When a large number of townhouses were constructed in the Auckland suburb of Bayswater, many neighbours were up in arms.

They took to Facebook:

- ‘Shoebox alley.’

- ‘Not the Kiwi way.’

- ‘Will turn into a ghetto!’

- ‘No garages. Not enough parking. Will clog up the streets…’

On it went on the local Facebook site.

Source: Trade Me Property / For Rent / Barfoot & Thompson

The intensification of Auckland has moved ahead. Sadly, some of the architecture is brutal at best. Development companies are set up. They build cheaply. Push the zoning rules to the limit. Then they move on.

Ockham Residential founder Mark Todd has blasted these developments, saying New Zealand has ‘opened the back door to the lowest common denominator’ in housing.

In a candid interview with OneRoof, he said, ‘That’s not best-practice use of urban land .’

Clearly, on sites that are appropriate for density, high-quality apartment buildings could create more affordable housing and more amenity.

A renter’s market

For the first time I can recall, landlords are saying it’s proving difficult to get tenants.

Unable to get their desired sale price, townhome developers are putting their places up for rent. While compact, they offer new fixtures and fittings.

According to Airbnb ‘quick stats’, there are now 13,000 holiday rentals in Auckland. I know of landlords who have switched to short-term lets here and via other channels.

From February 2024 to March 2025, average rents dropped 4.1% in Auckland and 8% in Wellington.

While this may be somewhat positive for renters, are home prices now more affordable?

House prices

New Zealand homes, especially in Auckland, still remain unaffordable. Prices have eased back slightly. For the year to April, REINZ data shows:

- Nationwide, median prices fell 1.1% from $790,000 in April 2024 to $781,000 in April 2025.

- Auckland’s median prices fell 4% to $1 million.

- Wellington’s prices fell 5.5% to $775,000.

Mean household income for the year to March 2025 was $165,561 in Auckland.

It takes 6.04x that income to afford a home here.

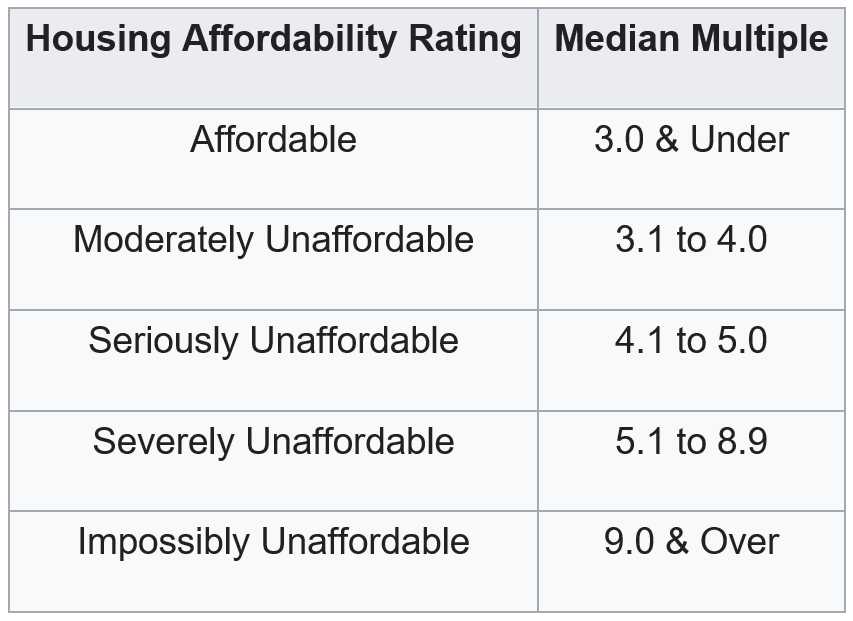

The Demographia International Housing Affordability annual survey classifies affordability according to the pressure it places on household income:

When you hear of people sleeping in cars and facing housing insecurity, consider that most New Zealand housing is in the ‘Severely Unaffordable’ category.

Changing ground

Medium-density rules have increased supply with large numbers of townhomes. The quality has often been lacking, with prices still high. This has changed the nature of the market. Especially here in Auckland.

The government’s ‘Going for Growth’ housing plan looks set to get underway this year. It could immediately make over 140,000 new sites available for building across Auckland.

For the year to 30 June 2024, Auckland’s population grew 2.4% to almost 1.8 million. New Zealand’s 1.7% to almost 5.3 million.

