You may have heard.

The S&P 500 has just hit a new all-time high.

For the first time in history, it’s sitting at just over 6,400 points.

I can already hear the pessimistic murmurs starting: ‘This feels unsustainable. America is going to collapse soon. It’s going to be a bloody massacre.’

What’s the reason for this alarmism?

Well, so far as I can tell, this seems to be tied to another statistic: the level of American government debt. This has also hit an all-time high. As I write this, it’s currently sitting at $37 trillion.

This number feels huge. Daunting. Scary.

So a disaster is looming. Right? Right?

Well, no. The logic is actually not that clear-cut.

Here’s why…

Source: A Wealth of Common Sense

You already know this. The mainstream media has a reputation for being myopic at best, dishonest at worst. They will tell you about what’s gone wrong with American society, but they won’t necessarily tell you about what’s gone right.

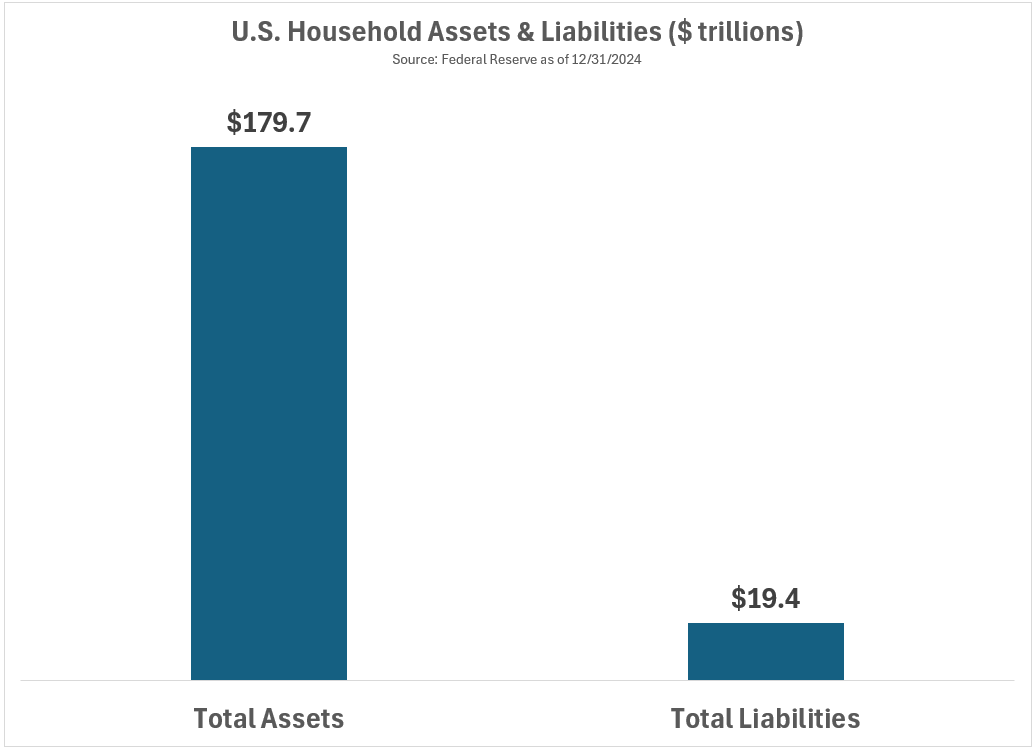

- So I’m going to take a contrarian stance here. Give you some good news. When it comes to financial wellbeing, American households have never been healthier. In fact, their total wealth has just hit an all-time high.

- At the moment, American households control around $180 trillion worth of assets. Meanwhile, they maintain around $20 trillion worth of liabilities. In other words, there’s a net worth of around $160 trillion.

This helps to put things into perspective, doesn’t it?

- Yes, the stock market seems to be acting very buoyant at the moment. But it’s not irrationally buoyant. The market is simply reflecting the fact that American households are doing very well in material terms.

- In fact, I dare say that when it comes to wealth creation and wealth accumulation, Americans have scored a home run here. They are richer than they ever have been.

- Of course, if you talk to social-justice warriors who choose to be pessimistic, they will beg to differ. They will say that the American Dream is dead. They will say that we badly need socialism to fix it. But perhaps that’s a matter of ideology rather than a matter of reality.

Source: Charlie Bilello

Meanwhile, here’s another aspect of the American economy that I find intriguing.

