Diversification is the only free lunch in investing.

—Harry Markowitz

Here’s a controversial question: what is the biggest threat to New Zealand’s economic security?

Well, some people would say it’s climate change. They fear that spiking temperatures and rising sea levels are going to harm us.

Meanwhile, other people would say it’s President Xi Jinping. They fear that he is going to push ahead with a Chinese invasion of Taiwan, starting a devastating war.

Others, still, would say it’s artificial intelligence. They fear that robotics and automation are going to destroy jobs, leading to unemployment.

Indeed, there are plenty of apocalyptic theories out there.

But here’s what I believe: the real danger to New Zealand is actually none of that.

In fact, I think our biggest threat isn’t even external.

Our most serious risk is actually internal. Domestic. Homegrown.

It’s something most Kiwis take for granted. A narrow asset class that’s highly concentrated and potentially stagnant.

Source: Image by Bernd Hildebrandt from Pixabay

Yes, I’m talking about our housing market. Right now, property prices are going through a correction, but affordability is still tricky.

- Just look at Auckland real estate. Between November 2021 and October 2025, Interest estimates that the median price for an Auckland house suffered a decline of over 20%. That’s quite a drop. But it hasn’t necessarily made things more affordable. At $1.03 million, the median price is still expensive.

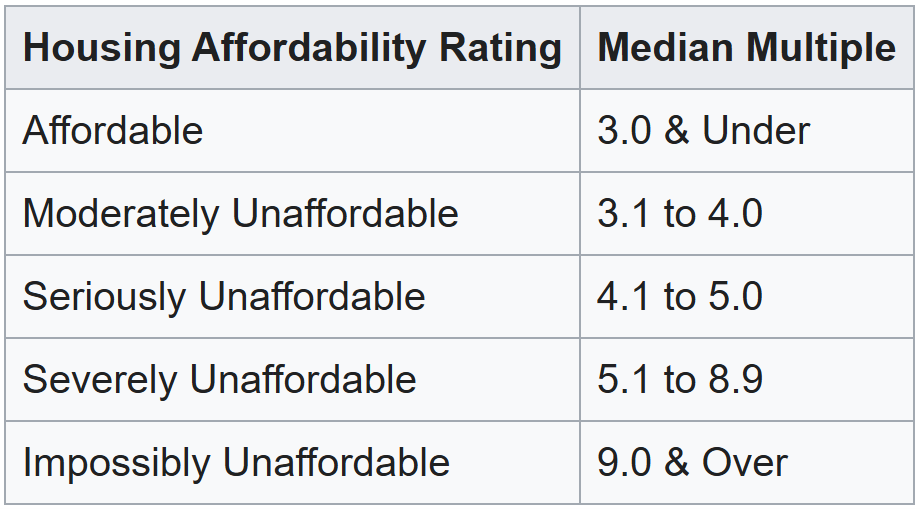

- According to MBIE, the median household income in Auckland is estimated at $131,900. Do the math. You will get a house price-to-income ratio of around 7.8. This sits within the ‘Severely Unaffordable’ range.

Source: Wikipedia

Are these figures problematic? Of course they are. But it’s important to understand how we got here:

- Between 1998 and 2022, the IMF reported that house prices in New Zealand surged by over 250%. This is an astonishing statistic. Especially when you consider what happened in other OECD nations: they only delivered an average price rise of around 70%.

- This has led some property investors to become exuberantly bullish. They tend to believe that house prices will double once every 10 years. They tend to believe that it will happen like clockwork.

- So, if this formula holds true, we can expect that the median Auckland house price will hit $2.06 million by 2035. Then it will hit $4.12 million by 2045. Then it will hit $8.24 million by 2055. Then it will hit $16.48 million by 2065. Then it will hit $32.96 million by 2075.

But wait. Hold on. Let’s tap the brakes for a moment. You should ask yourself: are such price increases possible? Are they logical?