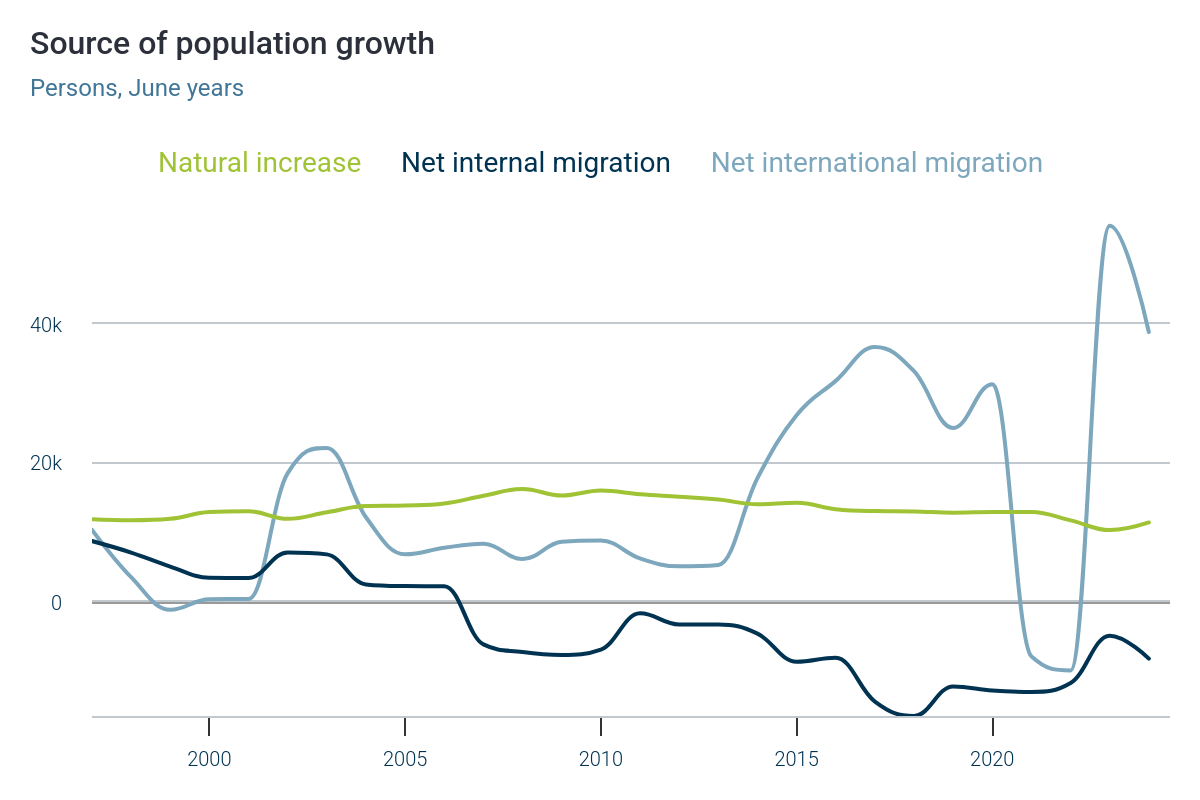

Over the last few decades, net migration has driven the bulk of population increase:

Source: Infometrics

In the 2024 year, net migration added 38,800 people. Natural increase (births minus deaths) only 11,400.

But net migration is now slowing. In the year to March 2025, New Zealand saw 26,000.

Although the number of new homes completed in Auckland has been dropping, there were still 16,811 added in the year to February. With the 2023 census showing average occupancy of 2.7 people per home, this suggests there is now enough construction to accommodate migration.

My view

We’ve had a flood of medium-density in recent years. Massive land-zoning release is still to come. Migration flows globally are set to slow. Even with lower interest rates, the property market has still failed to catch much of a bid.

The narrative used to be that immigration helped resolve the ageing crisis. Economists and politicians are now realising that migrants age too. As is a function of increasing wealth, they also have fewer children.

Instead, smarter governments are moving toward policies encouraging families to flourish enabled by more affordable housing.

Here in Auckland, most of the market is likely to stay constrained.

Yet, there is one segment that is seeing very strong growth. Premium homes.

About 5 km south of the townhouse development that rattled neighbours is the more exclusive suburb of Stanley Point.

This renovated villa recently sold in two days for $5 million.

Source: Property Value

Despite the tough market, this was almost 14% above the CV. And almost 80% above the last sale price in 2015. While the renovation is beautiful, this is not a home with the sea views often prized in this location.

Due to zoning and heritage restrictions, the neighbourhood is one of the few remaining ‘single house’ zones in Auckland. You cannot build medium-density townhouses here.

Yet, look to the top left of the photo above and you will see a quality apartment building. Devon Park was developed on a large coastal site in the 1960s to accommodate more people. Consistent with Mark Todd’s comments, it has improved the area, not detracted from it.

Stanley Point also demonstrates one sector of the market that is accelerating against the trend. Premium homes above $2.5 million.

But this is not a typical rental market. These are trophy homes for returning expats, high-net-worth migrants, and economically successful locals. This part of the market is doing just fine.

Globally, New Zealand is an ideal place to be based. There’s no capital gains tax, no inheritance tax, low population density, and a desirable lifestyle.

Investing in property today?

It might be hard to get good return on rental property going forward.

One landlord I know has a property with an LTV (loan-to-value) of ~50%. It’s a 2-3 bedroom unit in another desirable Auckland location.

He made a $500 profit last financial year. During that time, he spent many hours managing the property. Including a repair visit where the tenant locked himself out of the sole bathroom, then got stuck in the window.

There is no scale. Poor yield. And doubtful chance of a return to the rapid capital growth of previous years.

Here at Wealth Morning, we do invest in real estate for our wholesale clients. But we invest in large listed property companies. We are seeing strong dividend yields — typically around 5.5% p.a. And discounted property values in the share prices, often up to 30%.

It’s a simple analysis equation. Rates are set to come down further. The cost of borrowing (LTVs are generally 30-40%) will come down, improving FFO (funds from operations).

Sometimes if you’re prepared to go a little further afield, the discounts are even greater. Our REIT (real estate investment trust) asset in Italy is now up over 50% from this time last year. On top of this is a dividend of about 4%.

More importantly the business is at scale. It has a portfolio closing on €2 billion that is managed by professionals. No landlord visits. Just opportunity and return.

Free consultation

Are you looking for a transparent investment strategy that can produce meaningful growth and income?

We are preparing for risk-managed opportunity for the long-term.

If you qualify as a wholesale or eligible investor with market experience, we’re offering a free consultation this month to discuss your goals and the market outlook we see.

🎯 Request your free consultation here.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.