Do you get nervous when you fly on a plane?

Well, if you do, you’re certainly not alone.

Up to 40% of people may have some fear of flying.

Source: Image by RENE RAUSCHENBERGER from Pixabay

Psychologists call this condition ‘aerophobia’. Here’s what a typical experience with it looks like:

- Some people may get anxious when they feel their aircraft shaking during takeoffs and landings. This sensation is uncomfortable for them. So, naturally enough, they tense up.

- Meanwhile, some people not only tense up, but they get agitated. Their imagination runs wild. They are terrified that their plane may suffer a catastrophic incident, injuring or killing them.

- The symptoms of their panic can be intense. They may suffer heart palpitations, shortness of breath, sweating, trembling, and nausea.

Of course, it doesn’t help when their emotions are heightened by what they have seen or read in the news. Here’s an example:

- Back in May 2024, a flight from London to Singapore was carrying 211 passengers and 18 crew. That’s when the plane experienced a sudden case of turbulence. The aircraft plunged over 50 metres in less than one second.

- This violent acceleration led to a shift in gravitational force. So the people who weren’t wearing their seatbelts were catapulted up, with many of them smashing into the ceiling. As a result, dozens suffered head and spinal injuries. Tragically, one gentleman died of a heart attack.

This event can be best described as a freak accident. Yes, it was awful. But what is truly striking about this incident is the news coverage about it:

- In the aftermath, I noticed that there was a disturbing amount of detail being broadcast. The media kept using provocative keywords like ‘deadly’, ‘horror’, and ‘fatal’.

- Meanwhile, experts and pundits were brought in to be interviewed. These interviews were edited and framed for maximum emotional impact. They were played repeatedly on a doom loop.

- The underlying message seemed to be: ‘Watch out. This tragedy could very well happen to you soon.’

From a dramatic standpoint, it works. It really does. The staging of the material is effective. It makes the story appear more real than real. In fact, you could call it ‘hyperrealism’:

- However, is this actually helpful? Well, by consuming such hyperreality, we tend to lose out on what’s actually real, in an objective sense.

- Here’s why it matters. Every day, there are over 100,000 flights happening globally. They carry approximately 6 million passengers. Of course, the vast majority of the time, nothing happens during these flights. No turbulence. No terrorism. No crashes.

- In fact, millions of passengers usually arrive at their destinations safe and sound. Their only complaints? Well, the trivial things. Lousy inflight meals. Missing luggage. Jet lag. Nothing dramatic at all.

Of course, the news doesn’t report on such routine flights. They simply blank them out. This is because the news isn’t optimised for truth. It’s optimised for engagement:

- Now, what is fascinating to me is that the independent data actually shows that the number of aviation accidents over the years have actually been decreasing, not increasing. In other words: air travel is, in fact, getting safer.

- However, you wouldn’t necessarily know this if you’re watching the news. You might be getting the impression that air travel is getting more dangerous. This is because negative coverage of aviation appears to be increasing in intensity. This is also true of other controversial issues like politics or crime.

