Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

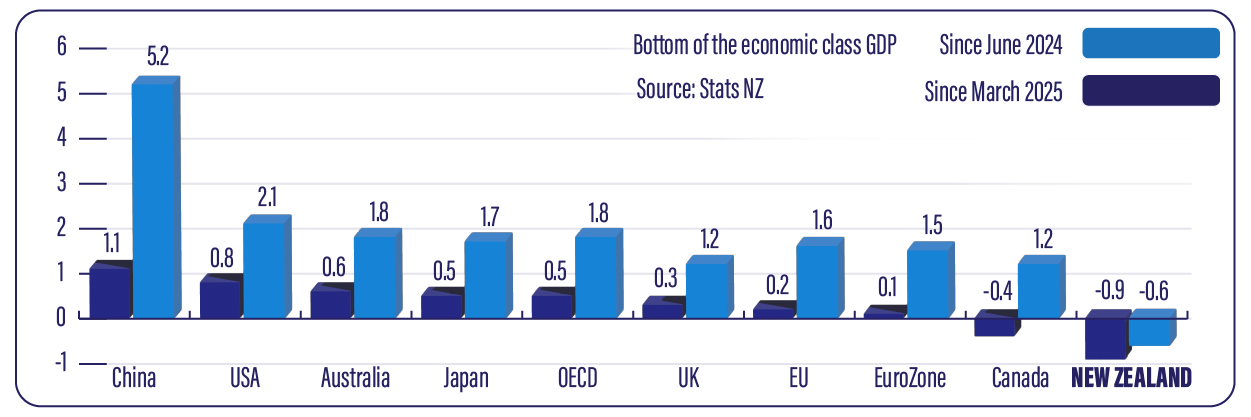

While our global portfolios move ahead with strong currency gains, it is concerning to see the local economy sliding backward.

On 19th September, the Taxpayers’ Union sent me an email putting this in stark relief:

Source: New Zealand Taxpayers’ Union

According to them: ‘Since June 2023, per-person GDP is down by 3.9 percent!’

Translation: The population has increased. Productivity has not. Most people who make their living solely in this country are worse off.

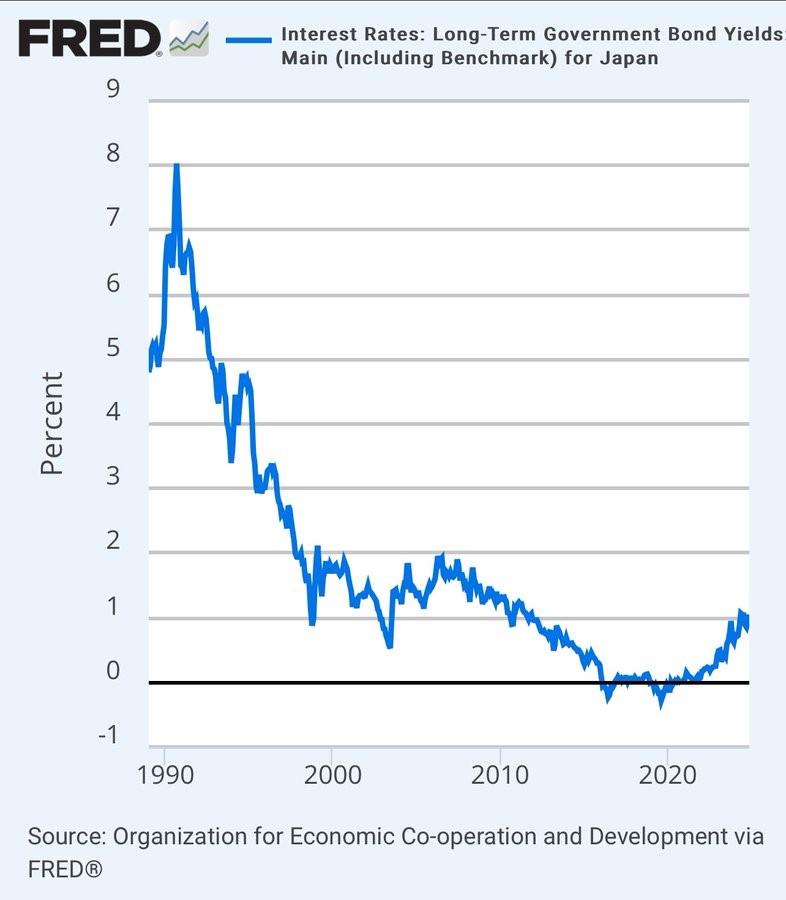

Blaming the government entirely is unfair. Few local analysts are mentioning the deep slowdown in China or the sharp fall-off in immigration.

Yet, in the long run, it is healthy to reduce our dependency on these factors. The same goes for relying on house prices always going up.

Of course, with an ageing population, we need migration. The challenge is to match that to skill and capital needs.

Slowdown for our top export market? Source: James E. Thorne / X

The New Zealand dollar is already a risk-weighted currency due to the size and remoteness of the economy. Add a much higher debt burden since Covid, and it’s little wonder NZD has been sold off.

Of course, this makes it more difficult to buy overseas stocks.

NZD has been oversold. It should rise again.

This country has much lower government debt-to-GDP than most other OECD countries. A fiscal or trade surplus could see upside.

But we shouldn’t be here. Radical reform was on the ballot. The blue team brought a teaspoon to a demolition job.

Yes, they have chipped away at the edges of the bureaucratic state. But to date, they have failed to turn around the ship as global markets price choppy waters.

Maybe we need to slide to the predicament of Argentina before most Kiwis wake up to the need for serious recalibration. Hopefully that wake-up call will ring in Wellington before the 2026 election.

We’ll continue investing overseas for stronger opportunity

Elizabeth Quay, Perth. Image by Jason Lim from Pixabay

A client recently returned from Western Australia.

He drove past one of the businesses we buy on the ASX. He said the difference in vibe between Wellington and Perth was stark. A much more positive mood. Mining trucks on the move. Hospitality and other businesses benefiting from all the activity.

While policymakers hesitate, markets don’t. We’ve positioned globally — because waiting for local productivity to rebound is not a strategy.

Our portfolios are on the move too…

Managed Account performance*

For the month of September 2025, we were up 3.79% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year (January 1 to September 30), we are now up 24.97%.

Our average annualised return since inception is 14.14% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 1.65%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 3.53%.

Our blended MSCI EAFE/S&P 500 benchmark was up 1.93%.

The road ahead

Our deployment of NZD into global markets has slowed. Clients have done very well from extensive holdings in EUR, GBP, USD, and even AUD. They have good growth and income from our value picks.

We are continuing to position defensively. We still see value in this market, particularly in overlooked industrial, resource, and property sectors.

Yes, rates are coming down. Markets are opportune. You trade what’s in front of you.

When NZD improves — as it will — we’ll look to add much more.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.