To master investing, you need to master your emotions.

—Peter Lynch

So, how are you anchoring yourself?

This is an important question to ask.

Why? Well, because the anchoring effect may very well determine your long-term prosperity.

Here’s how Wikipedia describes it:

The anchoring effect is a psychological phenomenon in which an individual’s judgements or decisions are influenced by a reference point or “anchor” which can be completely irrelevant.

Meanwhile, Harvard Law School has a more precise explanation:

The anchoring effect is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered (the “anchor”) when making decisions.

Let me show you how this might apply to you as an investor:

- I want you to think back to the Global Financial Crisis of 2007-2008.

- It was the worst banking disaster since the Great Depression.

- Millions of Americans lost their homes. Millions of Americans lost their jobs. Major institutions like AIG, Bear Stearns, and Lehman Brothers were pushed to the brink.

Do you remember the headlines? They were scary as hell, weren’t they? Well, here’s what happened to the three main stock indexes during the GFC:

- From peak to trough, the Dow Jones dropped over 50%.

- From peak to trough, the S&P 500 dropped over 50%.

- From peak to trough, the Nasdaq dropped over 50%.

Yes, it was a sea of red. There was carnage everywhere. So, here’s where the anchoring effect comes in:

- You already know this. Negative headlines tend to get 60% more clicks. And, yes, each additional scary word will increase the click-through rate by 2.3%. Because of this, the emotional distress becomes amplified. More real than real. Hyperreal.

- Indeed, to this day, I meet investors who still talk about the GFC. They have vivid flashbulb memories of it. Similar to the JFK assassination or the death of Princess Diana, these investors can recall *exactly* where they were and *exactly* what they were doing when they heard the subprime bubble had imploded. This was a shocking event in their lives. Never to be forgotten.

But…here’s why the anchoring effect can be misleading. Here’s what has happened to the market in the 15 years since the GFC:

- From trough to peak, the Dow Jones has risen over 400%.

- From trough to peak, the S&P 500 has risen over 600%.

- From trough to peak, the Nasdaq has risen over 1,000%

So, clearly, the stock market has climbed the wall of worry. Recovered all its losses. Clocking in bigger gains. Reaching greater heights:

- However, here’s what’s surprising to me. To this day, people are *still* continuing to talk about that time the market dropped 50%. But almost no one talks about the fact that the market has risen 400% to 1,000% since then.

- Human nature is funny that way, isn’t it? We tend to dwell on the memory of our pain. Not even positive progress can erase the scars.

Source: Leisure Capital Management

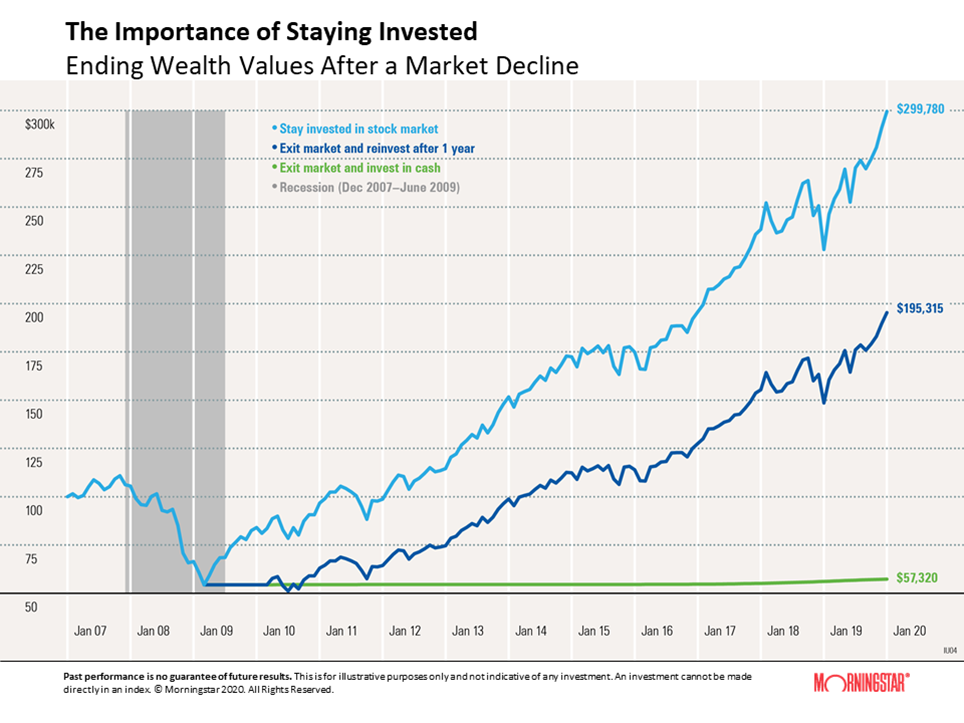

But watch out. Anchoring yourself in negativity can have a huge impact on your investing. For example, take a look at this fascinating graph here:

- This theoretical portfolio starts off in January 2007, with a theoretical value of $100,000.

- Unfortunately, soon enough, the portfolio suffers one heck of a wallop, dropping sharply because of the GFC. It’s very unnerving.

So, what happens next? Well, this is the story of three different investors and the aftermath of their decisions:

- The Green Line — This investor gets scared. So he pulls his money out of the market completely. He never re-enters the market. His account balance remains stuck at $57,320 by January 2020.

