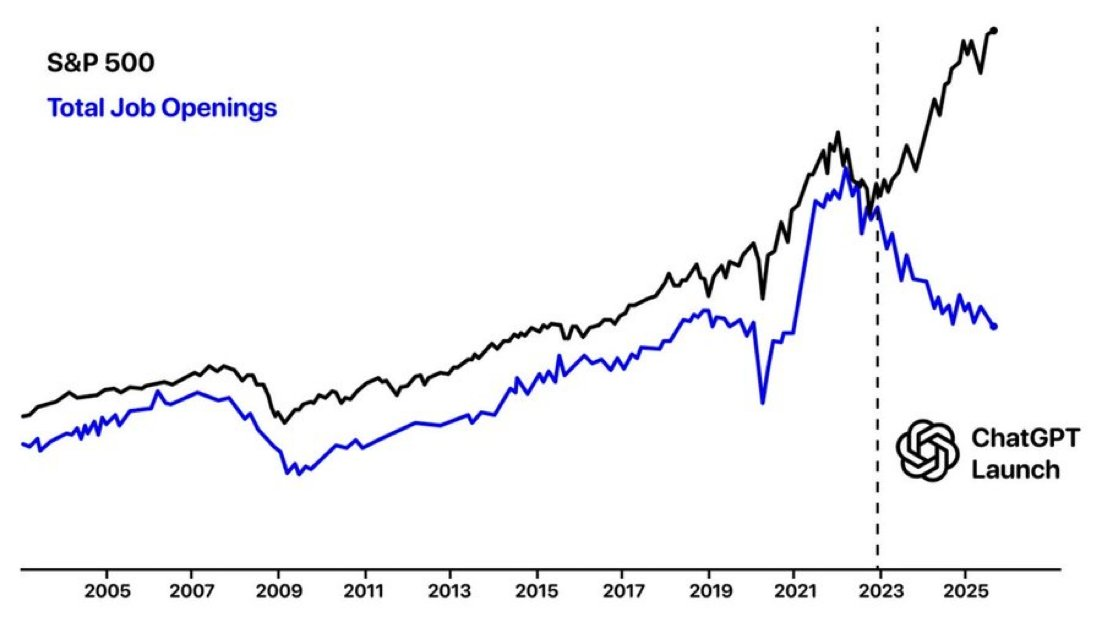

This might be the most foreboding chart you’ll see this year.

As AI gained traction in 2022, the long-standing link between market returns and jobs snapped.

Source: Scott Stirrett / LinkedIn

Lately, this has gathered speed. The black line of market return pushes ahead as company profits grow at a record pace. Yet the blue line of job openings is falling away.

What’s happening, and how could this affect the global economy?

Recruiters are reporting entry-level vacancies in white-collar professions have fallen by up to 35% in 18 months.

New Plymouth CBD. Source: MkNZ24 / Wikimedia Commons

Back in the 1990s, when I was a young accounting and finance student, I was given a scholarship and intern position with Ernst & Young in New Plymouth.

For a couple of summers, I would return from Auckland and do ‘first run’ accounts. It was monotonous work, and I soon found other ways to earn more than the $6.50 minimum wage that was in place back then.

The point of the internship was that it was ‘a foot in the door’ to a busy accounting practice. It was also a good grounding for me on which sorts of businesses make money. And which don’t.

While I never returned to EY, those opportunities today seem harder to come by.

For those with an eye on a lucrative career in accounting, law, finance, or even IT, this is bad news. AI can do much of the entry-level work that new graduates were once paid to do.

In my case, I followed a career in entrepreneurship. When you set up a new business or take over an existing one, your survival depends on meeting the market and honouring your customers.

Financial markets are moving ahead

Innovative and dynamic businesses are growing. Markets are rising because the earnings of many companies are up. AI and robotics can improve efficiency and margins across a range of industries.

In short, this is an exciting and profitable time to be investing in productive stocks. At the same time, listed real estate that provides for these trends is seeing promise as interest rates moderate. Logistics, industrial, and targeted retail is doing well. Professional offices not so much.

Education needs to keep pace

Italy is a poster child for chronic youth unemployment.

The rate of out-of-work young people (aged 15 to 24) has consistently been over 20%. About the worst in Europe.

Graffiti mural, Italy. Source: Image by Leif Linding from Pixabay

The reason for this?

In 2023, Giovanni Brugnoli, vice-president of Confindustria (the Italian employers’ federation), noted a ‘dramatic mismatch’ between labour supply and demand.

Data also suggested that almost one in two companies cannot find adequate staff.

It may often be heard that many young people in Italy are ‘overqualified’. Graduates have favoured liberal arts, when demand is for STEM. Technical institutes that provide real skills are seen as ‘second-class’.

I mention the example of Italy, because it demonstrates that when education systems fall behind, dramatic mismatches can build. This has real consequences for youth unemployment and societal decline.

The AI revolution will transform the demand for labour

Prudent investors will see opportunities to capitalise on this.

Will AI integration lead to much higher rates of total unemployment?

If history is anything to go by, technological revolution has created far more jobs than it has destroyed.

Here are some career paths expected to grow:

- AI developers and managers.

- AI researchers and machine learning engineers.

- Data scientists and engineers.

- Robotics technicians.

- Software developers with an emphasis on AI.

- Human-centric service roles.

- Healthcare practitioners (surgeons and nurses, using AI for support).

- Education and training (teachers and educators to reskill the workforce).

- Management and strategy (human judgment remains indispensable for strategic decision-making).

- Financial and business analysts (focusing on higher-level advisory and investment strategy).

- Skilled trades (electricians, plumbers and builders, particularly for an infrastructure boom).

- Agriculture and forestry (where on-site judgment is key).

While entry-level roles may shrink, the AI economy is creating demand for skilled, judgment-driven roles — both technical and human-centric.

In a fast-moving labour market, staying adaptable is essential. Countries must attract talent and capital with smart policies. And for individuals, strong investing today is the best insurance for the future.

These days, we’re running the ruler over our portfolios.

We’re looking for companies that will grow from AI, not be diminished by it.

And the good news is that most quality businesses are well-placed. Because they’re focused on the needs of their markets.

Quantum Income Strategy

Wealth Morning offers value-driven investing in developed markets — with a keen eye for what others miss.

We build strong, income-rich portfolios for Eligible and Wholesale Clients. Our Principals invest their own money in the same strategy. You retain full ownership and custody of your assets.

If you’ve invested before, built wealth, or meet wholesale criteria, we’d like to offer you a free consultation.

In a time of rapid change, clarity and strategy matter more than ever.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.