A couple of years ago, a local family wanted a new home. They had worked hard, saved, and invested. It was time to get some land with room for a pool. So they sold their smaller home in Devonport and found a large section in a suburb further north.

Then the developers arrived. They started knocking down the older homes on both sides. Soon the section was facing dozens of brutal townhomes overlooking and shadowing their yard. They were devastated.

Of course, this is not only a New Zealand issue. The same is being experienced in Canada.

Source: Riley Donovan / X

For many Kiwis, the quarter-acre dream is ingrained in our psyche. It was the promise of a low-density country at the bottom of the world with space to bring up our families.

Economics supported it. Primary industries that drove our prosperity could support high living standards across a light population base.

By the time I came along in the 1970s, that quarter-acre suburban dream had downsized to 800 sqm. But still workable for a veggie patch, family BBQ, or cricket game.

Density reshapes everything — how we live, how we vote, how we raise families, and how we prosper

Look across New Zealand today, and you’ll find our most densely populated electorates (for example, Auckland and Wellington Central) vote for socialism. Today, they are represented by Green Party MPs.

In the United States, the same trend has been observed. Once cramped apartments and townhomes become the norm, these areas move distinctly left. Ownership gives way to renting. Crime rates tend to go up.

Dense areas lean blue in the US — and red/green in New Zealand.

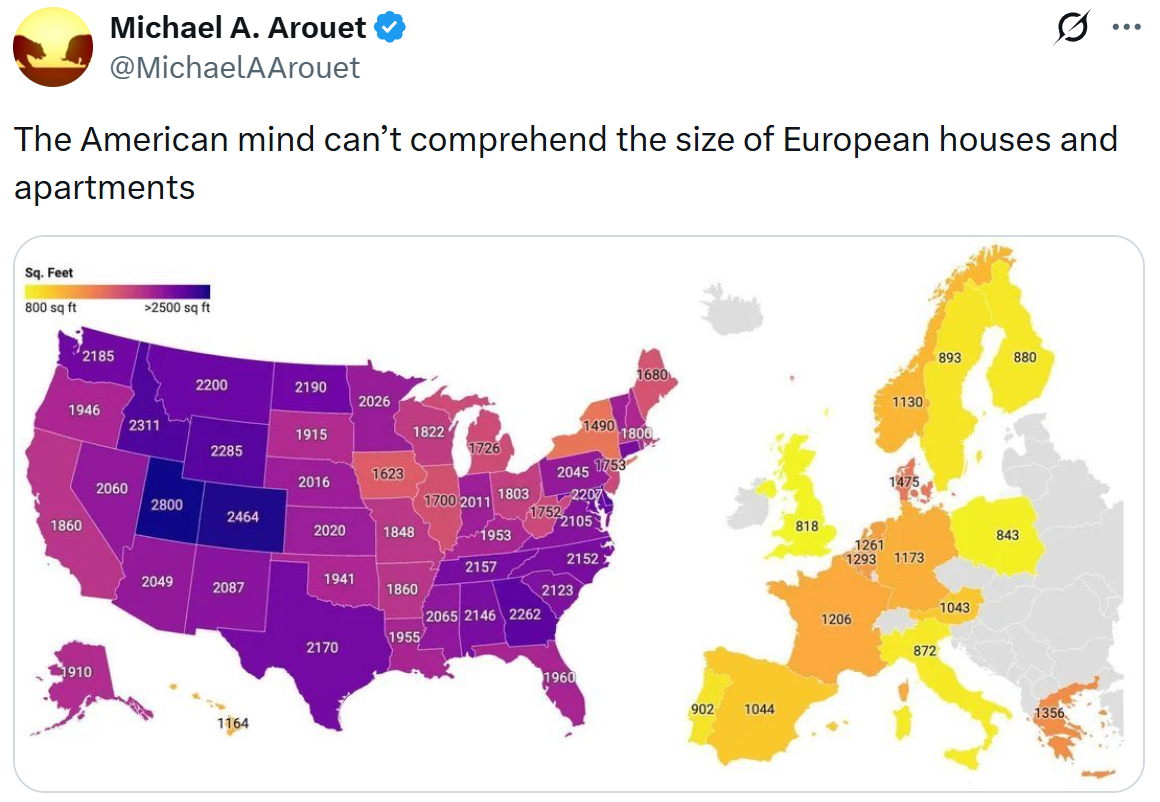

Well, you might say, what about Europe? Where apartments are more the norm and have been for centuries?

Yes, there are some beautiful old buildings with space and grace. There are also many urban towers of crime and decay.

Have you considered the fertility crisis most of Western Europe now faces? And the very high tax rates that have largely strangled innovation and economic growth?

Space has to be a factor. It always has been.

Source: Michael A. Arouet / X

We are near the point of no return in New Zealand. The dream of space where families can thrive is rapidly being given up to the wrecker’s ball.

The average Kiwi didn’t vote for this

Over the past 30 years, governments of both stripes have failed us.

- Some of the highest net migration rates in the world accelerated population density. A majority did not vote for this.

- A population that has risen too quickly in certain years has seen sluggish per capita GDP growth, strained services, and eroded living standards. We didn’t vote for this either.

- The housing shortage was caused by poor policy. There was no shortage of land — only a shortage of political will to extend zoning and streamline building approvals. Due to a degree of NIMBYism, we bear some responsibility.

Simply, we need more affordable, single-family homes for Kiwis — the kind that encourage children, stability, and long-term prosperity.

Once you’re boxed in, the idea of raising a family becomes far less appealing. And when the next generation shrinks, migration stops being a bonus and becomes a structural dependency.

Government comes for Auckland

Instead of alleviating the crisis by managing migration and freeing up building, the density ideologues are coming for our favourite lifestyle city — a bellwether for the rest of the country.

Plan Change 120 would rezone most streets for three‑storey townhouses and apartments — and large areas for five, six, even seven storeys.

Take a street I know well in historic Northcote Point. It faces potential seven-storey developments, even though it is a family street with heritage villas.

Source: Jorge Royan / Wikimedia Commons

The locals see the same risk of destruction. Northcote Point is not the inner city. It’s a popular, albeit upmarket family suburb. Soon, the roads will become gridlocked. The old homes and yards smashed up. And the fabric of the area will change forever.

Of course, left-leaning parties (and too often National) continue to push for density. For the denial of heritage. For 15-minute cities. For layer cakes of renting strangers to which socialism becomes attractive.

How do we save the Kiwi dream?

Source: Michael A. Arouet / X

First, we need to confront a political reality: density changes voting patterns. And voting patterns determine policy.

There are calls to lower the voting age to 16. But if we’re serious about long‑term planning, we should ask a different question: Should the voting age reflect maturity and economic participation — as it does for example in Taiwan (20), Singapore (21), and the UAE (25)?

Ask this question of all leaders: Are they putting their urban ideology first or New Zealand first?

Meanwhile, the US is moving in the opposite direction. They’re releasing land, tackling affordability, and even proposing bans on institutional investors buying single-family homes.

Developers like Pulte Group [NYSE:PHM] — which we moved wholesale clients into after our MDC exit — have surged 200% over five years by focusing on single-family housing in key markets.

The market rewards what families actually want — space, stability, and ownership.

Perhaps someone has been listening. As we were going to press, news just arrived that the government is poised to water down their Auckland intensification plans.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.