- The Dark Blue Line — This investor also gets scared. So he also pulls his money out. But here’s the twist: he only does so temporarily. After one year, he re-enters the market. His account balance surges, and he ends up with $195,315 by January 2020.

- The Light Blue Line — This investor doesn’t get scared at all. So he doesn’t pull his money out. Instead, he courageously stays put and rides out the storm. His account balance skyrockets, and he ends up with $299,780 by January 2020.

Of course, past performance doesn’t predict the future. But, still, I’ll leave you with this parting thought:

- As the storm of the GFC was raging, what would you have done? What would have been your response?

- The Green Line?

- Or…the Dark Blue Line?

- Or…the Light Blue Line?

- Ask yourself: would you have been able to anchor yourself in courage during that turbulent time? And if so, exactly how much courage would you have shown?

- Ask yourself: how much would you have gained? How much would you have lost? And what difference would your anchoring have made to your long-term financial progress?

It’s time to make a decision

Do you qualify as a Wholesale and Eligible Investor?

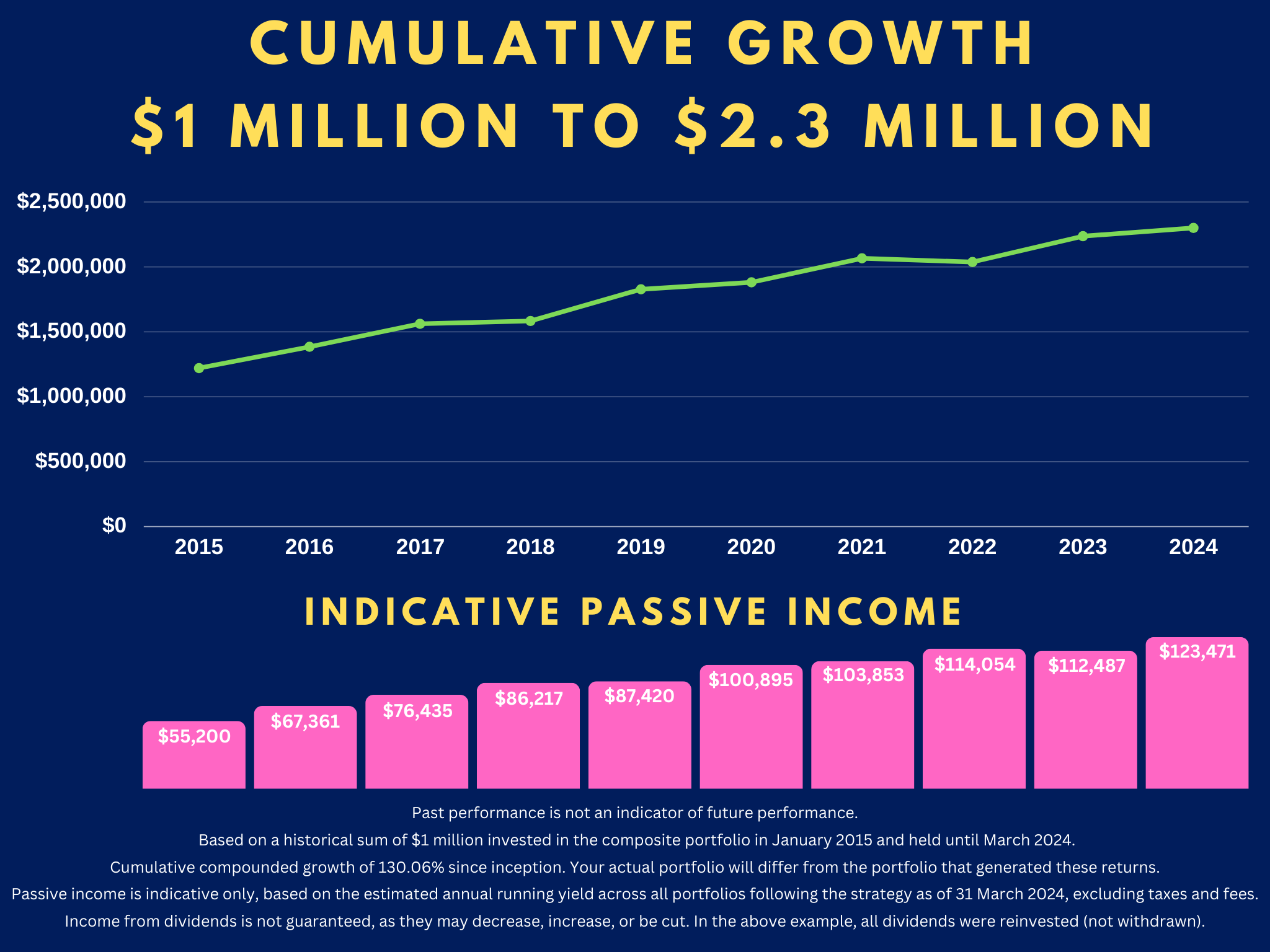

- If you do, we have a Quantum Income Strategy that’s designed to protect your wealth. Grow your wealth. Deliver you passive income.

- We go beyond New Zealand — targeting the best and brightest opportunities around the world. Our main hunting grounds for value are Australia, Europe, and America.

- Are you interested in finding out more? This could be the time for you to act.

🎯 Apply for Your Consultation Today.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.