Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

It’s been our best year in the markets, since we started our wholesale portfolios back in 2018.

Then, I’d just returned from working in offshore finance in Europe. I was convinced Kiwi investors could do better in managed accounts. This has come to fruition this year.

European outperformance

UniCredit, Italy’s No. 2 bank, was one of our top performing investments in 2025,

growing over 84% (before the ~5% dividend). Source: Author

We concentrated on building positions in Europe a few years ago when they presented remarkable value. 2025 saw the rest of the market realise that value. This has helped us surpass the S&P 500 this year.

Certainly, a highlight of 2025 was visiting Italy in January. There, I experienced the improving economy firsthand and explored a key centre owned by our property business.

This month, we received an early Christmas present, with our Hawaiian real-estate stock being acquired by private equity 27% ahead of our average buy from October to November.

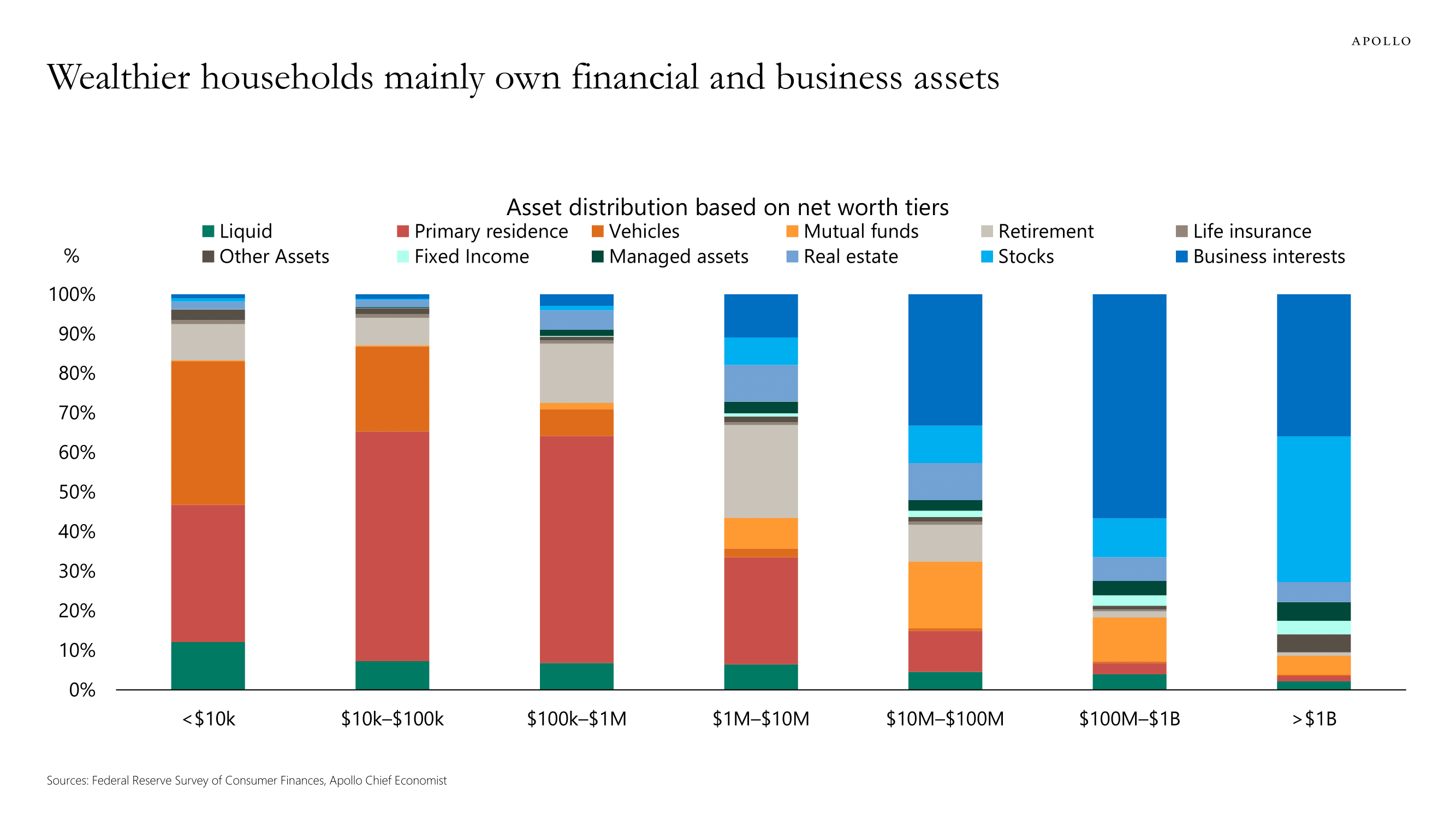

Wealth divide

A theme of this year has been an emerging divide. Global stock markets have powered ahead. Many regular Main Street businesses have struggled.

A friend of mine, running a dental surgery, told me that his WINZ receipts have doubled since Covid (people claiming dental work on the State). And he’s in a relatively affluent area.

Meanwhile, the 50% of households that invest in stocks have seen their wealth jump. The other 50% have gone backwards as costs rise and property prices go backwards.

