The single greatest edge an investor can have is a long-term orientation.

—Seth Klarman

Let’s face it: as a species, we human beings are not that great at seeing the big picture.

We are usually obsessed with the short-term. The microscopic. The worries of here and now.

What we tend not to see is the long-term. The runway that stretches out into the horizon. The potential of the future.

Likewise, we also tend not to see the roadmap of our past. We don’t really understand where we’ve come from. How far we’ve travelled. The bumps and shakes along the way.

Indeed, both the future and the past can feel too fuzzy, too foggy, for us to fully appreciate.

Let me give you an example of this. As recently as 1900, the life expectancy for an average person was 32:

- That’s not altogether surprising. In the words of Thomas Hobbes, life in the old days was ‘nasty, brutish, and short.’

- Indeed, when life was so limited, you only had enough energy to focus on the bare essentials. Food. Shelter. Safety.

- Therefore, things like creative freedom or adventurous innovation were luxuries very few people could afford to spend time on. After all, why bother? Most people would be dead by 32, wouldn’t they?

But, surprisingly, even having wealth in the early 20th century didn’t actually insulate you from trouble. Here’s a case in point:

- In 1924, Calvin Coolidge Junior was a 16-year-old boy. He was vibrant. He was precocious. He was prosperous. After all, his father was none other than Calvin Coolidge, the president of the United States. For this reason, you could say that Coolidge Junior was pretty much set for life. His privilege was assured. Who could doubt that he had a great future ahead of him?

- But, suddenly, all of that would change. One day, Coolidge Junior was playing tennis with his brother. That’s when he rubbed one of his toes raw. He developed a blister, and it progressed into a staph infection. He suffered a fever as the sepsis quickly escalated.

- The best doctors in America swung into action to treat Coolidge Junior. But it was no use. The boy’s condition deteriorated. He was dead within a week.

It was a stunning turn of events. The shadow of grief fell over the White House. The president mourned the death of his youngest son — and America mourned with him:

- This tragedy was especially cruel because of a historical fact: penicillin would be discovered only four years later by Scottish doctor Alexander Fleming.

- Soon enough, penicillin became the world’s first mass-produced drug with the miraculous ability to fight and clear bacterial infection. This ushered in a revolution in healthcare. At least 200 million lives have been saved by penicillin since then.

- Unfortunately, Calvin Coolidge Junior could not benefit from this breakthrough. He was simply born and raised in the wrong time. Heartbreaking.

Now, let’s fast-forward to the present:

- Today, in New Zealand, even the most impoverished homeless person can expect to have an average life expectancy of at least 55.

- That’s 23 years more than they would have had in 1900. Or…to put it into percentage terms…that’s an increase of over 71%.

- So, here’s a staggering fact. A homeless person in New Zealand in 2024 actually has access to better healthcare than the son of an American president did in 1924. This is revolutionary — even if you’ve never quite noticed it before.

