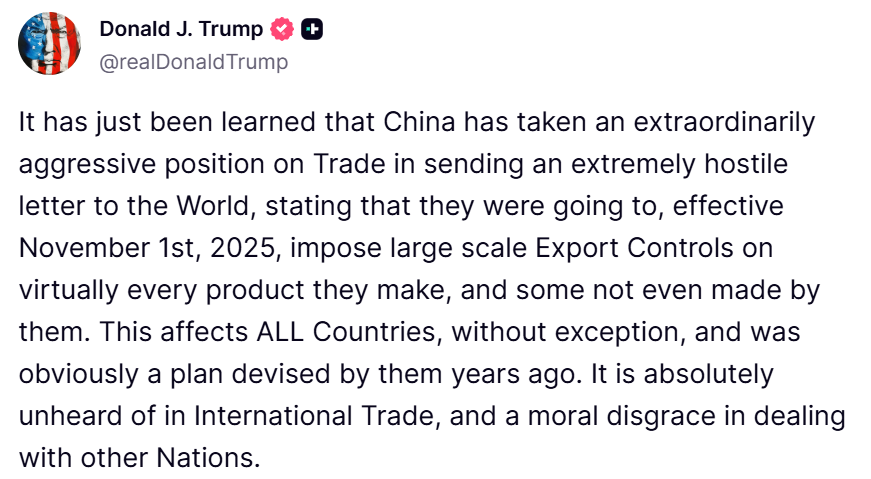

On October 11, Trump was angry.

Here’s what he said:

Source: Truth Social

He was talking about China’s stranglehold on rare earths. These are critical in the lightweight magnets used to miniaturise electronics.

As of November 1, he imposed an additional 100% tariff on China, as well as export controls on critical software.

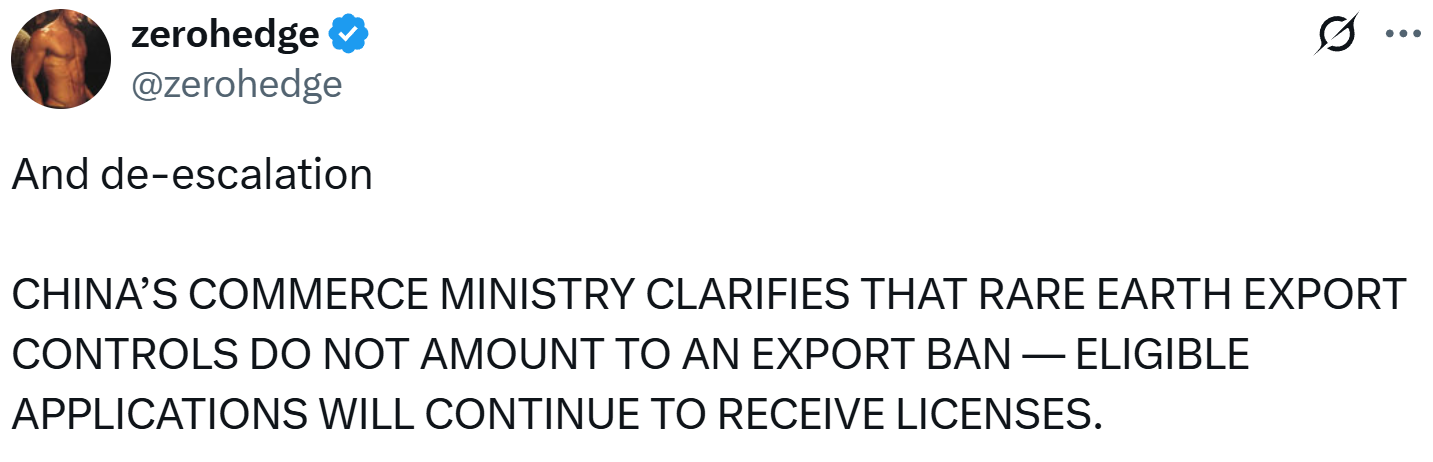

China responded immediately:

Source: ZeroHedge / X

The media narrative of US double standards and China’s upper hand lacks insight.

