The only way for investors to significantly outperform

is to periodically stand far apart from the crowd.

—Howard Marks

EVs were meant to bust the power grid. But it turns out not everyone wants one due to range anxiety, high prices and depreciation.

But there is something that will drain electricity like never before. And that’s AI.

Rapid growth expected for data centres. Source: Photo by StockCake

The AI sector is experiencing massive investment. That’s driving demand for data centres.

- Training large language models can consume the electricity of thousands of households.

- Goldman Sachs Research forecasts ‘global power demand from data centres will increase 50% by 2027 and by as much as 165% by the end of the decade (compared with 2023).’

- A challenge is to find sustainable energy sources to cope with this enormous new demand on the grid.

Here in New Zealand, we should be well-placed to host data centres with our renewable energy resources. Still, further investment is needed.

Immediate, investable demand is likely to focus on the US. Despite the scorn of the mainstream media, manufacturing investment under the Trump administration has surged.

Here are just some of the investments:

- Nvidia and Apple have said they would invest about $500 billion each in the country over the next four years.

- TSMC to expand US investment to $165 billion for AI advancements.

- IBM to invest $150 billion in US over the next five years, including on facilities for quantum computer production.

- Johnson & Johnson to increase US investment to over $55 billion.

- With four new facilities, Eli Lilly has said their US manufacturing investments will ‘more than double’ to $50 billion.

- Switzerland-based Roche recently announced it had allocated $50 billion to ‘further strengthen Roche’s already significant US footprint.’

- Hyundai Motor Group outlined a $21 billion investment it plans to make in the US.

- Clarios (a battery producer owned by Brookfield Business Partners) announced a $6 billion American energy manufacturing strategy.

- GE Aerospace is investing nearly $1 billion in its US manufacturing and supply chain.

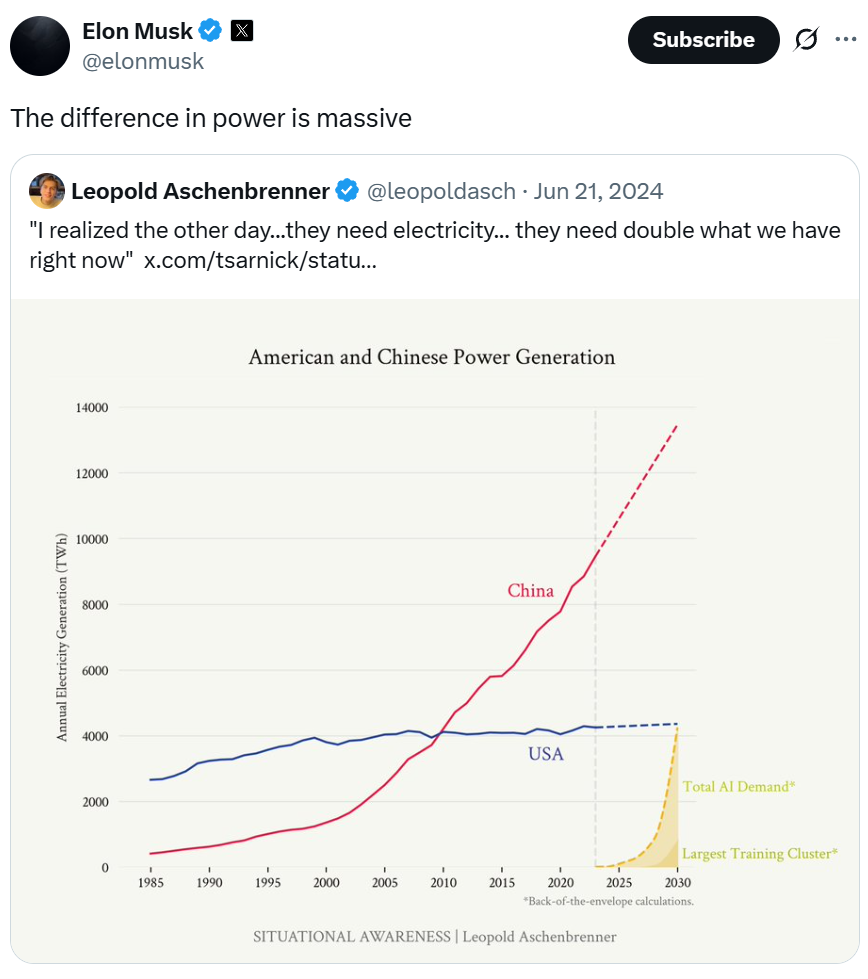

Consider the extra power capacity required. Add AI. Then consider the rivalry with China. This was Elon Musk’s pinned tweet in April:

Source: Elon Musk / X

Make no mistake. America is going to need to generate a lot more electricity. Cleanly. And cheaply. In the world’s largest economy with the strongest property rights.

This creates serious opportunity…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.