‘You never know what’s going to happen. You need a backup plan in case everything turns bad.’

I was having dinner with a friend who holds four passports (NZ, UK, Ireland, and India).

Another at our table chimed in that he had recently renewed three Australian passports for his family. That had cost him almost NZD $2,000, including the ‘overseas processing surcharge’. Apparently, Australia perceives they have a ‘golden passport’.

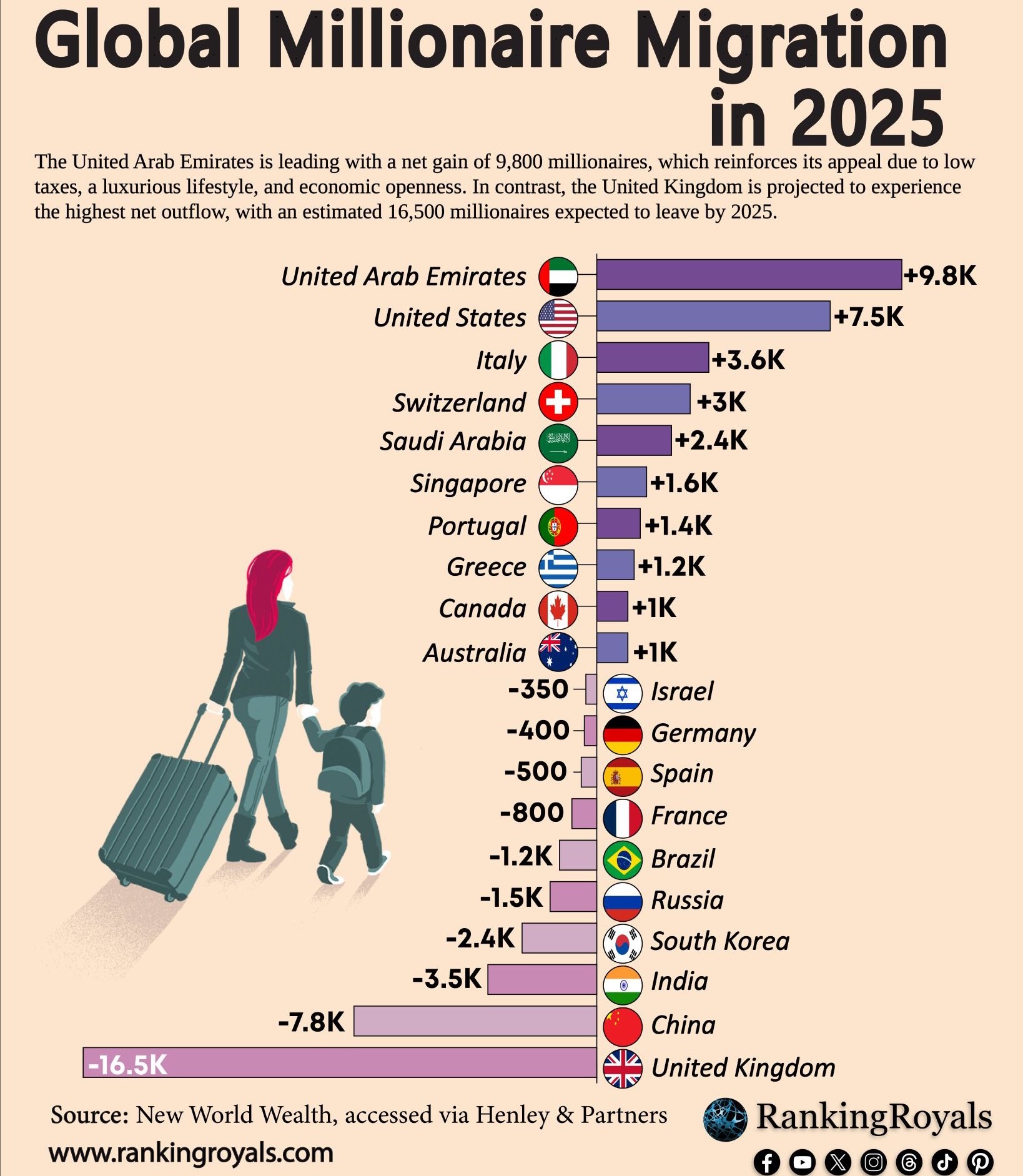

Right now, when you look around the world, New Zealand is a great place to be. None of the overseas residencies at the table offer more upside. In the case of the UK, productive people are rapidly fleeing.

