We had two calls the other week.

One gentleman was concerned a couple of automakers were somewhat anti-EV. He wanted to sell those stocks.

Another gentleman was concerned those companies were too much into EVs. He wanted out of them for that reason.

As an investor, I find more and more industries subject to very opposing views. Whether EVs, hydrocarbons, or pharmaceuticals; opinions can be at loggerheads.

First, when you’re managing money for high net-worth wholesale clients, one view reigns supreme. It’s the client’s money. So they are always right.

Second, while the market may be a voting machine in the short run, it’s a weighing machine in the long run. It sifts an enormous amount of complex data and provides answers over the years in price gains or price falls.

Usually, the things that actually hurt you are black swans that come from nowhere and no one predicts. Like the GFC, Covid-19, or the last government.

So, back to the EVs. The two companies in question were General Motors [NYSE:GM] and Toyota [NYSE:TM].

Last year, 2.9% of GM sales were EVs. 0.92% of Toyota sales were EVs.

Toyota’s chairman forecast EV new sales across the globe will peak at only 30%. He sees hybrid, hydrogen fuel-cell, and hydrogen combustion engines making up the remainder.

In an interview with Toyota Times, he also noted that over 1 billion people live in areas without electricity. Many of them are also Toyota customers. So they need a range of options.

The upshot was that our client who was an EV fan dumped GM and Toyota to hold Tesla [NASDAQ:TSLA]. Meanwhile, our client who was an EV sceptic kept GM and Toyota.

Both are smart guys. But what did the market say?

- Over the last six months, GM has risen 46% and pays a dividend of 1.06%.

- Toyota has risen 43% and pays a dividend of 1.86%.

- Tesla has fallen 36%.

Part of this is due to the fact that GM and Toyota were reasonably priced in the market in relation to their earnings. Tesla appeared much more expensive.

But there is an emergent trend: a lot of the hope riding on EV stocks has not come to pass and will not come to pass unless there are major improvements to the technology.

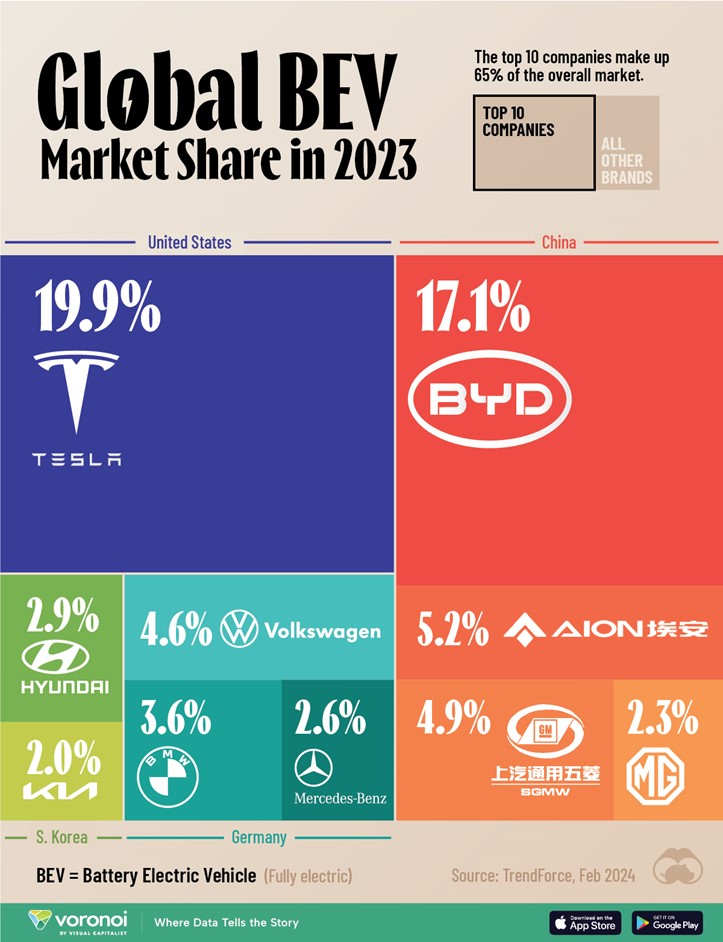

Source: Visual Capitalist

Earlier this year, when Mercedes-Benz [ETR:MBG] backtracked on plans to focus on EVs by 2030, the market welcomed that. Company leadership reminded investors: ‘Customers and market conditions will set the pace of the transformation.’

