It’s not what happens to you, but how you react to it that matters.

―Epictetus

New Zealand went into recession last month, with declines in GDP for both of the preceding two quarters: July to September (–0.3%), and October to December 2023 (–0.1%).

Total growth last year was 0.6%, well below the historical average of 2.5%.

Factoring population growth from high rates of net migration, the average Kiwi experienced a 3.1% contraction in their slice of the economy. While their purchasing power fell 4.8%.

The genesis for this occurred three years earlier

In mid-2020, Wealth Morning questioned the cost of Covid-19 lockdowns.

We looked at the potential opportunity cost of the $13 billion spent. Here’s what we could have done with the money:

- Built 50,000 homes and fixed the housing crisis.

- Built a second Auckland harbour crossing to get this city moving.

- Built several new hospitals or cancer centres.

- Built a nuclear power plant to power the entire North Island.

Lockdown relief or a new harbour crossing to unleash Auckland’s potential?

The hard choices of opportunity cost. Source: Wikipedia

Well, these scenarios are hypothetical, but they demonstrate that opportunity cost was the real cost of the Covid response.

In 2021, Auckland was thrown into lockdown over just one Delta case.

To be fair, a number of global cities experienced ongoing lockdowns. Some — such as Melbourne with 262 lockdown days — totalled even more than Auckland’s 185 days.

Cash was splashed around the world to support people and businesses to survive tough restrictions. Yet the monetary response for New Zealand was particularly large for the size of the economy.

By July 2020, we had spent 11.5% of GDP on Covid-19 fiscal policies, among the highest in the OECD. Australia had spent 9.2%, the UK 8%, and Italy just 3.4%.

By 2022, that spending had been facilitated by ‘printing’ around $71 billion of new money for the New Zealand economy. Increasing the money supply by a record level.

Asset prices took off in 2021. We saw very high inflation in 2022. The OCR was lifted to 5.5% by mid-2023 in an attempt to snuff it out.

This is the nature of a modern credit-based economy

Credit growth drives economic growth.

Some will say we should return to the gold standard, where growth in the money supply is limited by the supply of gold.

But, today, central banks have the ability to use monetary policy in the short run. They can try to prevent crises from spiralling out of control. The idea is to let the economy experience a short and sharp recession, rather than risking a deep depression as occurred in the 1930s.

The trouble is when debt gets too high. Or the response and the opportunity costs of that response outweigh the reality of the crisis.

Unfortunately, the response here in New Zealand failed to keep enough eyes on opportunity cost. It was then extended by a left-wing government. In fact, government spending continued to increase following the pandemic. It grew from 27.5% of GDP in 2017 to over 33% by 2024.

The crowding out of the private sector and the onslaught of a recession is now weighing across the economy.

Here’s a sample of reports I’ve received from businesspeople and investors

‘Our terminals are the emptiest I’ve ever seen them.’

‘The bank took me to lunch to discuss the debt across our [commercial] properties. They told me I don’t have to sell anything immediately. But they’re watching our situation closely.’

‘The sort of high-end retail we do is just dead. Nobody wants to fund larger scale purchases when they can’t get finance on their homes anymore, or have to pay an arm and a leg to get it.’

‘There’s now a glut of unsold homes on the market. The North Shore typically has around 1,300 listings on Trade Me at any time. That’s now at over 1,800.’

Source: Trade Me, April 2024

‘Global markets are moving ahead fast. But the NZX has barely moved. Meanwhile, the decline of the New Zealand dollar since last month’s recession announcement makes deploying overseas more difficult.’

‘I’m not sure how much longer we can keep up with these interest rates before we really start sinking. Like everyone, I’m just waiting and trying to survive until they come down again.’

‘We’re seeing a much higher level of monthly liquidations than we usually see in Auckland.’

Beating this recession

I’m a believer in preparing your strategy when it’s dark and visibility for most is poor.

