20 years…

Oh, it’s a good amount of time to take a measure of things.

- A child grows up and becomes an adult. Memories of childhood are another country.

- About a quarter of your life has gone, but you know more.

- A typical weatherboard house in New Zealand has been repainted twice.

Source: Pixabay

I’ve been investing in financial markets for 33 years.

I bought my first shares on the NZX as a Taranaki schoolboy at the age of 17.

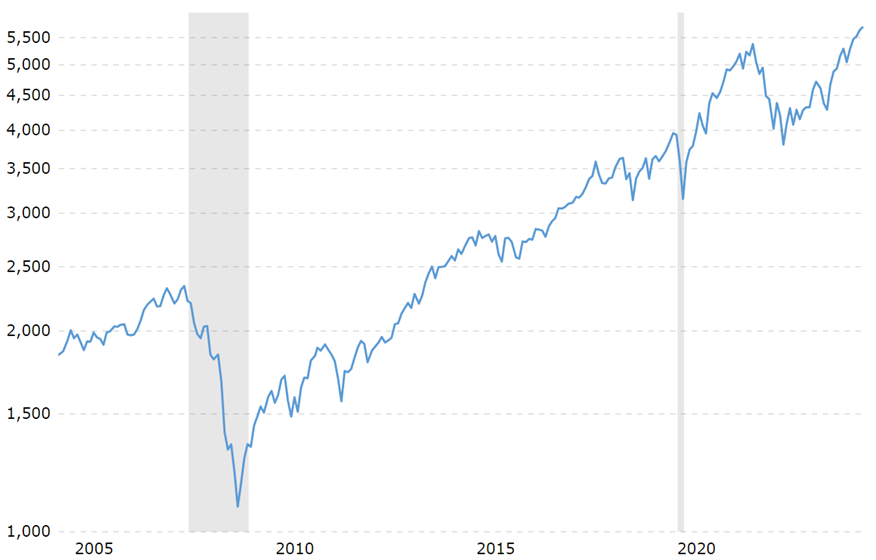

In this last 20-year supercycle, just two events have caused significant market drops.

S&P 500 Index, September 2004 to September 2024. Source: Macrotrends

Around the time of each of these events, I hired a house painter.

The first time, rot had to be taken out. It was easier the second time.

1) The Global Financial Crisis (2007-2008)

In 2007, excessive risk-taking and leverage in real estate was stripped bare.

As the enormity of the crisis became clear, the plumbing of the financial system seized up.

- The GFC lasted 1,379 trading days.

- The S&P 500 fell 57% from peak to trough.

- Unemployment reached 10% in the US.

- As for ‘lessons learnt?’ Governments should come to the rescue faster and harder.

It’s true. The GFC didn’t hit resource-rich Australasia as much as other markets. Rapacious growth in China helped insulate us.

Today, China’s once-growing market is slowing fast. Australasia may not be so lucky next time.

2) Covid-19 Crash and Inflationary Spiral (2020 / 2022-2023)

In March 2020, governments around the world threw economies into rolling lockdowns.

I remember going through portfolios line by line, checking for liquidation risks.

In fact, I should have recalled the lessons learnt from the GFC:

Governments should come to the rescue faster and harder.

The Covid-19 crash lasted only 117 trading days.

Image by Freepik AI image generator

Governments began pumping money fast and hard. Wages were paid. Interest rates were cut to the bone.

Like a V, markets restored rapidly. By 2021, markets were screaming high on printed money.

Then, in 2022, it unwound. Interest rates were hiked to combat the highest inflation rates since the 1980s. And we entered a long bear market.

By 2023, with interest-rate cuts on the horizon, the market turned again.

Now we’re probably in the early stages of the bull market we see today:

- The average bull market has lasted 3.8 years since 1932.

- The average bear market has lasted 142 trading days (about 30 weeks).

The Fed has just cut 50 basis points, with more fuel to come.

Never waste a good crisis

As the supercycle graph shows, markets climb a wall of worry.

In the short-term, crashes, corrections, and drawdowns hurt.

Over the long-term, they provide an opportunity to buy sparkling businesses.

Add compounding dividends into the mix and growth can be amplified.

Opportunity is yours

So, how do you grow and protect your wealth as interest rates tumble?

It’s going to become less attractive for savers to have money in the bank. Perhaps with the declining value of a dollar in the modern monetary system, it never really was.

Subject to your willingness to take some risk: quality assets positioned for the future are going to be key.

That means setting goals now. To get in the best place you can for the next 20-year supercycle.

A cycle where, despite what media-misleaders may shout, the world is more prosperous and has more potential to improve human life than ever before.

Coffee & Capital

Image by StockSnap from Pixabay

Want to learn more?

Come join us for our friendly new Coffee & Capital event.

We’ll be talking about what trends we’re seeing in the economy. And how smart investors grow and protect their wealth as interest rates fall.

- What is the outlook for the global economy and New Zealand?

- Are interest-rate cuts tracking for a soft landing and robust bull market?

- How is the real-estate cycle changing?

- What resources see supply-and-demand imbalances forming?

- Could this market still be overlooking some high-quality businesses?

- How will new waves of global prosperity change the world?

COFFEE & CAPITAL

Friday, 8 November, 2024

12:00pm to 1:00pm

✅ Register For Your Place Now

Pickles Café — Function Room

1 Antares Place, Rosedale, Auckland

$30 per person / limited spaces

Includes any lunch menu item, coffee

[ 2 SEATS LEFT ]

Come join us.

I hope to meet many of you here for our first session of Coffee & Capital!

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.