The pound of flesh, which I demand of him, is dearly bought; ‘tis mine and I will have it.

―Shylock, The Merchant of Venice

You’re probably familiar with the story of The Merchant of Venice.

Antonio, a wealthy merchant, takes a loan from Shylock. Shylock demands a pound of his flesh as collateral. Since Antonio has a ship due into Venice with expensive cargo, he is comfortable he can meet his dues.

Then the unthinkable happens. His ship is wrecked on a dangerous sandbar. He cannot repay the loan.

Source: Freepik AI Image Generator

Shylock demands in court at Venice that his flesh is collected.

Portia enters as a doctor of laws and makes a legal interpretation.

Yes, the bond does allow a pound of Antonio’s flesh. But, in the cutting of it, should ‘one drop of Christian blood’ be shed, Shylock faces confiscation of all his lands and goods ‘by the laws of Venice.’

Was the law ultimately prejudicial against Shylock? Or was it his fault for bringing a vengeful contract? There are many interpretations of that.

Capital depends on the rule of law

Many people think the key to wealth is capital. But it’s actually the legal protections behind that capital that count.

Katharina Pistor explores this in her new book, The Code of Capital.

Since early times, people have used capital as security.

Where that has not been available (waiting at sea, in Antonio’s case), other forms have been agreed to with the law the ultimate determinant.

The fact is that capital — its ownership, security, and use as collateral — is only as good as the legal system that supports and interprets it.

Which brings us to the Domesday Book. Completed in 1086 at the behest of William the Conqueror, this was the first comprehensive record of land ownership and tenancies supporting legal rights. Today, it is the oldest government record in The National Archives (UK).

It would take almost 800 years before another formal system of land registration was attempted, with the Land Registry Act 1862.

In 1990, all England and Wales became subject to compulsory land registration. Today, there are still unregistered properties in the UK.

Here in New Zealand, the current land-registration system replaced the deeds system from 1870. ‘Use of this system is compulsory — no legal interest in land may be created except by registration under the Land Transfer Act 2017’.

As legal systems protect capital, they can also undermine it

States in America are currently dealing with an increase in squatting.

Squatters look for vacant property they can occupy for long enough to gain rights to, unbeknownst to the owner.

Depending on the state, this can be as little as five years — for example, in California. After this time, they can apply for ‘adverse possession’. Should the squatters be discovered by the actual owner in the interim, they can be very difficult to remove. Costly and time-consuming litigation may be needed to enforce the owner’s rights.

Lax squatting laws are being exploited by savvy criminals. The problem compounded by the ongoing immigration crisis. According to Fox News, one Venezuelan TikToker was urging illegal immigrations to take over abandoned homes and invoke squatter’s rights.

Governor Ron DeSantis recently signed legislation ‘to end the squatters scam in Florida.’ The law focuses on prompt removal of squatters by law enforcement with criminal penalties before they can become entrenched in a property.

Ron DeSantis speaks with supporters in Iowa. Source: Gage Skidmore / Flickr

DeSantis said of Democrat-led states:

‘They’re siding with the squatters. In fact, we have seen squatters move in and claim residence. This forces a massive, long, drawn-out judicial review before they can even be removed from the property. These are people that never had a right to be in the property to begin with.’

Threat to property rights in NZ

Here in New Zealand, occupants of an abandoned property would need to show they have been actively using and improving the property for at least 20 years.

But in this country, we have seen other risks to property rights, particularly by the Green Party, who were promoting an aggressive wealth tax at the last election. They have further urged the beleaguered Labour Party to reconsider a wealth tax.

This would essentially mean that certain New Zealanders — including farmers and business owners — would have to pay financially crushing taxes to the government to simply maintain ownership of their property.

Not only would this be economically devastating, it would be very unfair to those who have worked and saved to build capital, producing jobs and income for others.

Capital flourishes under free markets and fair law

As investors, the lesson goes back to Venice. Your capital depends on the laws that protect it. Those laws depend on government’s ability to ensure fair rights and to enforce them.

DeSantis has just made property rights in Florida stronger by giving homeowners more protection against squatters.

Here are some other areas to watch out for…

Property laws can be vastly different in different jurisdictions

When I sold my apartment in Jersey, Channel Islands, I had to attend the Royal Court in St Helier on a Friday afternoon. I hoped my buyer would show up and raise his hand to agree to the sale.

Without this passing in front of the court, his intention to buy my apartment was no more than that. Suffice to say, this system — many hundreds of years old — was stressful and uncertain.

Be careful with financial intermediaries

Global shares are most commonly held by brokers as nominees. This means you will not own the shares. Your broker will hold them for you in a segregated account. In practice, this is usually fine when the broker has little or no debt, is in a well-regulated jurisdiction ensuring account segregation, and there are protection or insurance arrangements in place in the event of failure — for example, SIPC.

It is not so fine when that broker has no such backstops in place — or may be, in part, up for control by the Chinese Communist Party.

Due to New Zealand’s small market and growing red tape in recent years, it has become a desert for decent global brokerage services. I am concerned about the current range and quality of options for investors.

Consider a family trust

Should you be the victim of a lawsuit or some other financial catastrophe, your assets can be at legal risk. This is where a trust may be a good option to ring-fence your assets in a separate legal entity.

Unfortunately, again, the government here has eroded protections. Some parties threaten this further. Investors must now disclose all trust assets to the IRD. The Green Party was seeking a flat 1.5% tax on all trust assets, effectively rendering them toxic.

