Real estate has something in common with bonds. It has an inverse relationship to interest rates. As interest rates fall, its values tend to go up.

But real estate has an added benefit. Sometimes you can buy it at a discount to its market value. You can buy it below replacement cost.

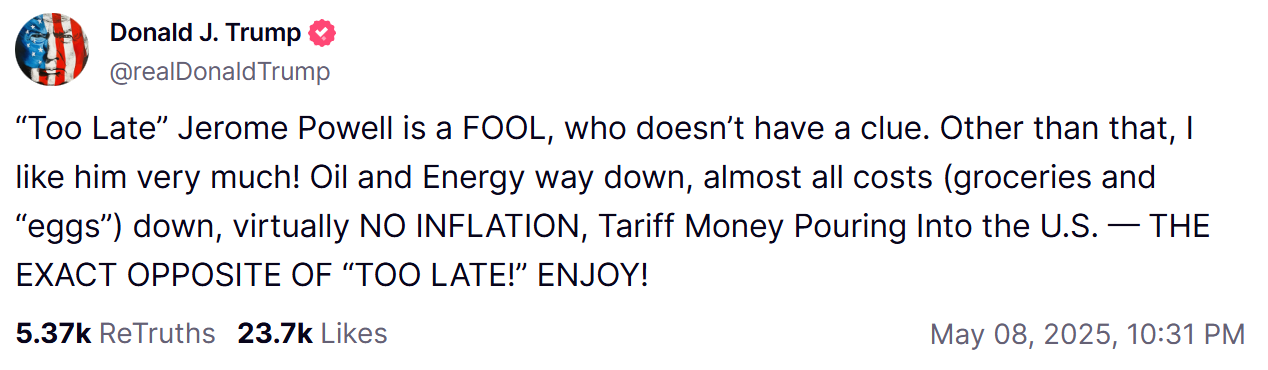

Well, there’s one real estate expert who thinks the US Federal Reserve has left cutting rates too late:

Source: Donald J. Trump / Truth Social

Given the European Union and other countries have cut quite substantially, Powell does seem to be leaving his run late. The interest-rate cycle has a lag. Inflation has already fallen to 2.4% (less than half a point from the 2% target).

Here in New Zealand, we are already down at an OCR of 3.25%.

The Federal Reserve mixed rate remains at 4.33%.

It must be due to come down soon.

Meanwhile, my colleague John Ling reported last month that the economy of California grew 6% in 2024. It became the fourth-largest economy in the world (behind the wider US, China, and Germany). It is outperforming the rest of the nation.

This got me interested in listed real estate in California. Are there any areas that could be undervalued? That could offer growth upside with income?

Naturally, I’m interested in mispriced opportunities here…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.