person / limited spaces

Includes any menu item, coffee

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.