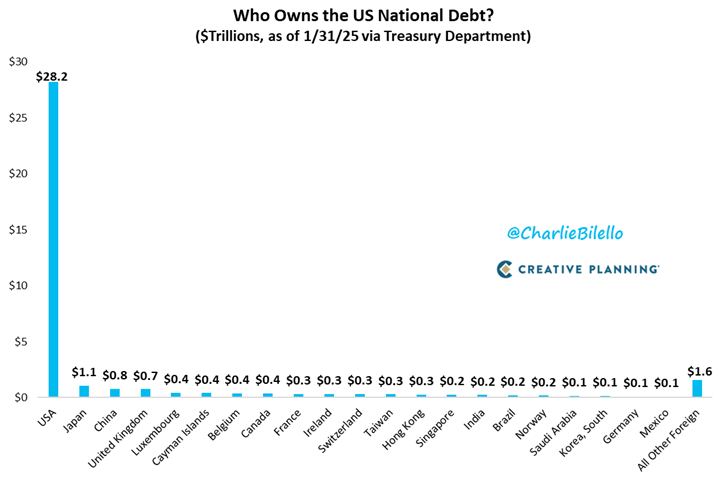

- Almost everyone keeps saying that the rise of the debt load is bad. However, few people have actually shown a willingness to understand what the debt load actually represents. So I will try to contextualise this for you in simple terms.

- At the moment, almost 80% of American debt is owned domestically by Americans themselves. We’re talking about American individuals who hold government bonds in their investment portfolios. We’re also talking about American institutions like pension funds who also own government bonds.

- So, what about the foreign ownership of American debt? Does this even matter? Well, it’s important to note that Japan is the largest foreign owner here. But even so, their share of it is quite measly. They only own around 3% of the debt load.

- Meanwhile, China owns even less of it. Only around 2% of the debt load. Pretty insignificant, in the grand scheme of things.

