The reports of my death are greatly exaggerated.

—Mark Twain (allegedly exaggerated)

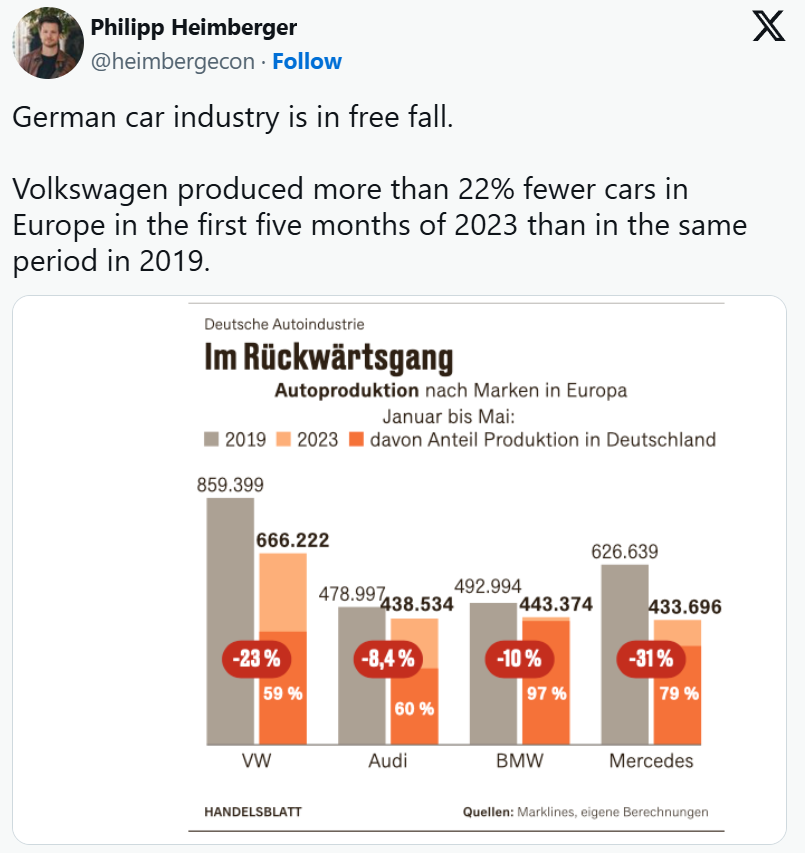

Apparently, the 139-year-old German car industry may soon be in its sunset phase.

The German auto industry — founded in 1886 with Karl Benz’s first gasoline-powered car — is now facing what analysts are calling a make-or-break moment.

Source: Philipp Heimberger / X

The industry is facing a perfect storm:

- Slow EV transition. German automakers were late to embrace electric vehicles (EVs), ceding ground to Tesla and aggressive Chinese brands. The abrupt end to EV subsidies in Germany in late 2023 further dampened domestic demand.

- Recession at home. Germany’s broader economy remains in a slump, with the auto sector dragging down GDP. Volkswagen and others are cutting thousands of jobs.

- Profit erosion. EY reports massive profit declines and overcapacity. Revenues in the sector fell 1.6% in Q2 2025 compared to the previous year.

- Chinese competition. German brands are losing market share to Chinese EV makers who offer cheaper, tech-savvy alternatives.

- US trade policy. Export-heavy German automakers are vulnerable to shifting US tariffs and protectionist moves under President Trump.

- Fossil fuel decline in China. Demand for combustion-engine vehicles has dropped sharply in China, once a key growth market. The Chinese economy is also slowing, with consumers looking to lower cost locally-made EVs — where there has been overproduction and a price war.

Yet there are glimmers of hope.

The Germans are not going to take failure lying down.

In this report, I argue that the German auto industry isn’t dying — it’s recalibrating. And in the chaos of EV disruption, margin erosion, and policy distortion, its comeback may be the most mispriced opportunity in global mobility.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.