So, how does it feel like to be 95 years old?

Well, I’m not there yet. Nowhere close. But I imagine it must be a poignant feeling.

To be 95 is to experience almost a century’s worth of economic booms and technological marvels. To witness market crashes and existential panics. To adapt, survive, and overcome all of that.

Well, soon enough, Warren Buffett will be celebrating his 95th birthday.

I think it’s a special date. A momentous date. And it’s fast approaching on 30th August.

But here’s the twist. After 60 years, Buffett will be blowing out candles for the last time as the CEO of Berkshire Hathaway. That chapter — grand and glorious — is finally coming to an end.

Source: Image by Paul ( PWLPL) from Pixabay

Now, I want you to let this sink in for a moment.

- Six decades. One company. One man. A singular legacy.

- Yes, Buffett will be staying on as chairman. Yes, he will still be around. But the day-to-day running of Berkshire? Well, that torch has now passed to Greg Abel. He will be the new CEO.

- It’s the conclusion of an era. It’s the closing of a book. It’s the moment when the most legendary investor of all time finally takes a step back — and lets the rest of us try to fill his shoes.

- Here’s a spoiler alert: we probably can’t.

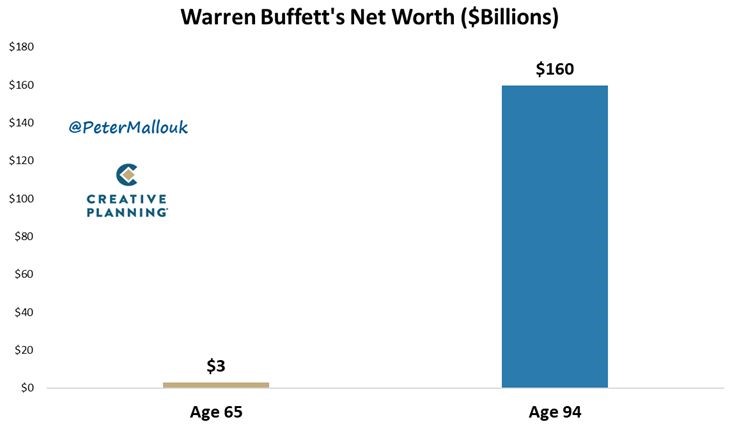

Source: Peter Mallouk / LinkedIn

I want to talk numbers. It’s the kind of numbers that will blow your mind.

- Buffett’s fortune today is estimated at around USD $160 billion. But here’s the surprising fact. The vast majority of his wealth — 98% of it — only came after Buffett hit the age of 65.

- How is this possible? Well, in Buffett’s own words: ‘My life has been the product of compound interest.’

- Yes, this is his secret sauce. His magic formula. The single most powerful force in finance. Maybe even in life?

- I imagine that Buffett’s use of compounding is like rolling a snowball down a long hill. With each turn, it picks up more snow. Then more. Then more. Until it becomes an unstoppable force of nature.

- You might argue that Buffett found his snow early. He also found his hill early. And then he just kept rolling. Year after year. Decade after decade.

- For Buffett, there were no shortcuts. No gimmicks. Just disciplined investing, extraordinary patience, and a refusal to panic when others did.

Now, at the moment, you can’t talk about Warren Buffett without also mentioning that infamous cash pile.

- Right now, Berkshire Hathaway is sitting on a war chest of around USD $348 billion. That’s almost 30% of the company’s entire asset base. Bigger than the annual GDP of New Zealand.

- For the longest time, the media couldn’t stop speculating about this. Why was Buffett hoarding so much cash? Was he preparing for a biblical market crash? Did he foresee doom that no one else could?

Well, forget the drama. It turns out that the real answer is much more boring. This cash wasn’t about fear. It wasn’t about catastrophe. It was about readiness.

- Buffett seemed to be planning ahead. Preparing for the day he would step down. So, he left a gift for his successor, Greg Abel. A kind of financial goodwill. An elephant-sized stash of dry powder.

- Perhaps this was a message. Unspoken but clear: ‘You don’t need to swing right away. But if you do, make it count.’

- It’s classic Buffett, isn’t it? The man who always preferred optionality over obligation. The man who understood that courage is about waiting for the right moment.

The hero we didn’t deserve

Now, here’s the part that gets emotional for me. Because it’s not just about numbers. It never was.

- Warren Buffett is more than just a billionaire. More than just an investor. He’s a symbol.

- He’s the living embodiment of calm in a chaotic world. The grandfatherly voice that says, ‘Stay calm. Focus on value.’

- Indeed, Buffett is the quiet giant who could sit through market crashes, wars, pandemics — and never once lose his cool.

- To watch Buffett retire is to feel something tug at your soul. It’s the same feeling you get when your favourite teacher leaves your school. Or when your childhood home is sold off. You understand it’s time. You understand it’s coming. But, still, you feel the ache, don’t you?

Well, as I write this, I can picture Buffett in his office at Omaha, Nebraska. Still sipping on a Coke. Still reading 500 pages of investment reports a day. Still chuckling at headlines.

- Yes, he’ll still be there at Berkshire. His presence still looms large. But here’s the thing: he will no longer be captain of the ship. And that changes the whole equation.

- Indeed, the wealth snowball has rolled farther than anyone imagined. Now, as it rests at the foot of the hill, massive and glistening, it’s up to us to figure out what it all means.

So, what will happen to Berkshire in the post-Buffett era? What comes next?

- Well, for a sense of perspective, I think it can be helpful for us examine where the company has been in the past.

- In particular, I want to look at three important dates here: 1962, 1993, and 2008. These were turning points. Critical moments that shaped Warren Buffett’s destiny.

- Here’s why these dates matter so much…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.