The power of compounding over time

Source: Carbon Finance

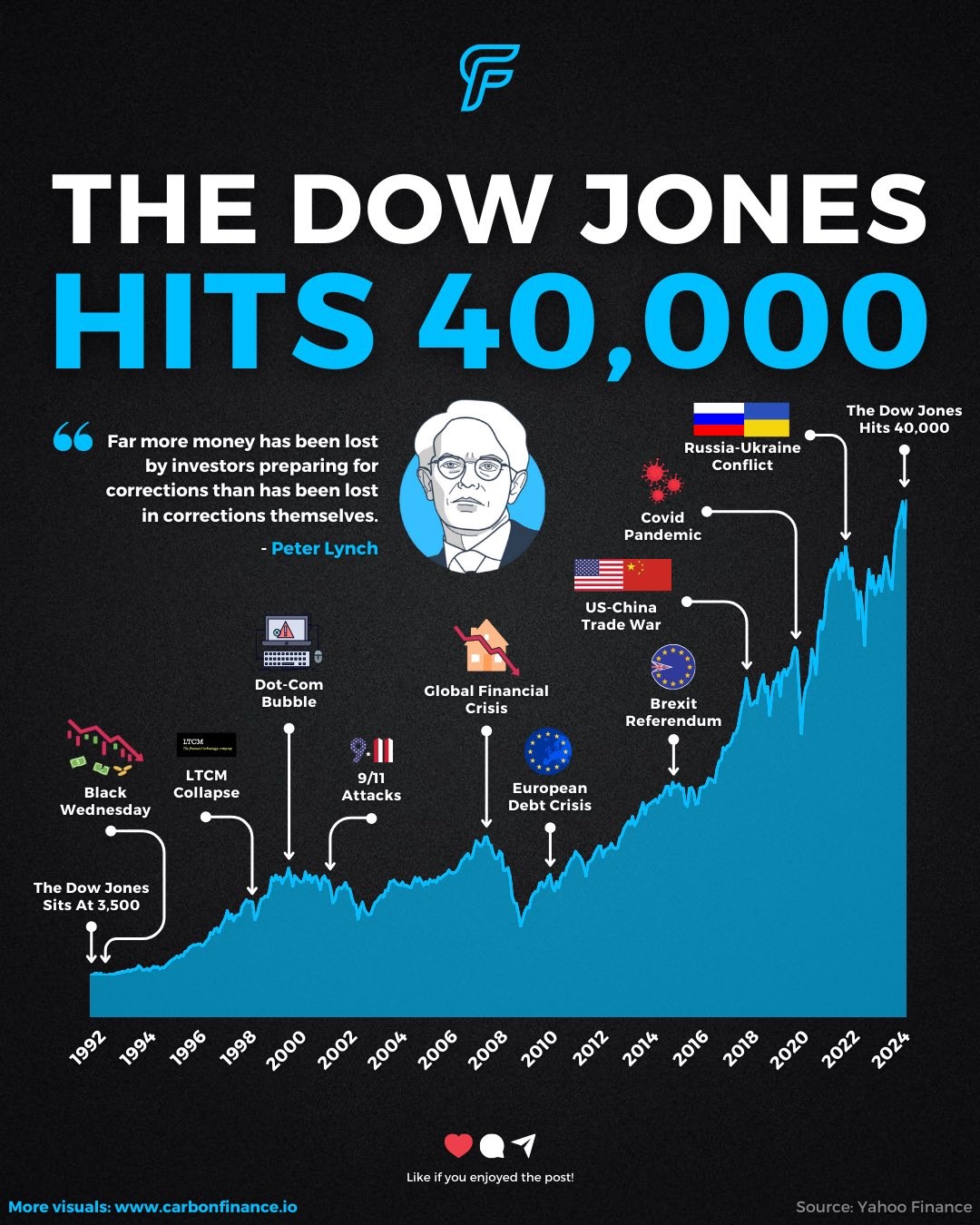

So, this brings us to the world of investing. If you’ve been reading the news lately, you already know that the Dow Jones Industrial Average has touched 40,000 points earlier this month:

- For some veteran investors, their response might have been to sigh and shrug their shoulders. ‘Yeah, 40,000. No biggie. Of course, I always knew it was going to happen.’

- Indeed, such a milestone may have felt like a foregone conclusion to such investors. But 40,000 is just a nice round number. It doesn’t actually tell you what the emotional journey been.

After all, just look at what’s happened along the way. There have been bubbles. Recessions. Wars. These were big historical setbacks. In fact, since 1992, there have been 10 separate fear events:

- Even a single fear event can create tunnel vision. It can cause your brain to freeze up. It can seriously knock your confidence. And if you’re affected by emotion, you might be tempted to say, ‘I believe this is the end. The economy is finished. We can’t possibly recover from this crisis.’

- Certainly, since 1992, this is exactly what anxious investors have said 10 times in a row. And if you choose to time-travel and look even further back, you’ll see more of the same fear.

For sure, there’s a noticeable pattern in behaviour here:

- People will tend to encounter an economic problem, and they say cannot be overcome. However, through productivity and efficiency, the market eventually overcomes the problem. Success breeds success.

- Then, later, another problem emerges. Once more, people get negative. They say it cannot be overcome. That’s when the market starts to work on addressing the problem. And so the cycle repeats.

This pattern only seems to be obvious in hindsight. For example, Todd Morgan, the chairman of Bel Air Investment Advisors, started his career in the 1970s. This was back when the Dow Jones was trading within the 500 to 1,000 range. Morgan recalls:

‘When it broke 1,000, everybody said, “You gotta get out of the market. It’s too high.”’

Too high? Gosh, that sounds like a big miscalculation, doesn’t it?

- By today’s standards, 1,000 actually feels like a very low bar. Especially given the fact that the Dow has recently touched 40,000 — which is a 3,900% increase.

- Interestingly enough, Todd Morgan now has a prediction. He says that the Dow could hit 80,000 by 2035. To achieve this, it would just have to experience compounding growth of 7% a year. And that 7% will snowball over time.

Based on this calculation, Morgan declares:

‘Before my grandchildren pass away in 64 years, the Dow will be at 2.8 million.’

Whoa. On the face of it, his prediction sounds outrageous, doesn’t it? How can Todd Morgan be so optimistic, given the present troubles of the world?

- Well, here’s the thing. It’s natural to have tunnel vision. It’s natural to be microscopic about the worries of here and now. But if you’re choosing to bet against the market’s ingenuity and resilience, you are probably making a losing bet in the long run.

- For example, let’s look back again on the 20th century. Do you remember the Wright Brothers? Yes, they were brilliant American inventors. They carried out the first test flight of an engine-powered aircraft — the Wright Flyer — in 1903.

- Later, NASA took America to the next frontier: spaceflight. With courage and ingenuity, they carried out the first manned landing on the Moon — Apollo 11 — in 1969.

- Now, think about it. What’s the time gap between these two revolutionary events? Well, a mere 66 years.

This is astonishing. It goes to show that progress can be wildly unpredictable. Sometimes there’s a huge leap forward. Sometimes it can happen a lot quicker than the critics generally assume:

- Indeed, to be an investor is to be an optimist. It’s about believing in humanity’s ability to improvise, adapt, and overcome.

- What is the role of the market? Well, it’s about push and pull. Supply and demand. Production and consumption. For this reason, new businesses must be created. New services must be provided. And, yes, existential problems must be solved.

- To invest is to capture a slice of the future. That takes courage. It always does.

If you have already reviewed us on Trustpilot, why not review us on Google?

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.