There was a homeless guy who started appearing in the car park of our local supermarket.

‘Why don’t you give him $50 so he can buy some food?’ my young daughter asked.

‘Well, why don’t you wash the windows and weed the garden, and I’ll pay you $50 to give to this guy.’

Then the penny dropped.

‘Wait a second. This homeless guy could come and do that work and earn $50 and buy the food he needs. And maybe if he keeps at it, he could afford rent or a home.’

‘Welcome to the free market,’ I replied.

Of course, there are people in our community who need help due to misfortune, and we shouldn’t shy away from helping them.

But in a prosperous country like this, the market can also help people to help themselves. And that is what the stock market delivers to us every day. Opportunities to do your homework and to prosper.

First, as an active investor, I’m focused on trying to do better than the average market outcome. By definition, this means understanding a collection of quality companies. Then buying into them when the market overlooks or misprices their intrinsic value.

Second, by choosing the companies I invest in, I have the option and satisfaction to find businesses I trust and believe in. This usually paves the path of least regret in investing. Even when stocks don’t perform as you may expect due to market forces.

Recently, my research has thrown up two unique paths.

A compelling story in medicine. And a reigniting commodity bull run.

Which will I follow?

Which could offer the most upside?

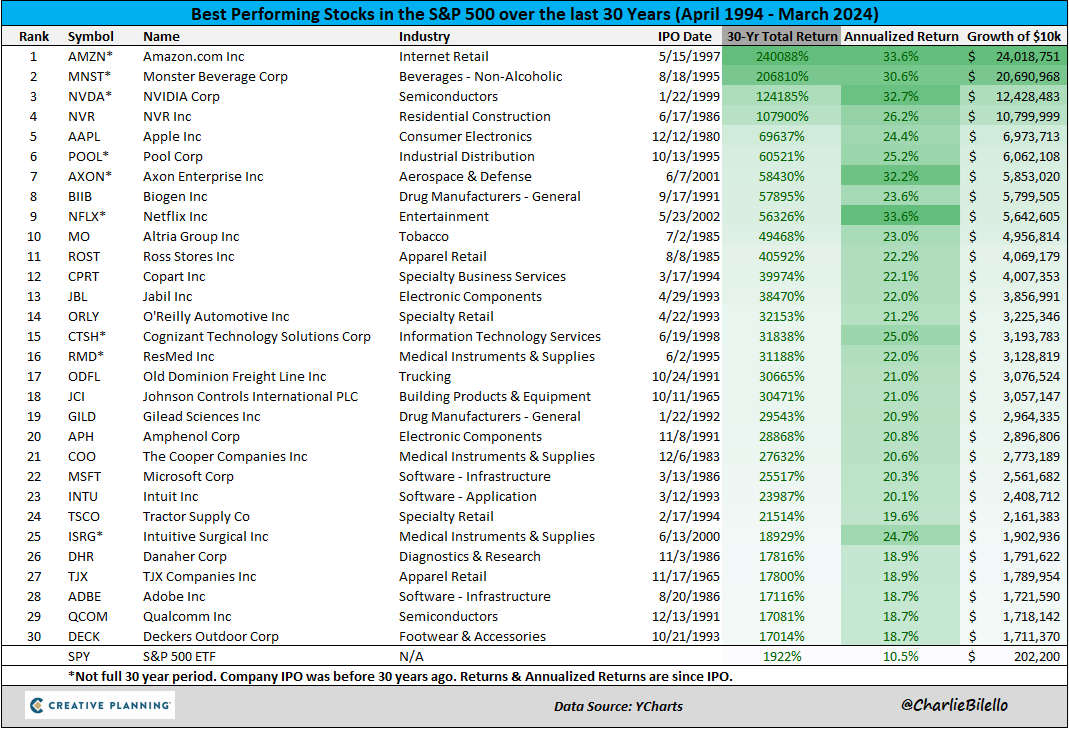

A few weeks ago, Charlie Bilello tweeted the top performing stocks on the S&P 500 over the past 30 years. It’s a great chart:

Source: X / Charlie Bilello

What do you notice? There’s technology, medicine, industrials, and consumer staples.

But very little in the way of energy or commodities.

Is this for good reason? Or is the cycle about to change?

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.