Source: Torsten Slok / Apollo Academy

Of course, it takes time to build a portfolio. But those that do gain a share of the most productive engines in the world: businesses. Investors can end up earning more from their equity assets than many jobs.

As you may expect, I’m entirely biased toward shares. Particularly toward listed companies with undervalued property.

When it comes to investing — I’m a ‘one-trick pony’. The only way I know to truly drive long-run wealth is via stocks. But I know that pony from its mouth to its arse.

Fast dollars and slow dollars

There are two ways you make money:

- Fast money — via a successful business or, occasionally, a very high-paying job.

- Slow money — via taking money and investing it in financial markets.

This year, slow money has become faster.

Long may that continue into 2026 as Main Street catches up with strong stock markets and growing liquidity.

Managed Account performance*

For the month of December 2025, we were up 2.40% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

For the full year of 2025, we have ended up 29.11%.

Our average annualised return since inception is 13.95% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 1.82%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 0.48%.

Our blended MSCI EAFE/S&P 500 benchmark was up 1.62%.

Opportunity in 2026?

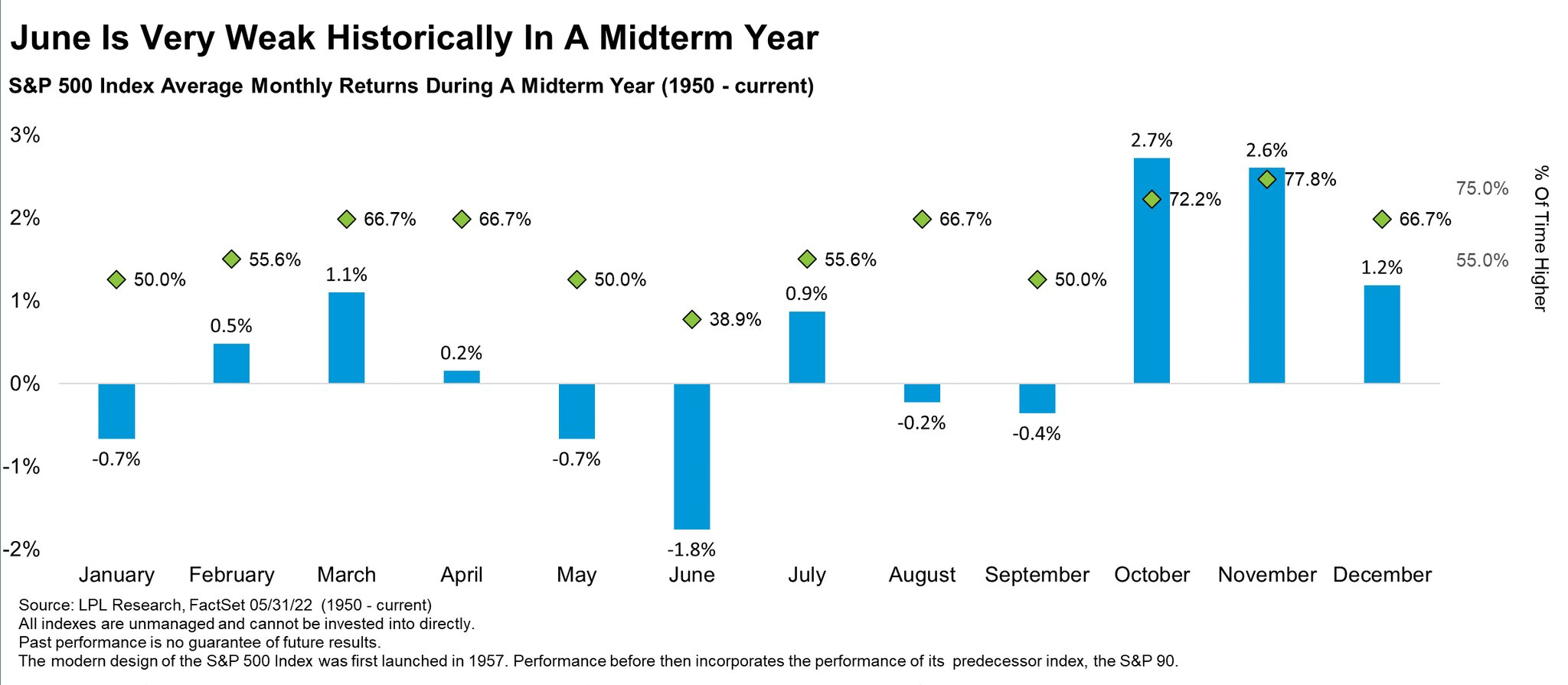

While Europe outpaced US markets this year, American indexes still lead sentiment. In the US this year, we see the midterm elections kick off from March.

History tends to show us that midterm years can see a weak January, May, and June.

This year, we’re poised to pounce in January. Given the run-up we’ve had, a global correction could be due.

Source: TonyLiberty / Reddit

January, February, and some of the first half of 2026 could be a great time to buy.

Beyond this, we expect earnings to increase and markets to continue to climb on top of US rate cuts and burgeoning liquidity.

There is still value on the table.

If you have slow money sitting idle, this may be the moment.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.