- Well, here’s the inconvenient truth. New Zealand is not a very high-income nation. We are not Ireland. We are not Switzerland. We are not Singapore.

- In fact, when adjusted for inflation, our median income is actually sliding backwards. We are losing ground, not gaining it.

Yes, it’s true that Kiwi real estate did enjoy a period of outperformance during the property boom that existed before 2022. However, by necessity, this must now be followed by a period of underperformance.

- The economists will call this ‘a reversion to the mean’. That’s the law of averages at work. So instead of assuming that property prices will keep climbing in a parabolic way, it’s actually more reasonable to assume that they will cool off and level off.

- Indeed, this is the natural cycle of things. Right now, our country is experiencing a reversal of fortune. But perhaps this fall from grace was always meant to happen.

In April 2025, Property Journal estimated that the total value of New Zealand’s residential market is sitting at $1.62 trillion. This is almost 400% the size of our country’s annual GDP ($435 billion).

- So forget agriculture. Forget tourism. Forget manufacturing. The numbers suggest that housing has become our nation’s single-largest industry.

- It’s bewildering, isn’t it? We’re talking about a huge chunk of capital just sitting there. It’s not flowing into new businesses. It’s not flowing into new products. It’s not flowing into new exports. It’s just sitting there.

Is this stagnant capital damaging our productivity and efficiency as a nation? Well, here’s what the evidence suggests:

- New Zealand spends just over 1.5% of its GDP on research and development. By comparison, across the OECD, other countries are spending an average of 2.7%.

- The funding gap is enormous. And the consequences are far-reaching.

- Just think about it. If we’re not spending enough on R&D, we’re not able to innovate. And if we’re not able to innovate, we can’t create good jobs with good salaries. And if we can’t create good jobs with good salaries, who will be left to buy our expensive houses?

- You might argue this is a doom loop. It’s driving young Kiwis away. The news headlines are ominous. Chances are, you’ve seen your fair share of them lately.

Source: Radio New Zealand

So, has our rock-star economy become a beggar’s economy? Does this mean that our nation will experience a Japan-style lost decade for house prices? Is this the End of Days?

- Well, I don’t think the situation is nearly that bleak. As Kiwi investors, we aren’t helpless here. We don’t have to surrender to fate. We can take immediate and decisive action for ourselves and our families.

- Instead of keeping our money locked up in a single geographic location, we can choose a more rational option: spreading some of our wealth globally. Across borders. Across markets. Across asset classes.

Source: Google Finance

Over the past five years, global stocks beyond New Zealand have surged.

- This means that investors who have been brave enough to buy and hold international assets have prospered.

- As economist Harry Markowitz reminds us: diversification truly is the only free lunch available in investing. And as Kiwis, perhaps we should be tapping into this opportunity more often.

Maybe the time has come for a national reset. Not just in policy, but in psychology.

- For too long, New Zealand’s prosperity has been measured by the square metres of a house and the speculative glow of a property listing. But bricks and mortar can only take us so far.

- If we want to strengthen our wealth base, we need to capture innovation, productivity, and enterprise. And this can only happen by investing in productive assets on a global scale.

- We must diversify now or watch the doom loop tighten. The choice is ours — while the free lunch is still on the table.

Our Quantum Income Strategy

So, what are smart investors looking for in 2026?

- Better prospects for capital growth.

- A stronger stream of passive income.

- Diversified wealth protection.