All the attack on trusts will do is continue to incentivise trust investors to avoid New Zealand and manage their wealth from brighter jurisdictions.

Diversify globally

Offshore assets can be complex to manage, but they can also give you many benefits. While New Zealand is in recession and the NZ dollar is plummeting, the pound and euro have been strengthening, and the US economy has been galloping ahead.

You can enjoy the benefits of diversification. Further, in the unlikely event that a wealth tax makes New Zealand un-investable, you would then have offshore assets to help springboard a potential change of residency.

The new coalition government is promising to get New Zealand back on track. Given the excesses of the previous years, entrenched spending, media corruption, and brainwashing of the young, they have a difficult task ahead of them.

There is now state upside, with downside risk from a vocal yet diminished socialist group.

In particular, New Zealand benefits from no capital gains tax, no inheritance tax, and may now see an improved economy from the coalition’s deregulation efforts. This should generate more wealth and create more economic opportunities for all Kiwis.

Should economic vandalism return again, most New Zealanders do have the option of permanent relocation to the larger economy of Australia.

Further, other jurisdictions are particularly welcoming of investors who can show a decent stream of regular passive income, or can invest in their markets at a certain level.

Exploring the right opportunities can build your capital. It’s then important to realise that protection of your capital is only as good as the laws and governments that back it up.

Stay awake out there. Protect your pound of flesh.

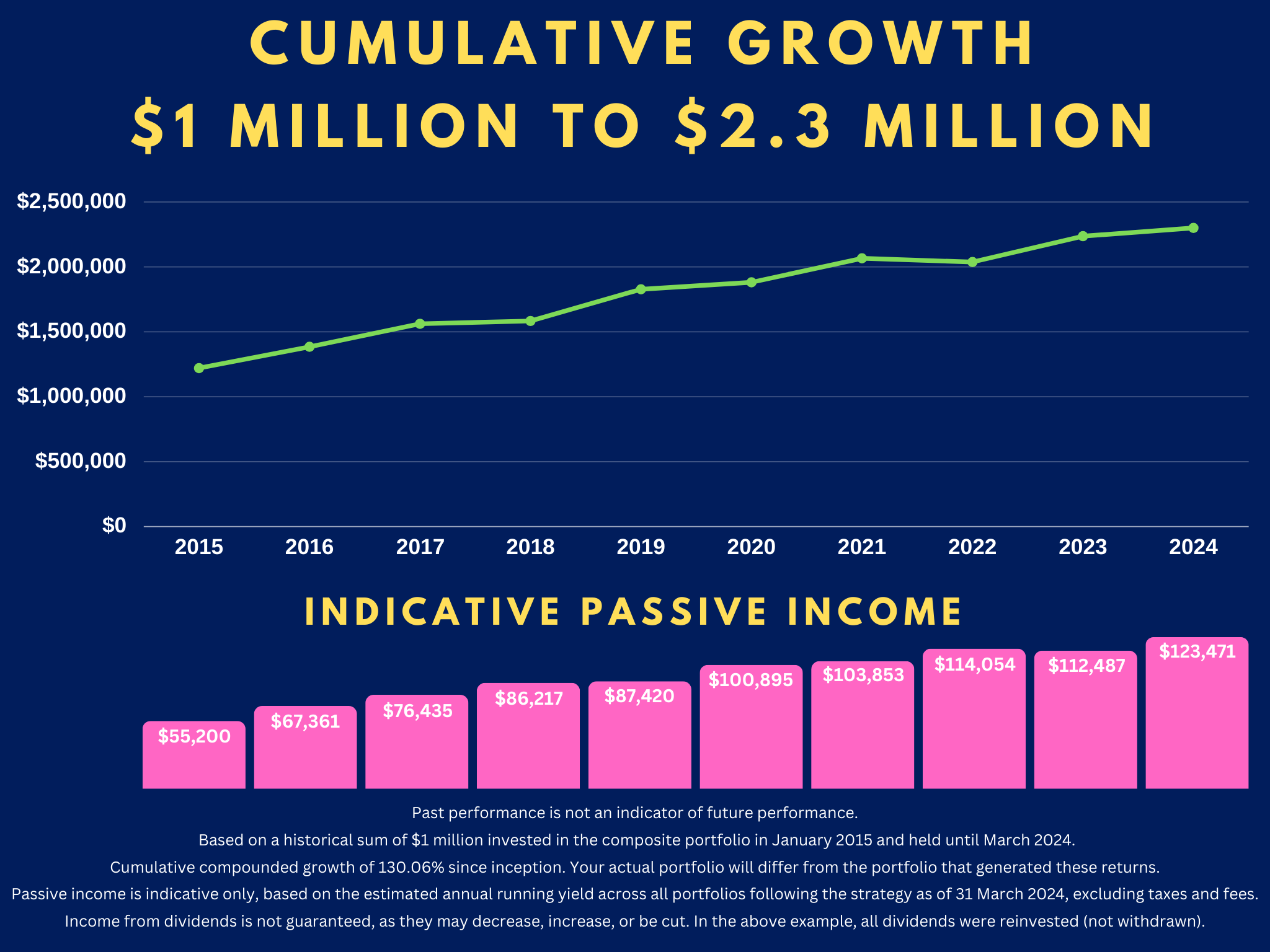

Our Global Quantum Income Strategy

Do you seek a wealth manager whose values and incentives sit alongside yours?

If you qualify as a Wholesale or Eligible Investor, our Quantum Income Strategy could help.

🎯 Apply for Your Consultation Today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.