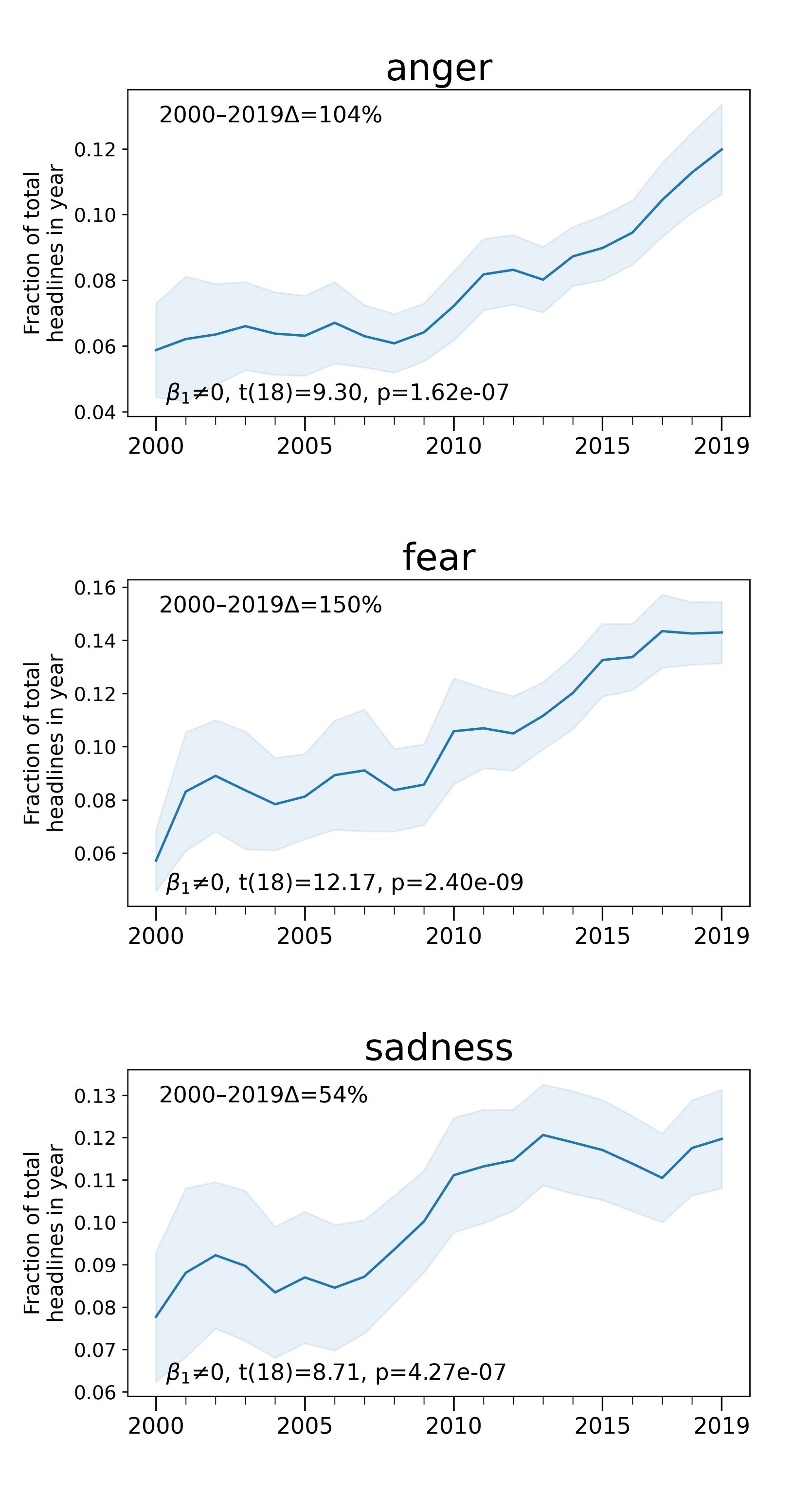

Researcher David Rozado has looked into this prevailing trend of negativity. He’s analysed 23 million headlines from 47 news outlets. What he’s discovered is startling. There’s certainly been a surge of pessimistic stories in recent times:

Source: David Rozado / Substack

Of course, negativity is a primal emotion. It digs its claws into your consciousness. It refuses to let go. But is such pessimism rational?

- Well, I have already mentioned this before: there are over 100,000 planes flying daily.

- So, even if a single adverse event was to happen today, the likelihood of you being involved in such an accident would be incredibly tiny. We’re talking about a 0.001% probability.

- Furthermore, even if 100 adverse events were to happen today, the chances of you being affected would still be astoundingly small. We’re talking about a 0.1% probability.

So, when it comes to the perception of risk, this is where the media’s messaging often fails:

- They will often talk, at length, about the possibility of something bad happening. They will engage in a doom loop. But they will almost never discuss the probability of it. Nor will they address facts that actually contradict their worldview.

- In other words, the media is very good at telling you about what’s gone wrong in the world. But they are not so great at telling you about what’s gone right.

The antidote for fear?

Now, let’s turn our attention to the world of finance. If you’re an investor, you may sometimes worry about the performance of your stocks:

- You know how it is. You’ve been doom-scrolling the news. You’re seeing all kinds of depressing stories. You’re seeing grim predictions about a market crash.