Source: Michael A. Arouet / X

The exodus from the UK reflects the fundamental problem with socialism. You end up with half the people feeling they don’t have to work or pay tax. The other half feeling there’s no point building businesses and employing people anyway.

As I write, the next Autumn Budget in the UK is expected to announce significant tax rises to cover ballooning welfare and debt-repayment costs.

For many years, wealth-building was safe in New Zealand.

But we made two mistakes. We let home prices catapult out of reach of younger people. And we allowed education and media to indoctrinate Marxism.

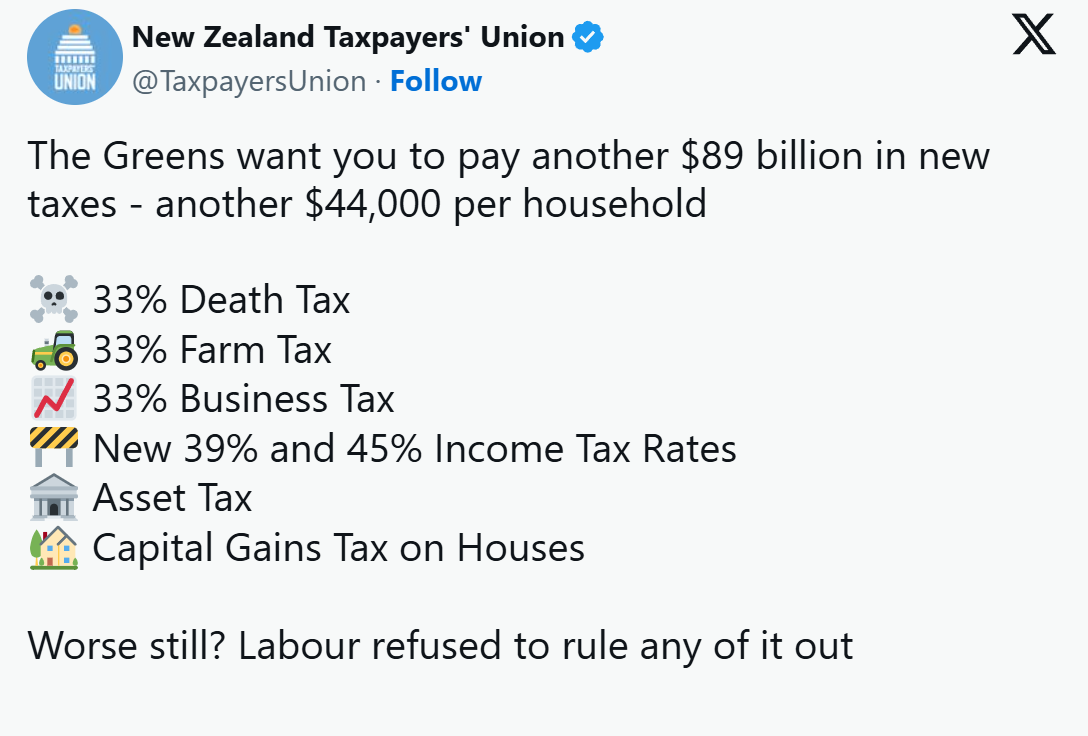

Today, the centre-left Labour Party depends on the more radical Green and Maori parties for electoral support. Last week, they were ahead in the polls. As we know, coalition agreements involve larger parties making significant compromises to smaller ones.

Source: NZ Taxpayers’ Union / X

Some of our private clients are worried about the 2026 election. Yes, they have spent their lives building businesses and prosperity. The deeper concern is the economic wreckage these policies could unleash on a small, isolated, commodity-reliant nation.

We have assisted clients to build wholesale portfolios in high-quality offshore stocks. Our service is global. It is residency agnostic. As NZD weakens, the benefits of holding assets in stronger currencies such as EUR or USD become apparent.

So, what if economic Armageddon arrives? What if New Zealand moves from being an incentive-based economy to one where capital, wealth, and income are all taxed more heavily?

