Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

None of the fear over tariffs, inflation, or the global economy has come to pass. In fact, the IMF just upgraded their 2025 global growth outlook to 3%.

Here in Auckland, property CVs have dropped about 9% since they were last done in 2021. Over the same measurement period (2021 to 2024), global markets — particularly in the West — have surged around 50%.

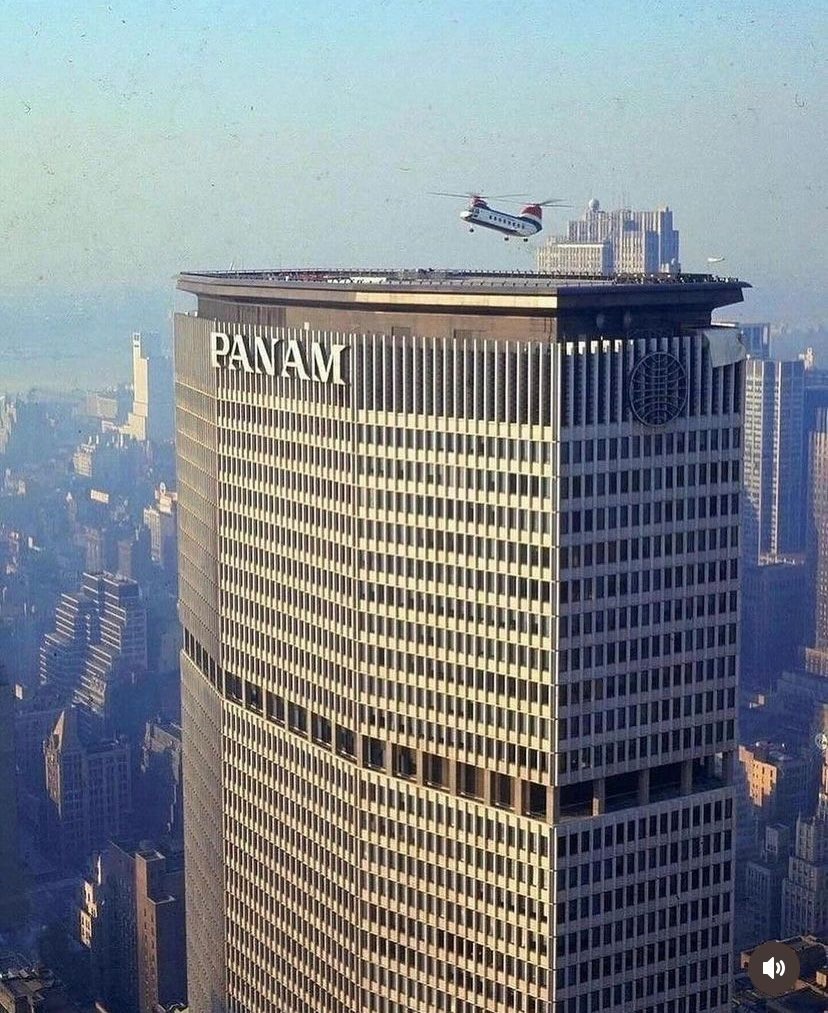

Source: Pepijn Leonard Demortier / X

An expanded money supply is chasing productive assets in the developed world.

The danger in such a market is to be drawn into more risk. Like a moth to the flame.

Agony can eventually catch up with speculative stock-market investors. For those with defensive quality assets, over the long run, any correction merely becomes a blip on the radar. A time to load up on more opportunity.

Are we seeing continued market prospects?

Yes, we’re still finding value from our deep research into risk-managed opportunity. We’re seeing high-quality businesses whose potential is not being fully priced.

Further, the market may have some more fuel to drink.

Interest rates in the US are now out of step with trading partners. (Fed rates of 4.33% versus the ECB at 2%.)

Trump wants the rates slashed to power ahead ‘the greatest economy in the history of the world.’

Potential rate cuts in the US — alongside record rates of investment, deregulation, and tax cuts — can only serve to support earnings growth. And this impetus is likely to spread into other markets such as the UK, Europe, and Australasia.

The orange man, thus far, is having a golden influence on world markets.

Within our strategy, that allows us to drive solid growth without exposing clients to excess risk or speculation.

We continue to monitor earnings and rate movements for tactical opportunities.

Managed Account performance*

For the month of July 2025, we were up 3.54% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year (January 1 to July 31) we are now up 16.09%.

Our average annualised return since inception is 13.43% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was down 0.86%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 2.66%.

Our blended MSCI EAFE/S&P 500 benchmark was down 0.37%.

The power of passive income

Many think investing is about achieving as much growth as possible.

Here in New Zealand, there is no capital gains tax. But the treatment of global shares is a little different. The FIF method generally levies opening balances at a fair dividend rate of 5%. This means you do pay a capital tax of sorts.

This is why we like dividend income, typically at 5% or more. The ability to pay dividends often demonstrates a resilient business with good cash flow. It also underwrites the tax in good times and bad, while delivering potential growth as a cherry.

We aim to build up strong and income-rich portfolios for our Eligible and Wholesale Clients, taking advantage of every market opportunity.

It’s a true partnership where the Principals’ own money is invested in the same strategy.

That alignment gives us confidence in what we do.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.