I want you to imagine this.

You’re stepping into a time machine. You’re turning back the clock. You’re travelling back through time.

Hiss. Whoosh. Boom.

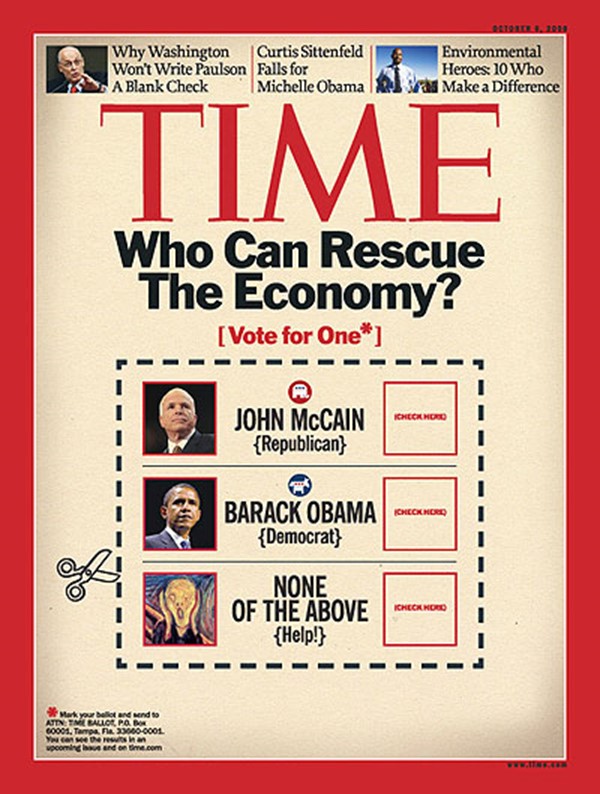

You arrive in September 2008. And here’s the catastrophic headline that you see…

Source: Barry Ritholtz

It looks pretty damn awful, doesn’t it?

- Millions of jobs are being lost. Millions of homes are being foreclosed. The seismic shock of the Global Financial Crisis is unfolding. It’s the worst banking disaster since the Great Depression.

- From New York to London; from Cape Town to Auckland; the mood is grim. Everyone is feeling a prevailing sense of doom.

- The commonly accepted wisdom is this: ‘The world economy has just been nuked into a smoking crater. It’s finished.’

Source: Barry Ritholtz

This is one of the most traumatic events in modern history. Everything looks bleak. Everything looks scary.

- But you must remember. You’re a time-traveller from the future. This means you already have the benefit of hindsight. You already know that the pessimism is actually overbaked and overdone.

- What comes next? Well, no one can imagine it yet, but a miraculous resurrection is about to happen. Out of the ashes of despair, the world economy will soon recover, rising like a phoenix reborn. Defying all the prophets of doom.