Now, this announcement was made alongside increased unit sales, dividends, and an expanded share buyback plan. Since then, the stock has climbed 24%, and the Company now projects a dividend yield of over 7%.

Governments versus customers

Around the world, governments have launched programmes to encourage (and in some cases force) the uptake of EVs.

Here in New Zealand, we had the Clean Car Discount (which ended in December 2023) and an exemption on road-user charges for EVs (which ended on 1 April 2024).

The EU is looking to effectively ban the sale of fossil-fuel cars in the bloc by 2035. However, in June, Europeans will be electing a new European Parliament. The largest political party — the centre-right European People’s Party (EPP) — rejects what they see as a ‘prohibition ideology’.

Back to Kiwiland, I recently came across a group of EV owners. They are nice people and want to care for the environment. They paid a lot for their new vehicles, imported from China.

Now some of these people have buyer’s remorse. Coming road-user charges and less than expected range, on top of the high price paid, has made the purchase less beneficent in their eyes.

But I can see a sensible government’s point of view. Subsidising expensive EVs means that lower-income people end up paying for the privilege of higher-income people. This makes no sense.

Customers versus the environment

A while back, I cycled up the busy road that leaves my suburb. Once you leave the quiet streets, the smell of exhaust fumes becomes unpleasant. Yes, it is far nicer to be passed by an EV than a truck belching diesel fumes. But this is not the whole story.

‘Why don’t you buy a Tesla?’ a friend (and passionate Tesla owner) asked me recently.

‘I really like my current car. And I couldn’t replace what I have with an EV for anything close to the same money.’

‘Yeah, but you’re killing the dolphins, mate.’

Dolphin killer? Source: Goodfon.com / Mercedes

I drive a large 10-year-old Mercedes SUV that I’ve owned for several years. It is diesel. But it has emission-reduction technology and switches the engine off when waiting in traffic. Yep, okay, it’s still a diesel…

While I do find the idea of EVs attractive, like a lot of people, I’m not ready to buy one. And here’s why:

- Day to day, for work or small bits of shopping, I walk and take a ferry. I need my car for longer road trips. My kids have long legs. The cafés where we like to stop don’t have chargers. So that’s when the ability to drive 1,300 km from a full tank with unrestricted use of air conditioning becomes a very worthwhile luxury.

- I’m concerned about depreciation. Maybe as a finance guy, I’m an exception here. But despite the age of my car, it has kept pretty reasonable value. When it does come to trade it, there won’t be questions about range or battery abuse.

- As for the dolphin comment, I have yet to be convinced that my vehicle engine causes consequential impact. By the way, I researched what is needed to absorb the carbon from my vehicular activities. About 22 trees. I have more than that around my home. This is before we factor the potential for population decline in many industrialised countries.

The future

The market seems to be telling us that demand for the current crop of EVs will not be as hot as expected. Many EV stocks have failed to deliver on their promise. Larger automakers are scaling back their EV plans.

CNBC recently reported:

‘A broad return to a more mixed offering of vehicles — with lineups of gas-powered vehicles alongside hybrids and fully electric options — assumes an all-electric future at a much slower pace, and it calls attention to ambitious EV targets set for the years ahead.’

This is no surprise to me as an investor. Hope is often, as one crude comedian put it, ‘a prick in disguise.’ Hype, bubbles, and premature enthusiasm is just part of the market process.

Whether that was the internet in 2000, EVs in 2020, or AI in 2024, so-called ‘hot trends’ can get ahead of themselves.

You have to consider risk. The more expensive or ‘hot’ things get, the more risk may be riding on them. A worthwhile trend or business model can take a decade to realise.

That’s why there’s probably a lot more development to come in the auto space. Solid-state batteries, which both Mercedes and Toyota are working on, could deliver much longer ranges and faster charge times. Toyota, GM, and Mercedes are also working in the hydrogen area.

Meanwhile, I’m not finding conviction right now in pure EV-focused companies, mainly due to valuations.

One area that does excite me more than these automakers is copper.

Copper is needed in larger quantities, not only in EVs but across a broad range of electrification initiatives. Copper prices reached a record high of $10,730 per tonne last year. Some analysts see copper prices rising more than 75% over the next few years as mining supply disruptions and a push for renewable energy collide.

I’d rather invest in a business exposed to diversified demand. On that note, our preferred copper-mining business is up 30% over the past six months.

Worldwide copper demand projects an excellent CAGR (compound annual growth rate) of over 6% out to 2029.

Isn’t that an easier investment proposition to analyse?

But I’m sure there are many opposing views on the copper industry too!

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.