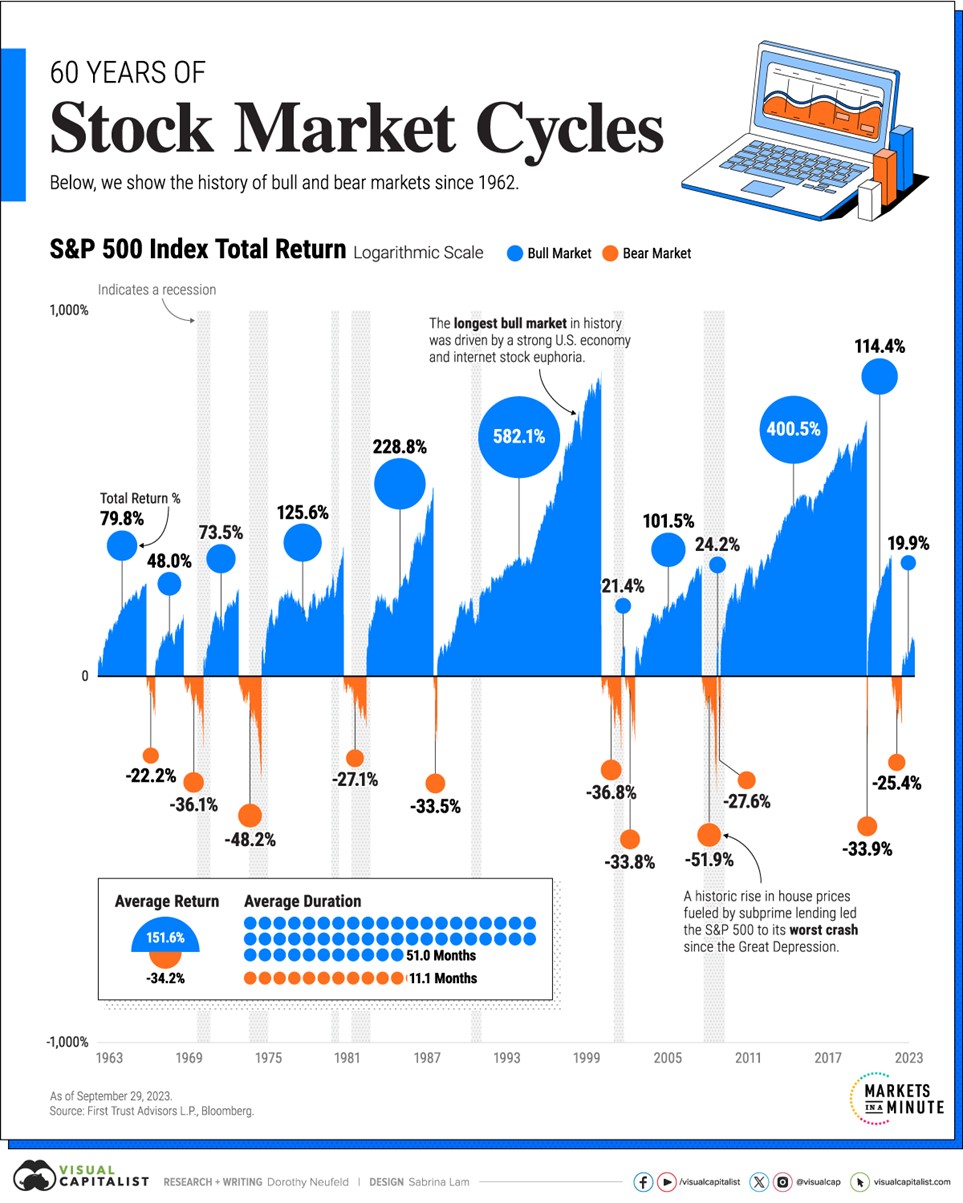

If you can get through the tunnel, you’ll be positioned to profit on the other side. That’s what happened to those who deployed in the markets following Covid’s aftermath in 2020.

A recession can expose unproductive assets and reveal value. When growth does resume it can be rapid. This is what many of our Wholesale Investors saw when the pain came to major global markets earlier on.

2022 and much of 2023 were difficult. Then things started to take off, led by tech stocks in the US.

Markets usually find light again after dark times. Source: Visual Capitalist

Markets usually find light again after dark times. Source: Visual Capitalist

It sure did help us being diversified globally. Across different countries, currencies, and sectors.

What we’re seeing in New Zealand is probably a delayed response. The economy had become ground down, tied up with red tape, inflexible, and slow to respond. Larger, more dynamic economies like the US were able to regather and tame inflation much faster.

International markets are watching closely for a return to growth in New Zealand. That should support a stronger Kiwi dollar. May that come sooner rather than later.

Would you like to share with me what you’re seeing in today’s economy?

Please email [email protected]

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.