- But…how much of this fear is actually credible? Well, there’s an old joke that goes like this: ‘Economists have successfully predicted nine of the last five recessions.’

Ben Carlson, a fund manager, believes that you can’t escape human bias. It’s always going to be there. So, it’s helpful to treat everything with a healthy amount of scepticism. More importantly, you need to be able to translate Wall Street jargon. Here are some examples:

- An economist might say, ‘The easy money has been made.’ But here’s the translation: ‘I didn’t make any of it.’

- Meanwhile, another economist might say, ‘This is a bubble.’ But here’s the translation: ‘I’m not invested in that asset that went up a lot.’

- Meanwhile, yet another economist might say, ‘I’m a veteran forecaster’. But here’s the translation: ‘I’m supremely confident in my predictions, but I’m almost always wrong. Except, of course, for that one time I made a lucky guess, got it right, and have lived off that call ever since.’

Certainly, economists say all sorts of things that end up being hogwash:

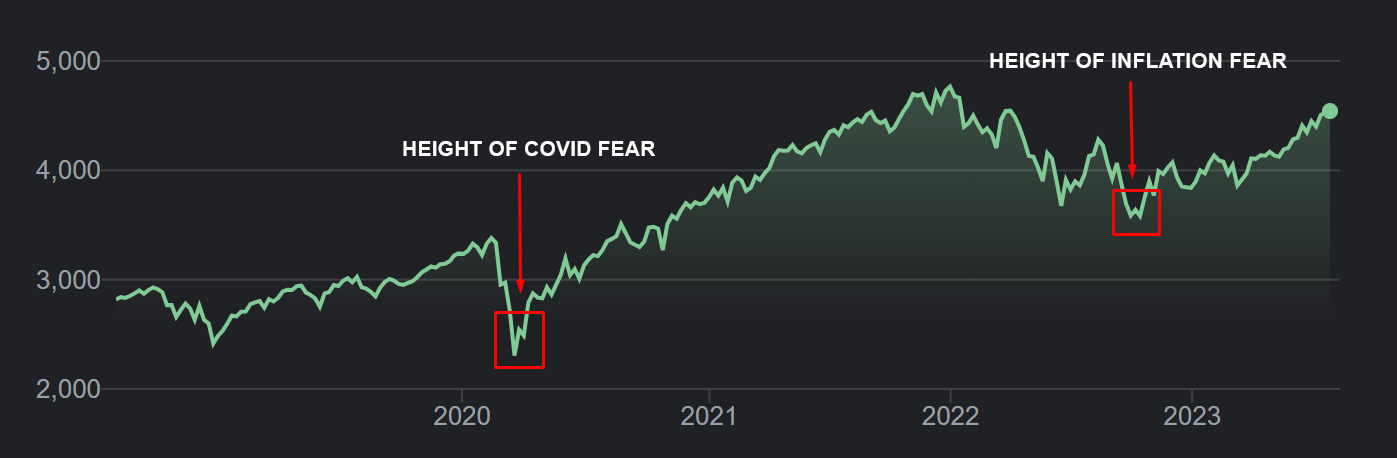

- For example, the Covid pandemic of 2020 and the interest-rate hikes of 2022 created enormous fear. This led many economists to forecast a major apocalypse for the stock market.

- The market, of course, simply thumbed its nose at the doomsayers. Like a highly evolved animal, it recovered, adapted, and continued marching on. Hungry for growth. Hungry for yield.

Source: Google Finance

Let’s face it. No one in the media has a crystal ball about the market. They are mostly guessing. A lot:

- Yes, for sure, recessions and corrections do happen from time to time. However, they are never quite as disastrous as they’ve been made up to be.

- Instead, they are just a natural part of the cycle. A prelude for future booms. A continuation of prosperity.

Ultimately, here are some critical thoughts to sum things up:

- John Kenneth Galbraith has said: ‘The function of economic forecasting is to make astrology look respectable.’

- Peter Lynch has said: ‘Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.’

- So, all things considered, perhaps it’s worth asking: are you better off ignoring the media noise? Are you better off forming your own conviction? Are you better off investing based on actual value?

- At the end of the day, being contrarian is more emotionally satisfying. Indeed, it may be far more rewarding than just following the crowd.

We’d love to hear from you…

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.