Go to the numbers. China depends on its export sector for growth. US tariffs act as a king hit. Exporters must scramble to find other markets.

The view that lost US sales are offset by rising trade surpluses with markets like the EU and Asia ignores the margin hit.

Any businessperson knows that to open new markets, you need to cut prices. If you want to trans-ship products via Asia, instead of going to the US directly, you’re going to need to share margin. Then there are higher transportation costs.

So the rare-earth standoff is likely China’s only choice to try to bring the Americans to the table. Trump is right to bluster against this.

Rare-earth dependency

A disastrous geopolitical error was losing rare-earth refining in the West due to environmental concerns. While rare earths themselves are not particularly rare, as of 2023, China had cornered around 90% of the refining and processing business.

The US could be a decade away from having its own complete supply chain.

One company we invested in for our wholesale clients back in May was Iluka Resources [ASX:ILU].

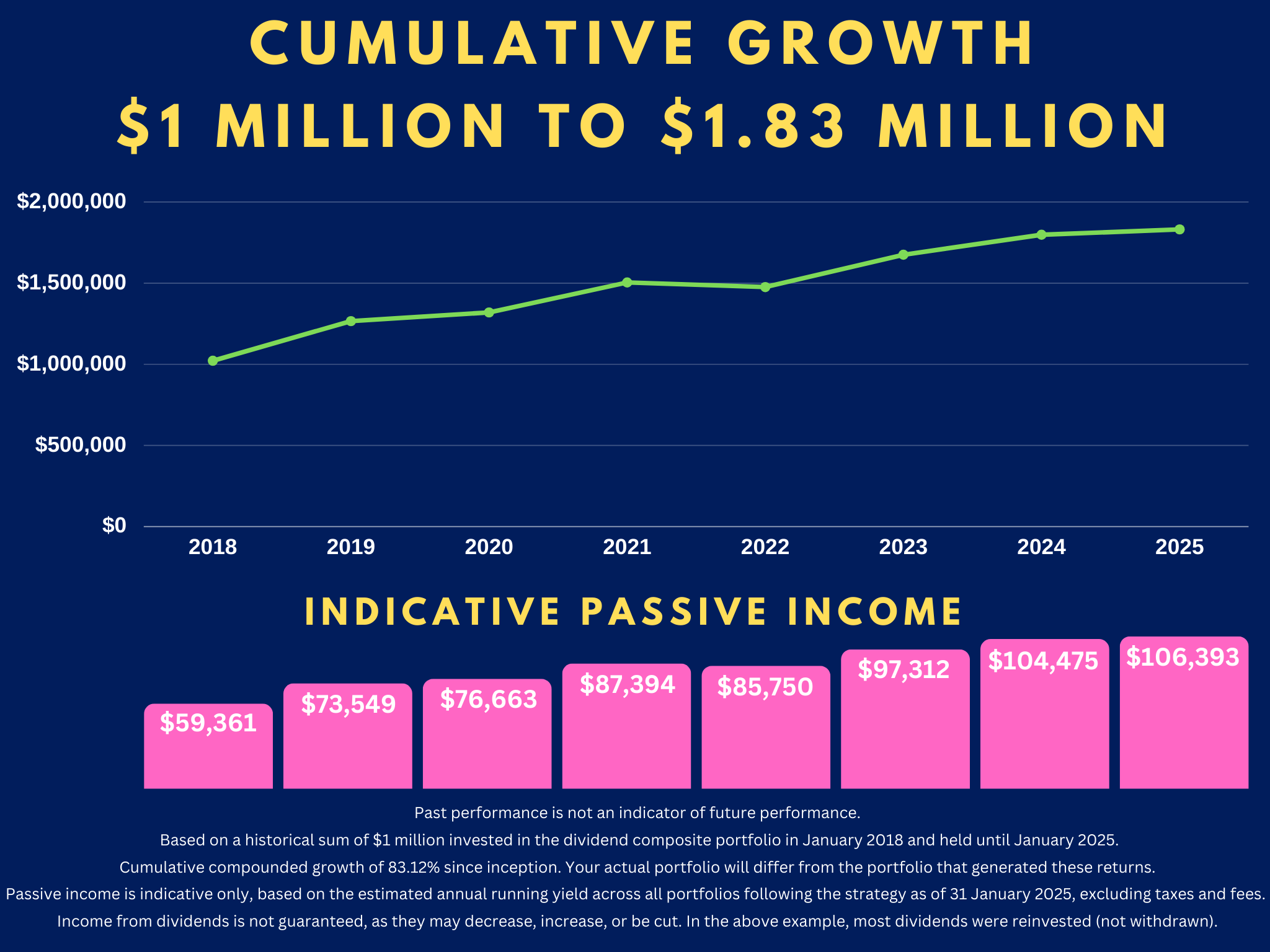

We’ve enjoyed a 130% return since then:

Source: Google Finance

Iluka has been stockpiling rare earths for years. It’s now on the verge of opening a processing facility at Eneabba, three hours north of Perth.

Here’s what Dan McGrath, head of Iluka’s rare-earths division, told the BBC back in August:

‘China has since very deliberately and overtly sought to control the market for the purposes of supporting their downstream manufacturing and defence industries…

‘We expect to be able to supply a significant proportion of Western demand for rare earths by 2030. Our customers recognise that having an independent, secure and sustainable supply chain outside of China is fundamental for the continuity of their business.’

One of the reasons we chose Iluka was that it’s not a 100% rare-earth play.

The Company’s main business is zircon mining (used in tiles and bathroom ware). This has upside as the construction industry starts to improve on lower interest rates.

It also has a royalty held on iron ore production from BHP’s Mining Area C. This underwrites some dividend income.

You see, there are alternatives to rare earths. We didn’t want to go all in on it. For ours is a value strategy. We exist to grow and protect long-term wealth, while achieving financial independence with dividend streams. More about that in a moment…

