Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

May you live in interesting times.

—Chinese proverb or curse

June has sure been interesting. Once again, the Cassandra chorus was wrong, and we made good money.

Meanwhile, America attacked Iran. The fake financial news predicted trade Armageddon. And the US debt bomb continues to inflate.

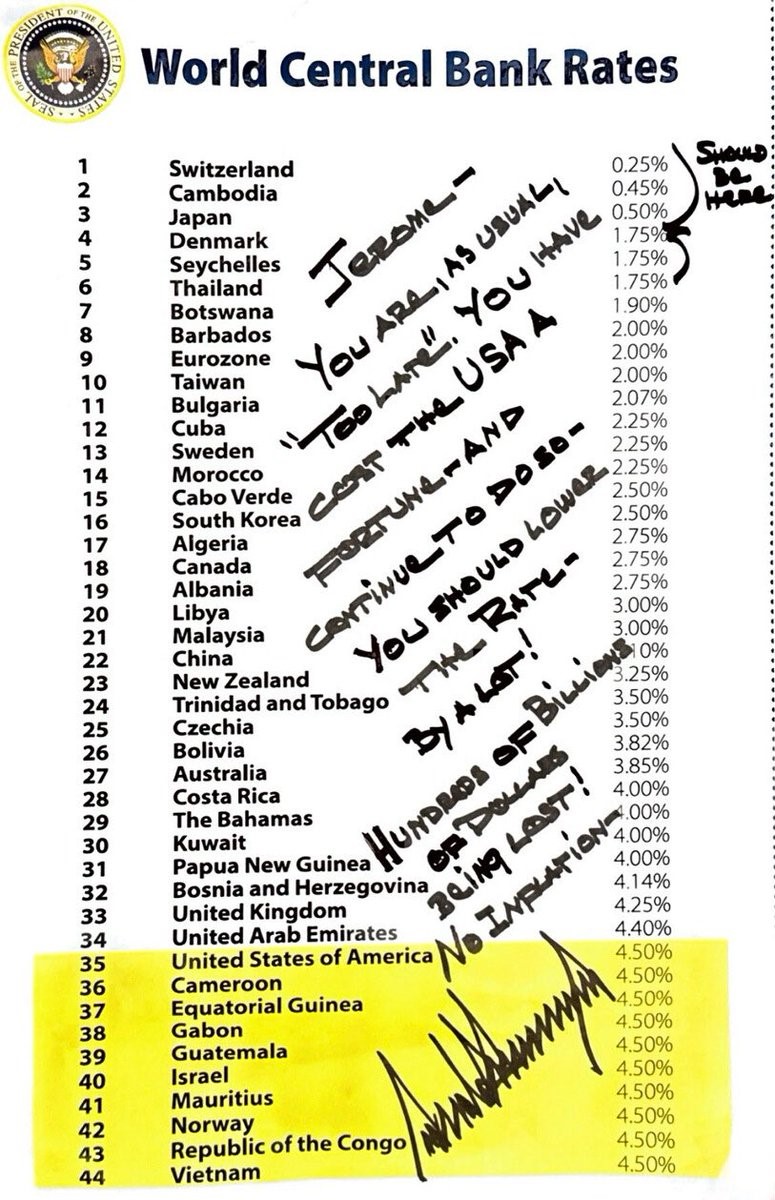

But interest rates are moderating around the world. Except for…well…

Trump sent Jerome a letter. And it wasn’t pretty:

Source: Geiger Capital / X

Source: Geiger Capital / X

The one thing holding back even more progress and prosperity is this old chestnut.

Highly paid bureaucrats on the public purse. Playing politics, perhaps?

Which is why you need brave representatives of the people with chainsaws. Trump to some degree. Argentina’s Milei in strident form.

Source: The Atlas Society / X

From chaos to strategy: how we navigated June

While the headlines screamed, here’s what we focused on.

At the trading desk, we must navigate what the market throws up. That means focusing on what you do want, not on what you don’t.

The beauty of investing in business is that all our efforts are focused on great companies that help make the world better.

We target quality companies with income and growth potential sitting at value.

As some begin to reach their potential, we search far, wide, and deep to find new opportunities.

- In the past month, we’ve uncovered another gem in that old value market of Italy.

- One of our innovative picks is really taking off.

- Value real estate continues to grow and produce excellent yield — for now, ahead of term deposits or DIY.

- And we’ve found a niche opportunity in resources.

Managed Account performance*

For the month of June 2025, we were up 2.15% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year (January 1 to June 3), we are now up 12.55%.

Our average annualised return since inception is 13.12% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 0.41%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 4.53%.

Our blended MSCI EAFE/S&P 500 benchmark was up 0.95%.

Volatility is coming

Interesting times — or in market-speak, volatility. That means opportunity.

On July 8, the tariff deadline arrives.

No deal goes quite according to plan.

The TDS media is bound to go nuts. The market might shake and shiver.

This will give us opportunity.

Like surgeons, John and I will go in at the trading desk. We will scrape and scrounge value and quality for our clients.

Such interesting times are no curse at all to the value investor.

Let’s talk over coffee about what July volatility and beyond might unlock.

We still have a few places left for our cosy winter café gathering…

[ INVITATION ]

Our Next Upcoming Live Event: Coffee & Capital

Come join us for our next friendly Coffee & Capital event.

It’s a chance to meet other investors, learn more about how we’re navigating this current market, and bring your questions or comments.

At this critical time, we’ll be unpacking key issues for our readers and investors. We’ll be talking about what is impacting the market right now…

- Trump 2.0. Is the second coming of the orange man (and tariffs) good or bad for investors? What opportunities are we seeing at the trading desk?

- Property deluge. Investing in NZ used to be all about residential property. But with falling property values and reports of a rental crunch, is this old chestnut out of steam? We look at the future for property and some alternatives as falling interest rates shine a light.

- World order disruption! Global markets are excited at the prospect of an AI earnings boom, but are disturbed by intensifying geopolitical tension and conflict. How do you navigate risk and opportunity in these strange days?

COFFEE & CAPITAL

Friday, 18 July, 2025

11:00am to 12:00pm

❌ This Event Is Now Sold Out

Goodness Café (Backroom)

228 Jervois Road, Herne Bay, Auckland

$37 per person / limited spaces

Includes any menu item, coffee

[ Special Member Price ]

For Managed Account clients & Quantum Wealth subscribers

❌ This Event Is Now Sold Out

$27 per person / limited spaces

Includes any menu item, coffee

Come join us!

Our last event sold out quickly.

Please reserve your seat today.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.