Do you remember the 1980s?

It was a fascinating era, wasn’t it?

This decade was filled with big hair, synth-pop music, and neon colours. The culture was defined by the rise of yuppie consumerism. There was a sense of extravagance. Boldness. Perhaps even excess.

But behind the flashy fashion and rampant materialism, there was a darker side to the ‘80s. You could see it happening in the area of global trade.

At the time, Japan was experiencing an enthusiastic rise in fortune, going from strength to strength — even as America appeared to stumble, gripped by a crisis of self-confidence.

Source: UBS

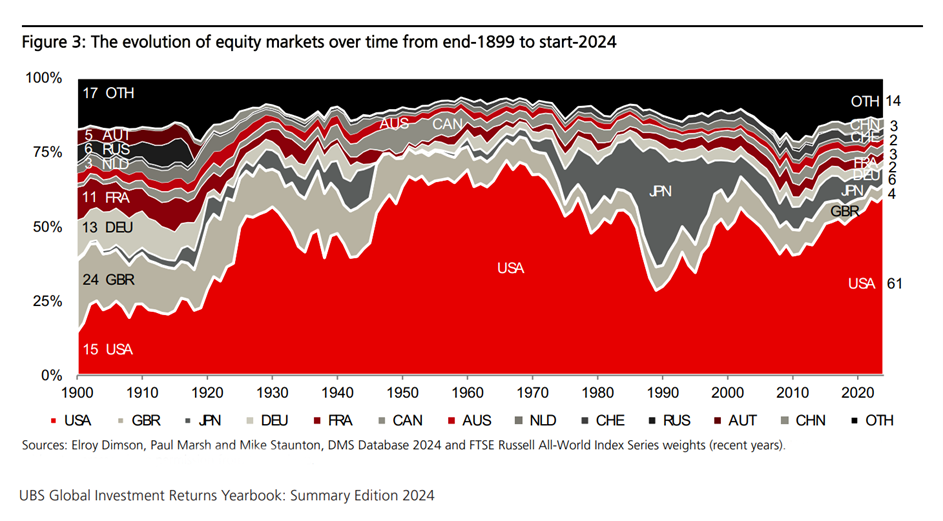

How did this happen? And why? Well, just take a look at this graph here. It gives you a quick snapshot of the international stock market:

- In ‘50s, ‘60s, and ‘70s, American companies were dominant. The post-war economic boom had turned America into an industrial powerhouse. This boosted the reputation of its financial assets. Investors couldn’t get enough of the American Dream. Everyone wanted a slice of it.

- But then the ‘80s rolled around. And that’s when the American growth engine suddenly sputtered and faltered. American brands started to lose their shiny appeal. American stocks began to slide backwards in terms of market capitalisation.

- By the end of the decade, American equities only represented 33% of the global pie. Meanwhile, Japan’s market capitalisation had exploded, capturing 45% of the pie.

- The momentum in Japanese stocks was striking. In 1980, the Nikkei 225 index started off at 6,867 points. However, by 1989, it had hit a peak of 38,915 points. This was a surge of 466%. Simply astonishing.

- Also, it wasn’t just Japanese companies that were soaring. Land and real-estate values skyrocketed as well. It was a euphoria. A feeding frenzy of greed.

Kazukuni Yamazaki, a former employee at investment bank Nomura Securities, described what the jolly mood in Tokyo felt like:

‘Everyone, including groups of young office ladies, was standing there, checking stock prices and squealing in excitement.

‘It was really crazy that everyone was talking about wanting a golf club membership that cost 500 million yen when none of us was really into golf.’

Indeed, it looked like Japan’s economy was an unstoppable freight train. It was expanding aggressively:

- Everyone had this perception that America was no longer the industrial hub of the world. Instead, the Japanese were the masters now. The samurai of manufacturing. They could produce cars, electronics, and consumer goods cheaper and faster than the Americans could.

- Most tellingly, the trade deficit between America and Japan was growing at an alarming pace. America was buying more and more from Japan — while Japan bought relatively little from America. This only served to strengthen the Japanese position.

- Of course, the irony here was impossible to ignore. In the 1940s, America had decisively defeated Japan on the battlefield. But in 1980s, it was Japan that seemed to be overtaking America in the boardroom. The role-reversal was staggering.

Perhaps in a sign of things to come, a young real-estate tycoon named Donald Trump captured the public imagination in America. He did so by going straight for the jugular. He publicly attacked Japan’s trade policies:

- Were the Japanese acting in a way that was ruthless? Were they deliberately flooding the market with cheap products? Were they mercilessly destroying their American counterparts? If so, what could be done to stop the invasion of Japanese brands?

- Well, Trump’s solution was simple: it was time for America to fight back. A trade war would need to be declared. The playing field would need to be weaponised with quotas and tariffs. Trump said: ‘Let’s not let our great country be laughed at anymore.’

Now, understandably, Trump’s statements hit a raw nerve in the American heartland. The anxiety had reached a feverish level. Many people believe that Japan was on the brink of knocking America off its throne. Seizing the capitalist crown. This was a terrifying thought:

- But…perhaps the fear was exaggerated? Perhaps emotion had prevailed over common sense? Well, with the benefit of hindsight, here’s what we now know: Japan would soon become a victim of its own success.

- By 1991, the Japanese asset bubble was overinflated. There was too much speculation, too much debt. And when the country’s central bank — the Bank of Japan — started raising interest rates, a massive credit crunch was unleashed. The entire house of cards immediately crumbled. It was a stunning collapse.

- The Lost Decades would follow. This was 30 long years where the Japanese economy fell into stagnation. They suffered from extremely low growth, as well as a persistent lack of confidence. It didn’t help that the Japanese birthrate was plunging as well, creating an ageing population that further eroded the nation’s competitiveness.

- The Nikkei 225 stock index — which had previously peaked at 38,915 points in 1989 — would fall into a terrible death spiral. By 2008, it had dropped as low as 6,994 points. This was a devastating decline of over 80%.

Meanwhile, the American stock market has roared back with renewed strength and vigour. It this surprising? Well, maybe not:

- America’s long-term economic fundamentals has always been more always dynamic and adaptable than Japan’s. America has benefited from a younger demographic, as well as skilled immigration. Two-thirds of the companies on Silicon Valley have been founded by first or second-generation immigrants. This has contributed to stronger corporate performance over the long-run.

- So, naturally enough, investors began to favour American assets again. And with increased capital inflows and high market liquidity, America would take the lead once more as the undisputed heavyweight champion of the world.

In recent decades, interest in Japanese stocks have faded away. Many investors have made it a point to avoid the Nikkei. Well, who can blame them? It’s a case of once burned, twice shy:

- However, I have observed that a curious trend is now emerging. Over the past year, the Nikkei has suddenly emerged as a strong player, delivering a return of over 42%. This has allowed it to broadly outperform its American counterparts.

- Remarkably enough, in February 2024, the Nikkei hit 39,098 points. This was a record. The first all-time high in 34 years.

- What is the reason for this unexpected display of strength? Is this just an accident? Or…is it time for contrarian investors to take a closer look at what the Land of the Rising Sun has to offer?

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.