While Iluka is building Western capacity, others are exploring rare-earth-free alternatives altogether.

This follows US-funded research at the University of Minnesota:

Source: Niron Magnetics

Iron-nitride magnets are made from iron and nitrogen (abundantly available). Their magnetisation levels can surpass the key rare earth of neodymium. They could offer even more efficient motors and better temperature stability.

At this stage, Niron Magnetics is building ‘a new 190,000-square-foot facility to supply rare-earth-free permanent magnets for data center cooling pumps, automobile motors, robotics, consumer electronics, defense and drone equipment, and other applications critical to the US economy.’

European manufacturing concerns

The EU is even more dependent on Chinese rare earths than the US.

So we began researching impacts on target manufacturers there.

Mercedes-Benz [ETR:MBG] is an unloved stock. The market ignores its very strong cash flow and dividend yield.

While its legendary engineering has led in petrol and diesel engines, the business has struggled to compete with the new wave of EVs.

This looks set to change with new long-range models being launched. The Company is also investing extensively in alternatives such as solid-state batteries.

Source: Pixabay

Back in June, Mercedes told CNBC:

‘In the future, Mercedes-Benz wants to use new material compositions to dispense with heavy rare earth metals such as dysprosium in our electric drives.’

Their next-generation EV platform has almost no heavy rare-earth content.

Smart countries, companies, and people never let themselves become dependent

This is a battle for freedom.

Socialists want you dependent. They depend on that for their control.

Don’t depend on one job or source of income. Invest to become financially independent.

Diversification is the one free lunch in finance. Take that free lunch.

Our wholesale managed accounts strategy focuses on income and growth picks that create financial independence. We seek smart, quality businesses with defensive passive income optimised for New Zealand tax.

We eat our own cooking — it’s a true partnership where the Principals’ own money is invested in the same strategy.

We’re currently offering a free consultation to Wealth Morning readers.

Do request your free consultation here.

I look forward to speaking with you.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.