Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

What a month. During the first half, a frightening correction got underway, blamed on the escalating Middle East situation.

World War III could be nigh, some conjectured!

But these events in relatively small economic centres have thus far been a smokescreen. Another chapter in a long-calibrated conflict — as my colleague John Ling pointed out on April 15.

There are some more likely reasons for the drawdown:

- Ongoing American economic strength, causing the Fed to push back on interest-rate cuts. (We’ll soon learn whether this strength has come from prior stimulus or performance, as earnings season is digested.)

- Deleveraging by traders as they sell off equities to cover margin under threat from ‘higher for longer’ rates.

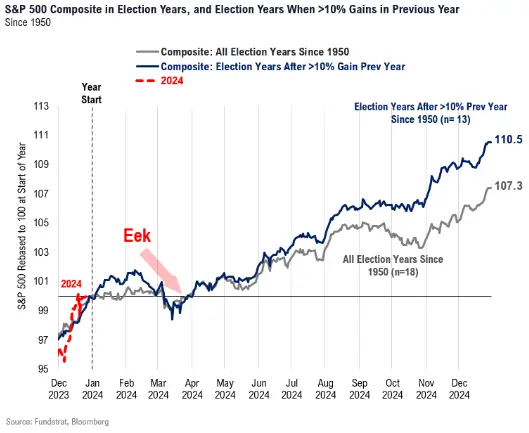

- Early April can be a horrid month in election years, prompting a first-quarter sell-off before a buoyant market gets going again.

Of course, in markets, temporary weakness is your opportunity. Inexperienced investors mistake the opportunity of volatility for the road to ruin.

Actually, when things are a bit cheaper and fear is ear-splitting, that’s when you best dive in and position portfolios to make some long-run money.

For clients with funds in early April, you would have seen some new trades come through. Particularly in Europe where we started a new position in a large Italian business.

Unfortunately, we missed its earlier 80% rise, but the value is keen enough that we see more to come. And a dividend of over 5% while we wait.

You’ll also have noticed a lot of our buying has been in Europe

This has been for good reason.

The Euro was more reasonably priced against the Kiwi. And we’ve also formed strong conviction that the ECB will front-run the Fed on rate cuts.

We don’t think this was being priced for much of April.

And it’s goodbye to a successful US position

Richmond American Homes by MDC, selling in Denver, Colorado. Source: Crystal Valley

Finally, this month saw settlement on the acquisition of our positions in M.D.C. Holdings [NYSE:MDC] by Sekisui House [TYO:1928]. An excellent profit was achieved following the value we spotted in this business over a year ago. Clients who held MDC will have now received USD into their accounts.

This will be deployed, most likely, into new US positions when the time is right.

USD has been strong of late. In particular, we’re monitoring another very promising homebuilder.

Meanwhile, the broker is continuing to pay good interest on larger cash balances.

Managed Account performance*

For the month of April 2024, we were down 1.91% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Our MSCI EAFE benchmark was down 2.83%.

Our average annualised return since inception is 13.71% p.a.

Please see our performance chart for more details.

Some drawdown = extra opportunity

There will no doubt be more volatility as we approach the key growth driver of interest-rate cuts in our markets.

There is still time to capture value, and we encourage clients to add funds to their account where able to do so.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.