Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

Wall Street commentators have been calling it the TACO trade.

It goes like this:

Source: Brew Markets / X

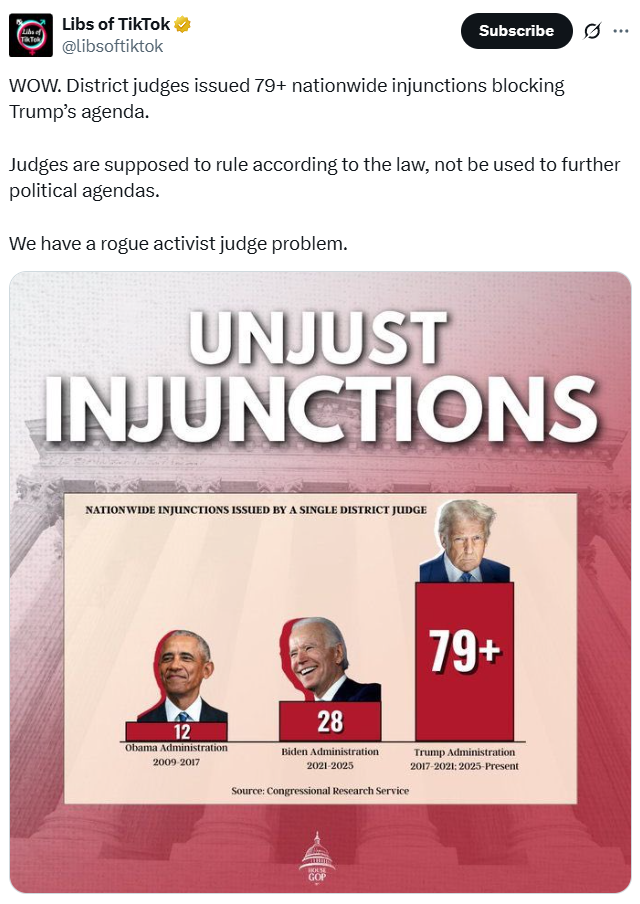

I see more of an AJAX trade: ‘Activist Judges Always Exasperate’.

That’s been the case at the district-court level.

Source: Libs of TikTok / X

Yet the more compelling argument for a strong market in these strange days is this: the market is doing what it always does. While it hates uncertainty, it also has the ability to look ahead.

Tariffs pull on uncertainty fears. Markets and investors hate uncertainty.

When courts slow the tariff process down, it lessens that uncertainty. For investors, that provides a path with handrails.

Wealth Morning strategy

We have done what we always do. Buy value when we see it in great quality businesses that we will hold for a long time.

May’s market has seen pockets of uncertainty. ‘Gaps in the traffic’. These have proven good times to buy.

The wider impetus has been upwards, towards a bull market. The market is pricing ahead more interest rate moderation in developed markets around the world.

If the Fed was to start cutting rates like the other central banks, we might be off to the races sooner.

Tariffs are ultimately deflationary, not inflationary

A chief cause of market uncertainty is the unknown impact of tariffs:

- Might they be inflationary?

- Could they slow down the global economy?

- Will people lose their jobs?

Looking ahead 12 months (as the market tends to when it is operating outside a cloud of fear) — tariffs ultimately may not be inflationary at all.

Source: Anthony Pompliano / X

There might be short-term price increases — though the extent of these will be mitigated by manufacturers and retailers ‘eating them’.

Short-term price increases are very different from inflation.

Inflation is a systemic and dynamic increase in prices over time. Tariffs are technical and static price increases to incentivise local production and competition.

Remember when GST was first levied in New Zealand in October 1986? It was a one-off price increase. By 1988, inflation had fallen sharply.

Tariffs should encourage alternative suppliers to enter the market and take advantage of price discrepancies.

They can drive innovation. For example, when factories adopt robotics and AI to become more efficient.

Increased productivity can give rise to a market sweet spot: falling inflation — or a ‘good sort’ of deflation.

And this is what markets are beginning to price: interest rates will fall to encourage more investment and consumption.

For our real-estate and value portfolio, this should drive even further growth with income.

Managed Account performance*

For the month of May 2025, we were up 3.14% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year, we are now up 10.40%.

Our average annualised return since inception is 13.10% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was up 2.97%.

This month, to further improve benchmarking accuracy, we are using the S&P 500 in proportion with our growing holdings in the US.

The S&P 500 benchmark was up 5.04%.

Our blended MSCI EAFE/S&P 500 benchmark was up 3.24%.

Shocks and shakes

On the downside, markets are perhaps forgetting that the tariff reprieve is temporary.

Tariffs are paused while waiting for negotiation. They are further paused while they are contested through the court system.

Yet any drawdown due to tariff fear could be an opportunity.

In the long run, tariffs could moderate interest rates, see favourable deals negotiated, and boost productivity.

AI could be a key driver.

That could produce a lot of earnings growth.

Earnings growth means stock price growth.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.