Right now, the country attracts investment to this far corner of the world because it does not tax it. What if the settings change? Such that people no longer want to come here? And existing productive people want to leave?

Now, tax residency and citizenship are different things.

New Zealand tax residency generally taxes your worldwide income. It is complex to become non-resident for tax. Not only must you be out of the country for 325 days in a 12-month period; you must also have no ‘permanent place of abode in New Zealand’. That test considers many factors, including intentions and social ties.

But let’s put that to one side for the moment. And explore some jurisdictions that may offer attractive settings for economic refugees.

Note: I’m not considering ‘exile’ tax havens with small economic bases here, or Caribbean ‘pay for passport’ scenarios. Instead, we’re surveying a blend of lifestyle, economic opportunity, and favourable settings for investors with share portfolios.

United Arab Emirates (GDP per capita: USD $49,378)

Key incentives and perks

- No income tax, capital gains tax, or inheritance tax.

- Corporate tax of 9% above approximately USD $100,000 threshold.

- VAT 5%.

Visa options for investors

- 10-year visa for real estate or business investment of minimum USD $550,000.

- Possible citizenship after 30 years.

United States (GDP per capita: USD $85,810)

Key incentives and perks

- Married couples: 10% up to approx. USD $24,000, 12% up to $97,000, 22% up to $207,000, 24% up to $395,000.

- Capital gains tax at 0% up to approx. $97,000, 15% to $600,000.

- Only six states impose inheritance tax.

- Corporate tax rate of 21%.

Visa options for investors

- Green card via investment of minimum USD $800,000 in a business that creates or preserves jobs.

- Citizenship after 5 years.

Italy (GDP per capita: USD $40,226)

Key incentives and perks

- 7% flat tax on all foreign income for up to 15 years for those moving to specific areas of Southern Italy.

- For residents/local income: inheritance tax at 4% over €1 million for spouse or children.

- High progressive income and capital gains tax rates to 43% for over €50,000.

Visa options for investors

- Show €38,000 passive income for a married couple for a renewable 1-year visa, with permanent residency after 5 years.

- Golden Visa for €250,000 investment in start-ups, or €500,000 in Italian-listed companies.

- Citizenship after 10 years.

Portugal (GDP per capita: USD $28,845)

Key incentives and perks

- No inheritance tax, but stamp duty on local assets.

- High progressive income and capital gains tax rates to 48% for over €84,000.

Visa options for investors

- Golden Visa for €500,000 investment in approved managed funds with 60% Portuguese companies.

- Citizenship after 5 years.

Cyprus (GDP per capita: USD $38,654)

Key incentives and perks

- No inheritance tax.

- Capital gains tax of 20% only on Cyprus property.

- Progressive income tax to 35% over €60,000.

- Corporate tax of 12.5%.

Visa options for investors

- Golden Visa for €300,000 investment in property or a Cyprus company, and prove passive income of €50,000 per year.

- Citizenship after 7 years.

Montenegro (GDP per capita: USD $12,935)

Key incentives and perks

- Highest personal income tax rate of 15%.

- Capital gains tax of 15% except on primary residence.

- EU member candidate offering investment upside should it be admitted.

Visa options for investors

- Purchase of property in the country (no minimum value required).

- Citizenship after 10 years. Or citizenship by investment in approved real estate projects from €250,000 + €200,000 government contribution.

(The country analysis above is a rough guide at time of writing and is subject to change.)

Dubai, UAE. Source: Paolo Magari / Flickr used under Creative Commons License

It’s hard to beat the UAE for tax efficiency, the USA for opportunity, and the affordable lifestyle option of Southern Italy.

Yet, if you were to add New Zealand to this list, we sit very well for investors:

- No inheritance tax.

- No capital gains tax.

- Maximum tax rate of 39%.

- Quality of life.

- World-leading food producer.

- Temperate safe haven.

For now, we have a forward-thinking government looking to improve settings and not restrict them. Sure, it could paddle the boat faster. Yet, with the new investor visa regime, we may well join the positive millionaire inward-migration list next year.

If we are to stay attractive and build a prosperous place for our kids, this is no place for Looney Tunomics.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.