Source: Carson Group

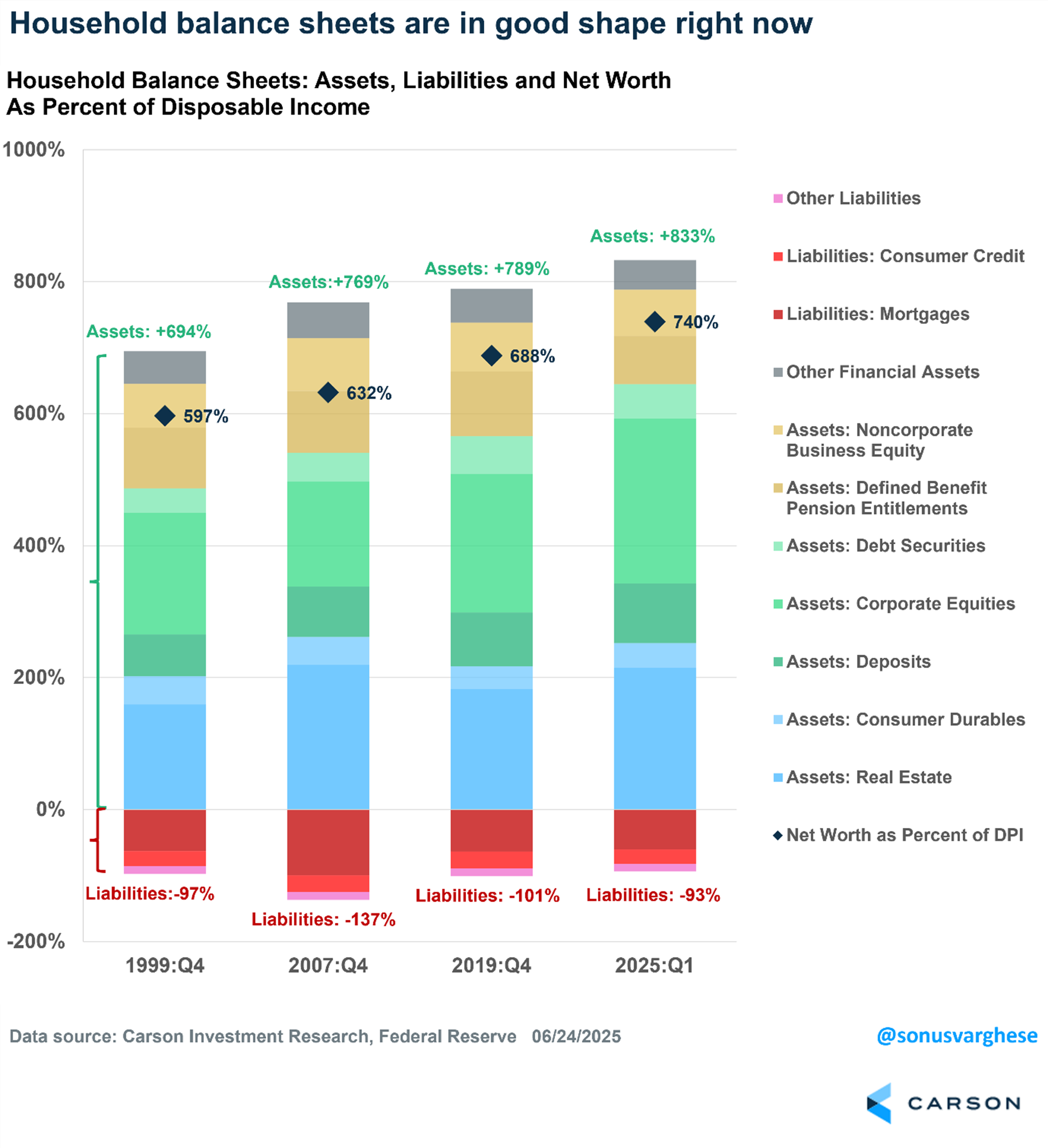

Now, here’s another surprising observation: what appears to be a liability for the American government might actually serve as an asset for American households.

- In other words, a deficit on one side of the accounting ledger might actually act as a surplus on the other side.

- Ultimately, what is positive for the balance sheet of American households must also be positive for the balance sheet of the United States as a whole.