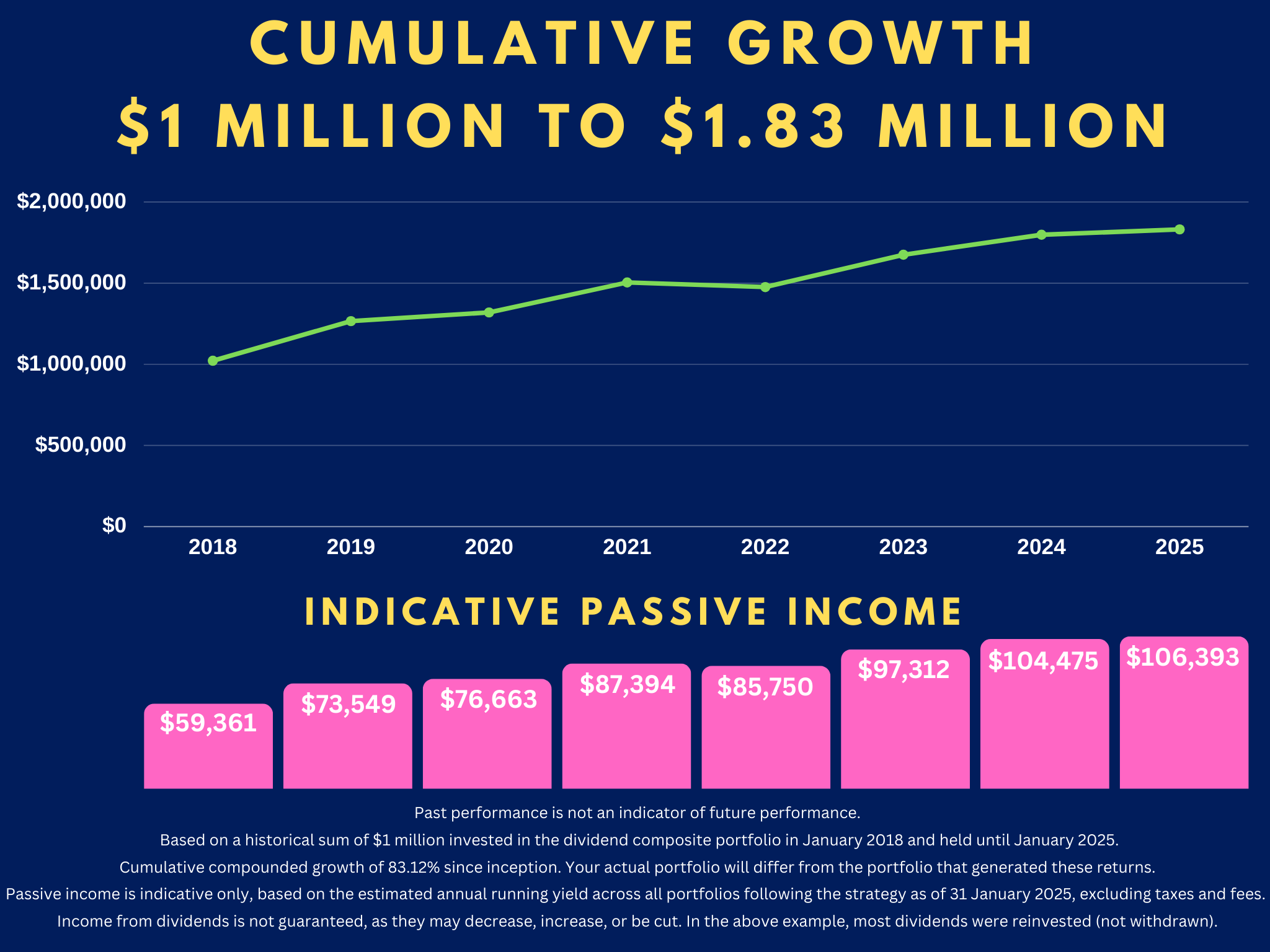

You could achieve all this when you choose to buy into global assets on the stock market.

- This is what we’re focused on with our Quantum Income Strategy.

- If you qualify as a Wholesale or Eligible Investor, we can help you set up and manage a global brokerage account.

- We are already hunting for investment targets in Australia, Europe, and America. We are especially keen on resilient sectors like infrastructure, industrials, and energy.

For our target client, we are focused on securing strong dividend income of $50,000 or more per year (depending on capital and market conditions).

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2026 and beyond.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.