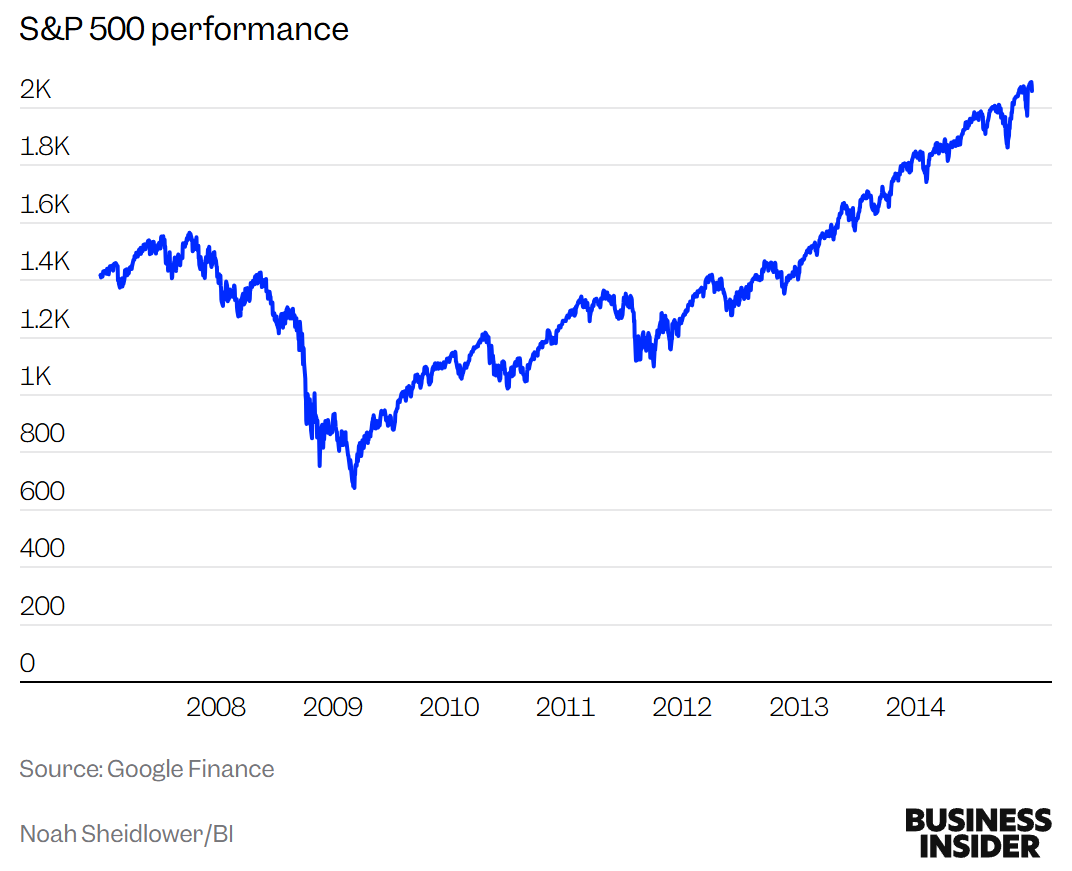

- The S&P 500 will embark on the longest and most sustained bull run since the Second World War. From trough to peak, the market will soar over 500% between 2009 and 2021. It’s an astonishing rejuvenation.

Source: Business Insider

But wait. That’s not the end of it. There’s another dramatic twist about to happen.

- A mysterious figure on the internet named Satoshi Nakamoto is going to launch a new digital asset. It’s going to be called Bitcoin. The exact date for the launch will be 3 January, 2009.

- Once this happens, Bitcoin is going to grow. It’s going to expand. And it’s going to shatter all expectations.

Of course, in September 2008, none of this is apparent yet.

- The politicians; the bankers; the economists — all of them are suffering from a serious case of myopia. They are short-sighted. They can’t see any light at the end of the tunnel.

- In fact, even if you tell them about how bright the future actually will be, I doubt you will get a positive response at all.

- I think the politicians, the bankers, and the economists might roll their eyes and scoff. They might say to you: ‘Bitcoin? What Bitcoin? Never heard of it. What you’re saying is insane. Piss off. We’ve got better things to do. Don’t you know the economy has just suffered a heart attack and needs to be resuscitated?’

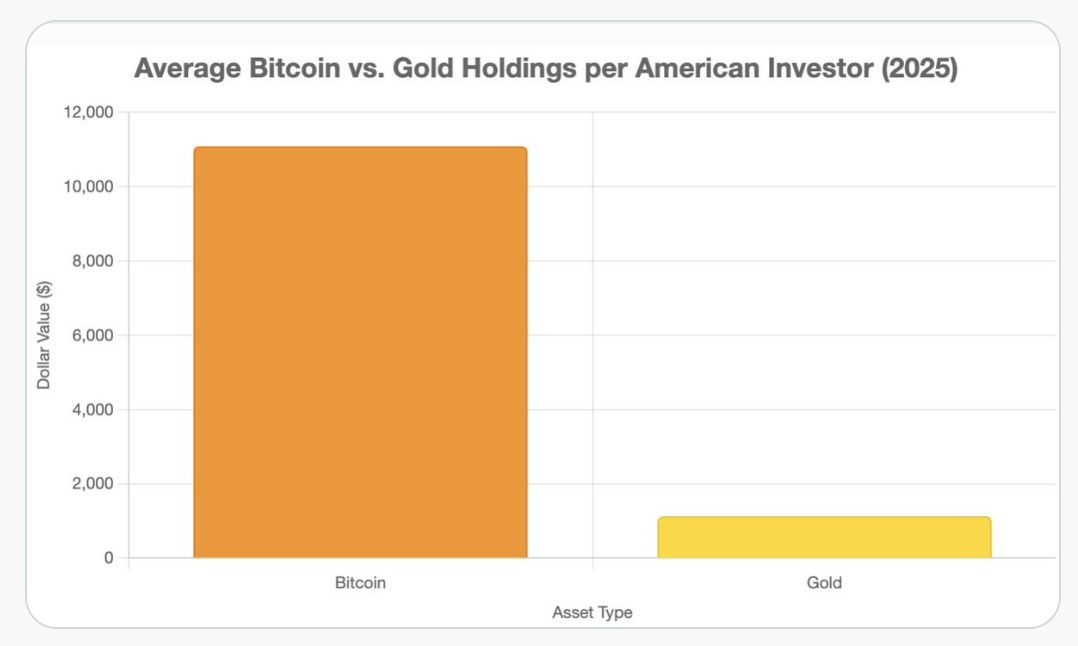

Source: Charles-Henry Monchau / LinkedIn

Now, let’s jump back in the time machine. Let’s fast-forward to 2025. And incredibly enough, here we are.

- For the first time ever, roughly 50 million American investors now own Bitcoin, which eclipses the 37 million who choose to own gold.

- This is staggering, isn’t it? It seems to overturn centuries of conventional wisdom.

- Yes, gold was once the unchallenged king of fear trades. But now, a 16-year-old line of digital code has become a serious challenger, seeking to capture the crown.

- So how on earth did this happen? Why did it happen? And more importantly, what should a sober investor do?

- Well, I want to break this down for you. Rationally and carefully, I want to examine the merits of both Bitcoin and gold…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.