Source: Apricitas Economics

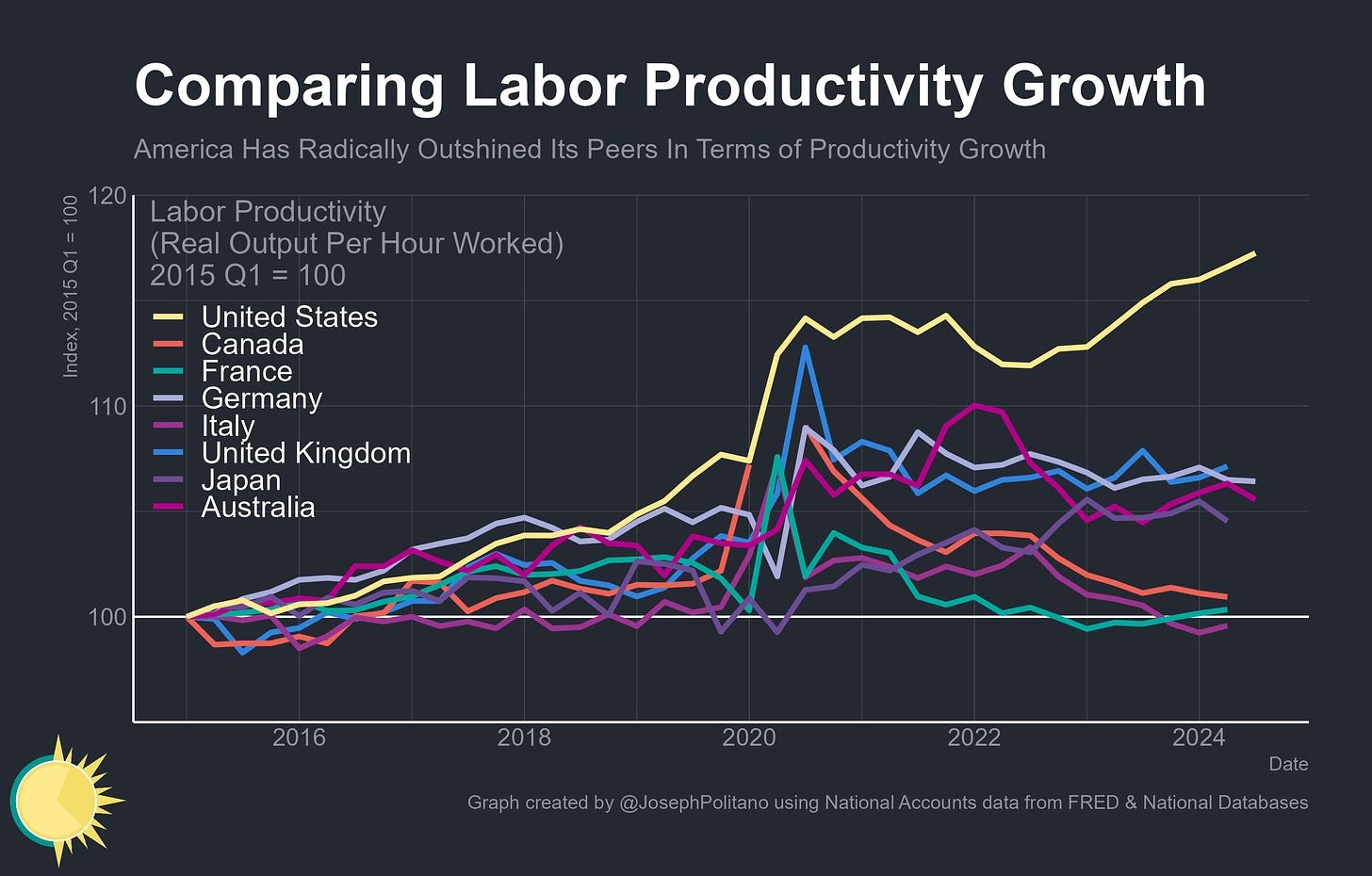

Finally, I want to talk about something that the mainstream media continues to ignore: American productivity. This trend continues to defy the naysayers. How come?

- Well, quite simply, America is a country of entrepreneurs. A country of go-getters. A country of overcomers.

- The Protestant work ethic is hardwired into the American DNA. Diligence is perceived as a divine calling. Being hardworking is a form of service to God. The harder you work, the more blessed you may be.

- Of course, I realise that religion is always a touchy subject. But you can’t talk about American capitalism without talking about American religion. The two are intertwined in a way that’s impossible to separate.

I believe that the so-called Frontier Thesis applies here, where risk-taking and innovation act as a great motivator. In 1893, historian Frederick Jackson Turner spelled it out like this:

American democracy was born of no theorist’s dream; it was not carried in the Susan Constant to Virginia, nor in the Mayflower to Plymouth. It came out of the American forest, and it gained new strength each time it touched a new frontier. Not the constitution but free land and an abundance of natural resources open to a fit people, made the democratic type of society in America for three centuries while it occupied its empire.

Yes, I’m aware that Turner’s optimistic language sounds almost shockingly alien today.

- After all, we now live in a world of 24/7 streaming media. Where we are continuously spoon-fed with angertainment and rage-bait. About all the reasons why the United States is hopeless. Doomed. Finished.

- In 2008, right-wing critics said that Barack Obama’s brand of socialism would destroy the American economy. Then, in 2016, left-wing critics said that Donald Trump’s brand of nationalism would destroy the American economy. And in 2025? Well, lather, rinse, repeat.

- But I actually think that the negativity is overdone. And, frankly, it’s deceptive.

- Millions of Americans are continuing to strive on each day. Overcoming challenges. Solving problems. Building more wealth.

I believe that the courage, resilience, and adaptability of the American people cannot be underestimated. What they have is a dynamic energy that’s bigger than any one president; bigger than any one government.

- Indeed, for all its faults and frailties, the United States is an extraordinary nation that’s more than the sum of its parts. It will continue to survive and thrive. I remain optimistic about its future.

- In the cheerful words of Warren Buffett: ‘Never bet against America.’

It’s time to invest in freedom

Successful investors tend to be resilient:

- They are regular folks who have painstakingly built up their wealth instead of inheriting it.

- These people are helping the world to change for the better. They are investing in companies that are creating new jobs, new products, new services.

- In fact, if there’s a problem out there, you can bet your bottom dollar: there’s already an entrepreneur working hard at figuring out a creative solution for it. And that, in turn, will generate even more wealth in the long run.

At Wealth Morning, we run what may be the only active night-trading desk in New Zealand for our Eligible and Wholesale Clients:

- Every week, we aim to buy into exceptional companies in America, Europe, and Australia.

- Our focus is on sectors that offer the perfect balance of growth and income.

- Our mission? To capture pockets of outstanding opportunity where we can.

- Where others see doubt, we see clarity — and we aim to use it as a springboard to build a better future.

🎯 Click here to book a consult with us and find out more about our Quantum Income Strategy.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.